- TOPLEY'S TOP 10

- Posts

- Smarter in 10 Minutes

Smarter in 10 Minutes

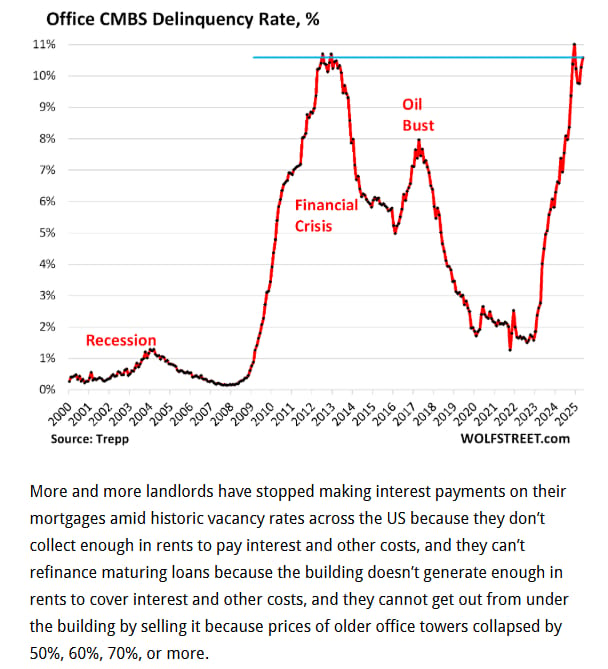

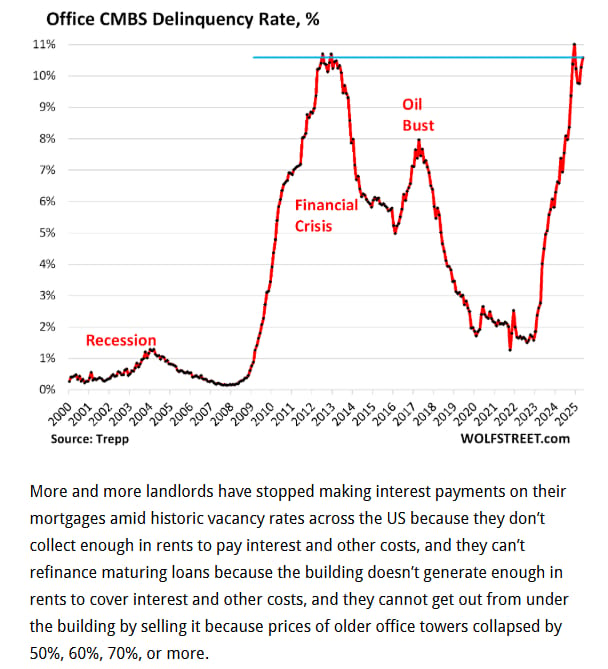

Office Delinquency Rate Spikes Back to New Highs

….

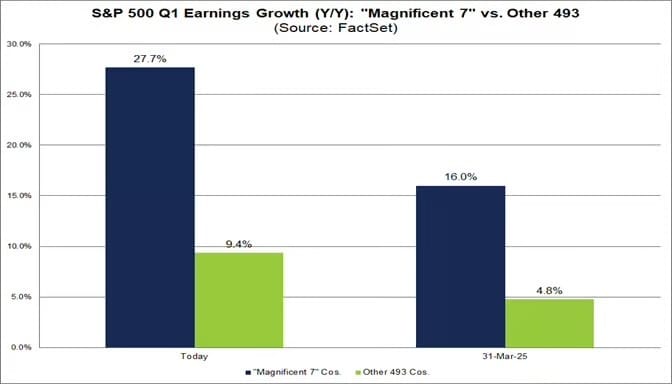

1. Mag 7 Deliver on Earnings Growth

Mag 7 EPS growth. The Mag 7 reported YoY earnings growth of 27.7% in Q1, nearly 3x that of the Other 493.

…

…

3. 10 Million Driverless Rides

Prime number: 10 million driverless rides (Morning Brew)

Now that Uber and its ilk have made the luxury of a personal driver like Miss Daisy’s available to the masses, the next big thing is starting to gain popularity: not having a driver at all.

