- TOPLEY'S TOP 10

- Posts

- Smarter in 10 Minutes

Smarter in 10 Minutes

10th Biggest One-Day Gain in History

….

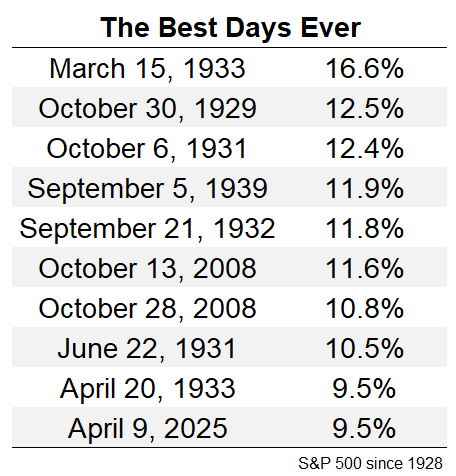

1. Wednesday Move was 10th Biggest One-Day Gain in History

According to my data, Wednesday’s giant move higher was the tenth-best day ever for the S&P 500 going back to 1928:

…

…

3. North Korea Hits $6B in Crypto Theft

North Korea is now the world’s most dangerous crypto thief. It has swiped more than $6 billion in cryptocurrency over the past decade—a sum so large that no one else compares.

The country’s hackers are both patient and brazen, according to investigators. To get into companies’ computers, they comb through employees’ Facebook and Instagram pages and invent tailor-made stories to trick them into clicking on links with viruses. Some North Korean hackers have even become employees themselves, fooling U.S. companies into hiring them as remote IT workers and gaining access to their networks.

…

…

5. Housing in South Update

New single-family houses for sale in the South, where Florida is by far the largest housing market, have ballooned past the Housing-Bust high since mid-2024 to a range between 290,000 to 304,000 houses for sale, with 296,000 new houses for sale in February, up by 72% from February 2019, according to Census Bureau data, which doesn’t provide state-level data, only regional data.

Those new houses are adding large amounts of additional supply to the surging inventories of existing homes. Homebuilders are the pros in this business, they know how to move the inventory: price cuts, building at lower price points, large-scale mortgage-rate buydowns, and incentives. And homeowners wishing to sell have to compete with this supply of new houses and increasingly aggressive builders.

Buyers are still on strike: In the South, pending sales of existing homes rose month-to-month in February, seasonally adjusted, but were down by 3.4% from the collapsed levels February last year, and booked the worst February in the data from the National Association of Realtors. Compared to 2019, pending sales plunged by 29%.

…

5. Office to Apartment Conversions in U.S.

Food for Thought: Office-to-apartment conversions in the US:

…

…

…

9. Ten Million Less Viewers without Caitlin Clark

March Madness hit badly in Caitlin Clark's absence as women's Final Four TV ratings revealed.

Via MSN: UConn's Final Four win over UCLA averaged 4.1 million viewers on Friday, which was a drop of over 10 million viewers compared to last season when the Huskies faced Iowa and Caitlin Clark.

When the Hawkeyes advanced to their second consecutive national championship game with a dramatic 71-69 win over UConn, it drew a record 14.2 million viewers. While the Huskies' win over the Bruins in 2025 was the fifth-most watched women's college basketball game ever on ESPN, the absence of Clark was felt.

"I feel like we’re just scratching the surface. If you would have told people this is where the WNBA is, five years ago … people probably wouldn't have believed you, because they never thought that was possible.

"They never thought people would buy tickets; they never thought we’d play on ABC, never thought we’d be on ESPN. They never thought there could be sold out arenas or little kids wanting to wear WNBA jerseys."

…

10. An Investors Best Friend

Buffett on bear markets: ‘An investor’s best friend’

Via CNBC: The S&P 500 has suffered losses in the wake of Trump’s recent tariff announcement, but it has yet to officially close in bear territory — defined as a 20% fall from recent highs. If a bear does emerge, market analysts say it will likely be because investors are bracing for a trade war that could cause a global economic slowdown.

It wouldn’t be the first time Buffett’s navigated a worldwide recession. In 2008, in the midst of the global financial crisis and its associated bear market, Buffett penned an op-ed for the New York Times.

“The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher,” he wrote. “In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary.”

“So ... I’ve been buying American stocks,” he continued.

Buffett acknowledged that he had no idea what the stock market would do next. And indeed, after he published the piece in October 2008, the S&P 500 wouldn’t find its bottom for another five months.

But as Buffett has pointed out over and over, businesses, en masse, have always found ways to innovate and increase their profitability over long periods, contributing to the historical upward trend in the stock market.

Many investors were hesitant to put their money at risk amid a financial crisis, Buffett said in 2008.

“But fears regarding the long-term prosperity of the nation’s many sound companies make no sense,” he wrote. “These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.”

Buffett favors buying stocks when they’re relatively cheap, as doing so boosts your returns over time. If you have money to invest and decades to realize compounding growth in your portfolio, it makes sense to continue investing in a diversified stock portfolio through downturns.

“In short, bad news is an investor’s best friend,” Buffett wrote in 2008. “It lets you buy a slice of America’s future at a marked-down price.”

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.