- TOPLEY'S TOP 10

- Posts

- SMARTER IN 10

SMARTER IN 10

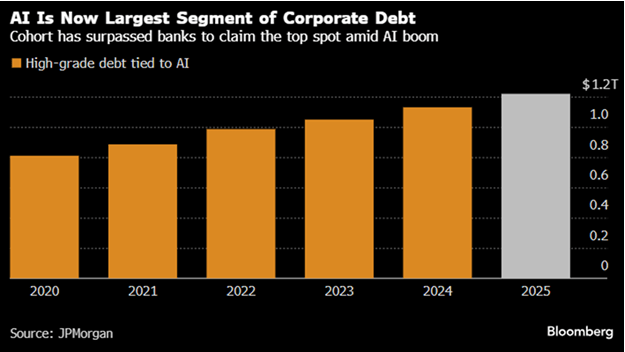

AI is Now Largest Segment of Corporate Debt

?

1. AI is Now Largest Segment of Corporate Debt-$1.2 Trillion

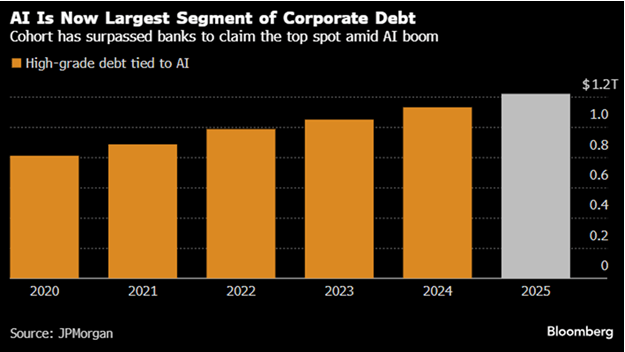

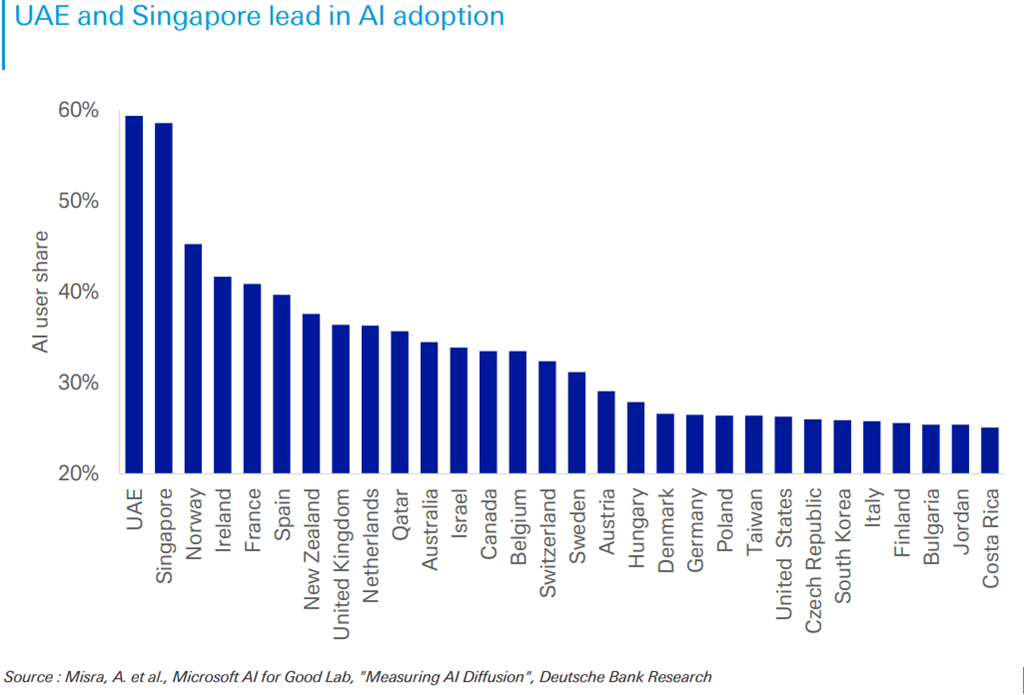

UAE and Singaport Lead AI Adoption-Jim Reid Deutsche Bank

?