Alphabet-owned Waymo recently surpassed 10 million paid driverless rides, and is poised to see 20+ million by the end of the year, the Wall Street Journal reports. And that’s with the self-driving taxis only available in a handful of cities, including tech’s spiritual home of San Francisco. Its rise has been rapid as people in those cities stopped seeing cars with no one in the driver’s seat as a threat and started seeing them as a convenient way to get around. Per the WSJ:

There were 1 million paid Waymo rides as of 2023, and 5 million by the end of 2024.

People were paying for 10,000 Waymo rides per week in August 2023. From there, the number grew from 50,000 per week in May 2024 to 100,000 per week in August of that year. It now sits at more than 250,000 per week.

That means riders beyond early adopters are now willing to hop in a driverless cab. A recent viral post on X suggested that data firm YipitData showed Waymo going from 0% to 27% of San Francisco ride shares between August 2024 and April 2025. Bloomberg reported in April that the same data firm found 20% of Uber rides in Austin during the last week in March were Waymo rides, just weeks after a partnership between the two companies rolled out there.

…

…

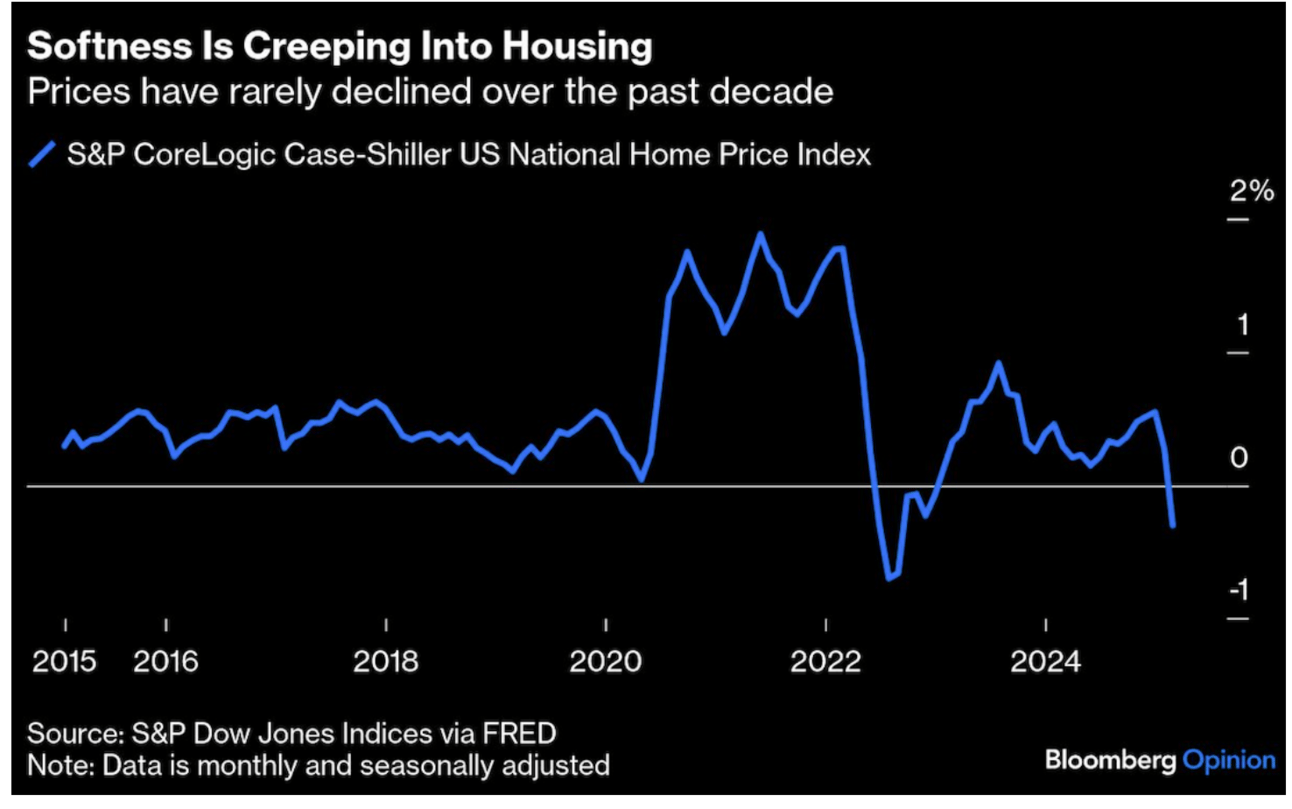

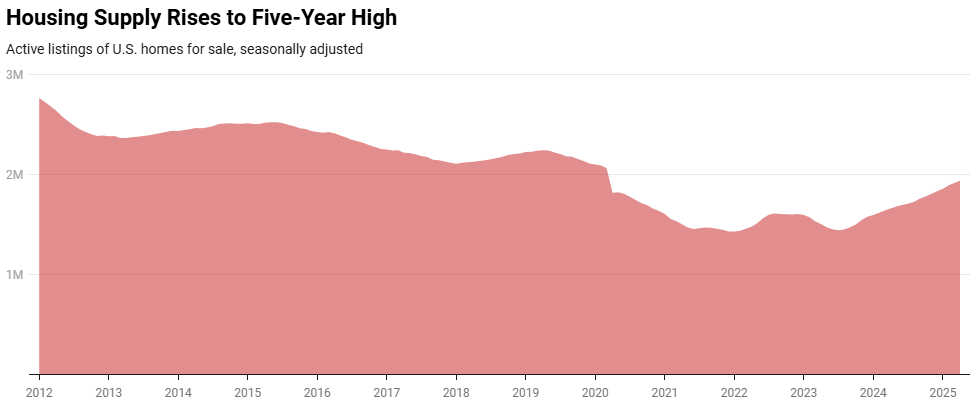

5. Real Estate Friday

Softness is Creeping into Housing Market

Office Delinquency Rate Spikes Back to New Highs

Wolf Street

…

…

…

