- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

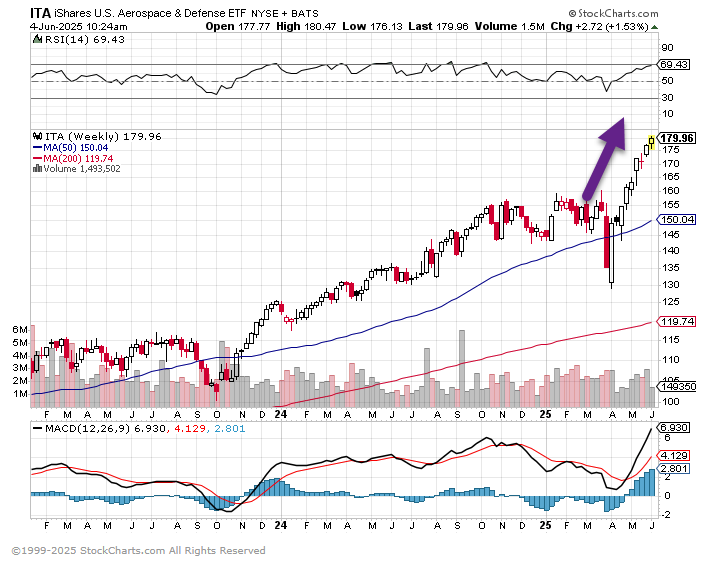

Aerospace/Defense ETF Spikes to New Highs

2….

…

…

…

…

…

…

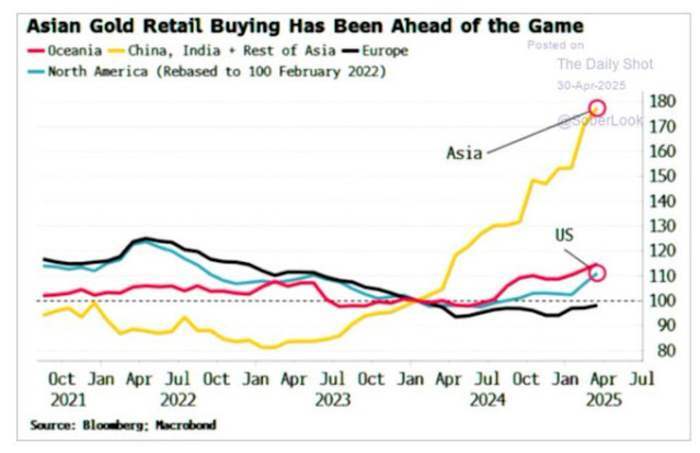

7. Asian Retail Buyers Driving Gold Buys…American Retail Buying Technology Stocks

Current retail demand is mainly driven by Asian investors, while U.S. and European investors are nowhere to be seen.

…

…

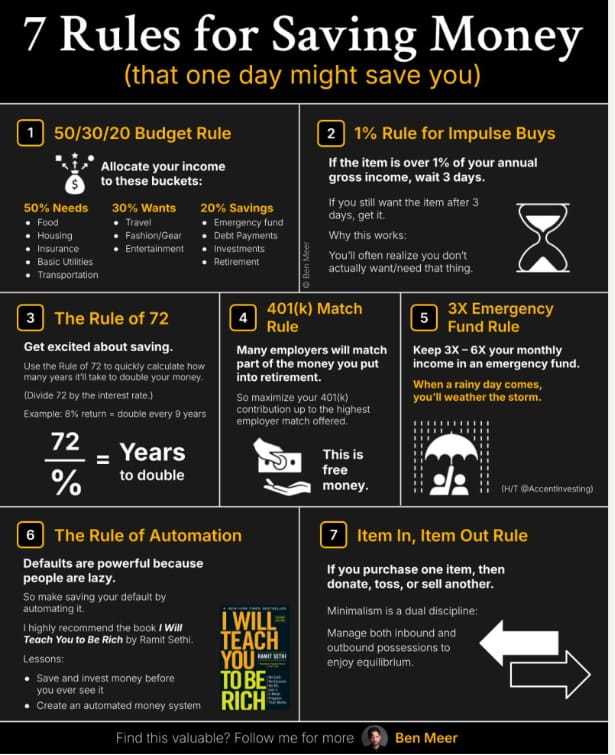

9. Retail Investors Did Not Panic in 2025 Sell Off…..401(k) savers stayed on course through market volatility, Fidelity found

Via Yahoo!Finance: Retirement savers reached an average savings rate of 14.3% in the first quarter, a new record. Kerry Hannon · Senior Columnist

Retirement savers weathered a chaotic stretch of market gyrations in the first three months of the year, consistently adding to their savings, according to Fidelity Investments’ quarterly analysis.

While they experienced a drop in average 401(k), 403(b), and IRA balances, mostly due to market swings, savings rates remained consistent, with the average 401(k) savings rate increasing to a record 14.3%.

“We saw a lot of positive savings behaviors among employees,” Mike Shamrell, vice president of workplace thought leadership at Fidelity Investments, told Yahoo Finance.

“It was really encouraging to see that despite a lot of things going on, and economic ups and downs, people continued to save and didn’t pull back, or make a lot of changes to their asset allocation,” he said. “As a result, we saw the individual 401(k) savings rate increase to the highest level that we've seen.”

To break it down, the average employee contribution rate was 9.5%, and the employer contribution rate was 4.8%. This combined savings rate of 14.3%, up from 13.5% in 2020, is the closest it's ever been to Fidelity's suggested savings rate of 15%.

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.