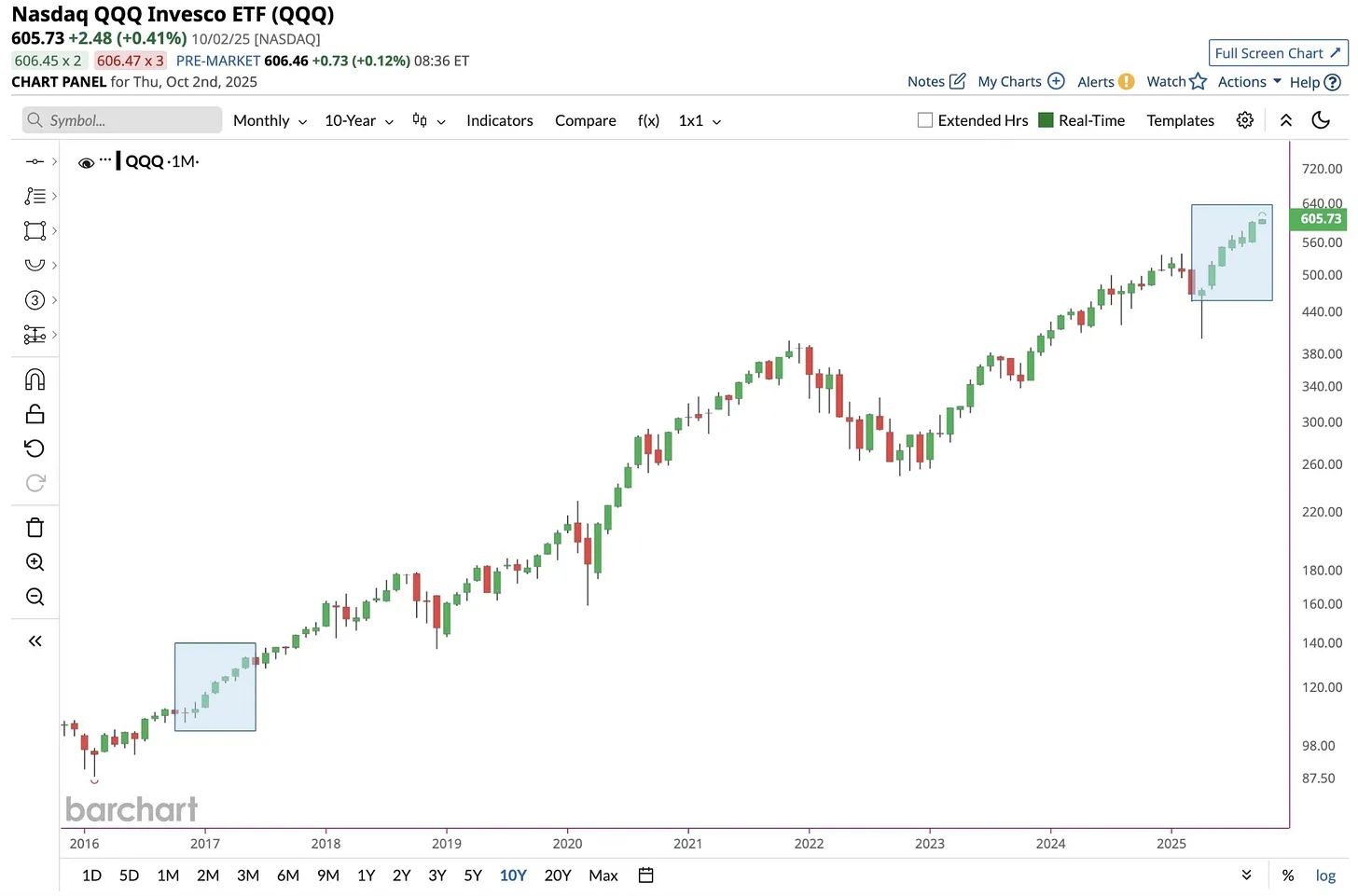

2. Nasdaq Up 7 Months in a Row

Take a look at the Nasdaq over the last 7 months. It’s a thing of beauty. It has been up 7 months in a row. The best streak since 2016-2017.