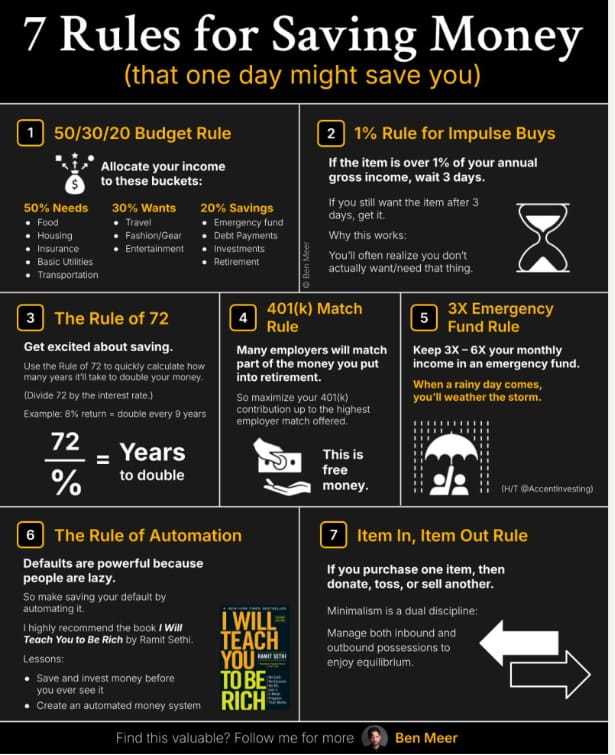

9. Retail Investors Did Not Panic in 2025 Sell Off…..401(k) savers stayed on course through market volatility, Fidelity found

Retirement savers reached an average savings rate of 14.3% in the first quarter, a new record.

Via Yahoo!Finance: Retirement savers weathered a chaotic stretch of market gyrations in the first three months of the year, consistently adding to their savings, according to Fidelity Investments’ quarterly analysis.

While they experienced a drop in average 401(k), 403(b), and IRA balances, mostly due to market swings, savings rates remained consistent, with the average 401(k) savings rate increasing to a record 14.3%.

“We saw a lot of positive savings behaviors among employees,” Mike Shamrell, vice president of workplace thought leadership at Fidelity Investments, told Yahoo Finance.

“It was really encouraging to see that despite a lot of things going on, and economic ups and downs, people continued to save and didn’t pull back, or make a lot of changes to their asset allocation,” he said. “As a result, we saw the individual 401(k) savings rate increase to the highest level that we've seen.”

To break it down, the average employee contribution rate was 9.5%, and the employer contribution rate was 4.8%. This combined savings rate of 14.3%, up from 13.5% in 2020, is the closest it's ever been to Fidelity's suggested savings rate of 15%.

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.