…

…

…

5. Small Percentage of Social Media Creators Receive All the Eyeballs

Prof G Blog The bigger issue isn’t whether the AI-generated art is “good” or “bad.” It’s that most consumers don’t actually want to create it in the first place. Media consumption has long followed the “1% rule”: Only a small fraction of people create content, while the vast majority consume it.

• 4% of YouTube videos account for 94% of views on the platform.

• 5% of videos on TikTok generate 89% of the views.

• On Instagram, 3% of videos earned 84% of all views.

• The top 25 podcasts reach nearly half of U.S. weekly listeners.

…

…

?

?

9. Great Majority of Wealthy Parents Giving to Adult Children

Barrons The great majority of wealthy parents are giving their adult children financial support, according to a new survey by Ameriprise. Three-quarters of the survey’s 554 respondents are footing the bill for their adult children’s big-ticket items, like down payments on homes or tuition for graduate degrees. Nearly two-thirds are also covering ongoing costs like phone bills.

?

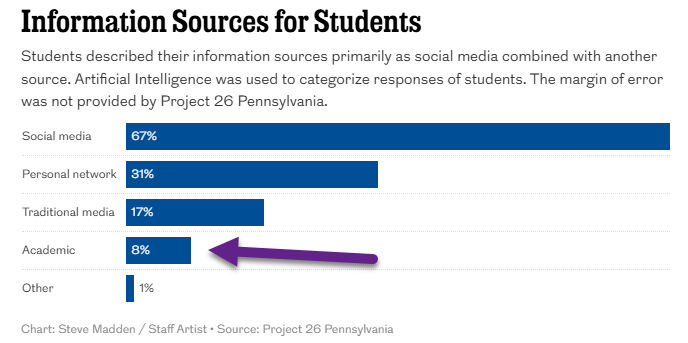

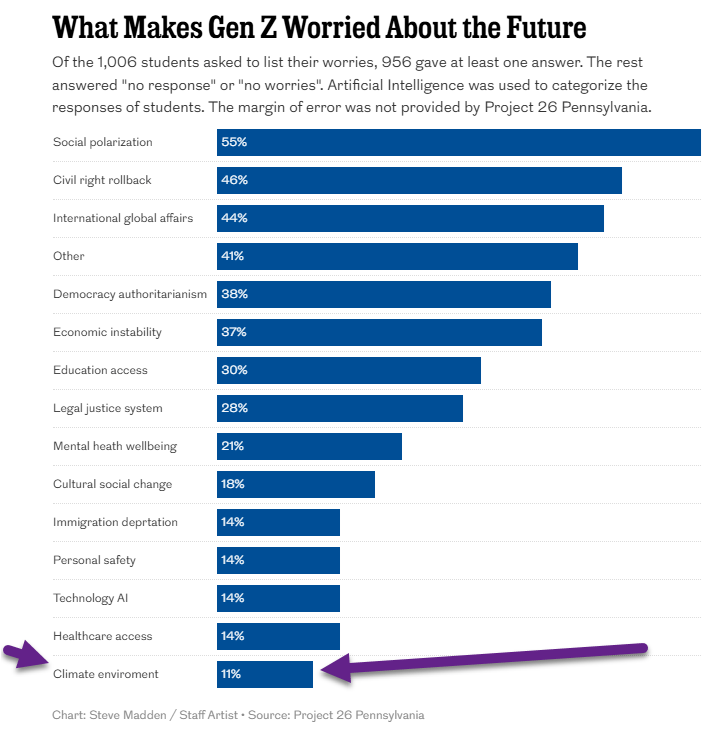

10. Interesting Poll of Pennsylvania College Kids….2% Trust Politicians, Climate/Environment Ranks Last in List of Worries, and Academics Come In Last for Information Sources

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.