- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

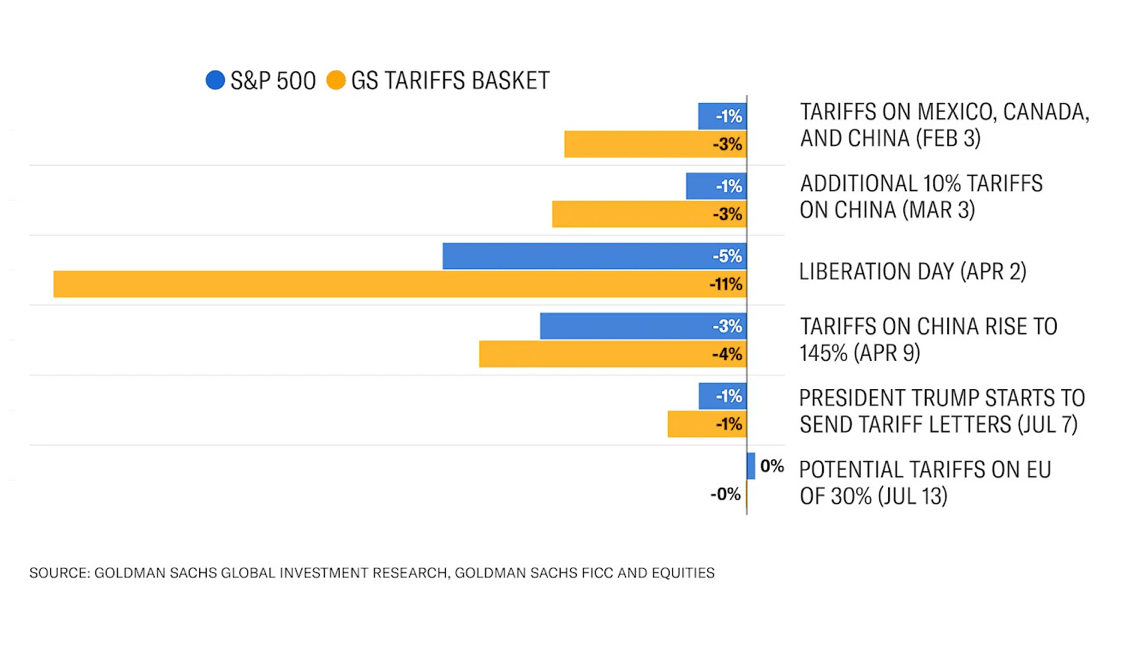

Tariffs Having Less of an Effect

2….

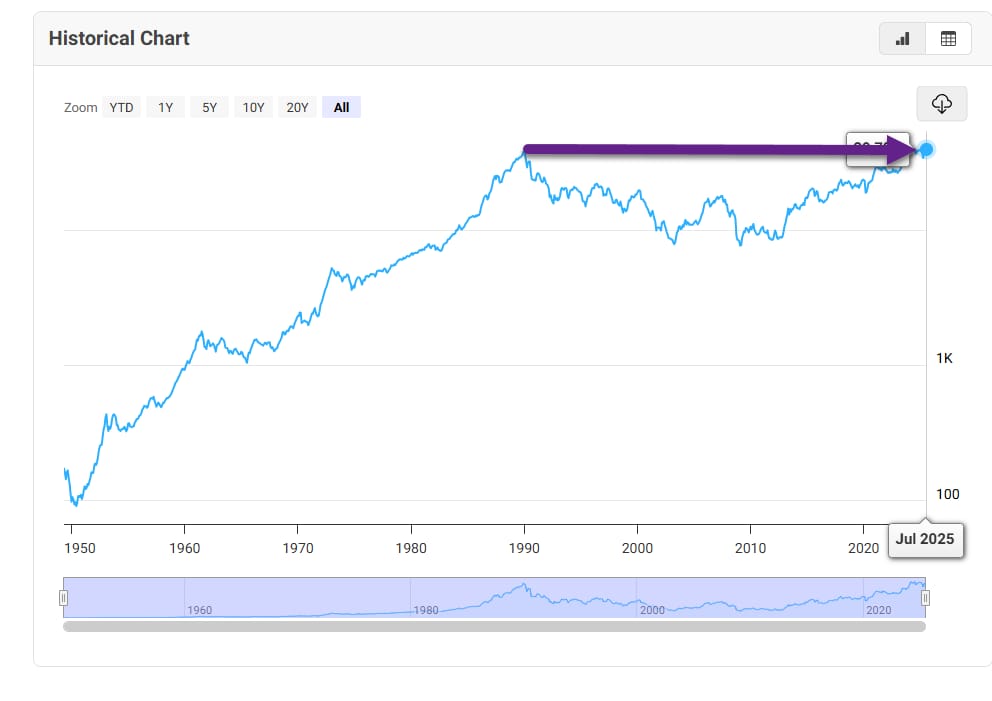

1. Nikkei 225 Index (1949-2025)—Japanese Stock Market Finally Breaks Above 1990 Bubble Highs

…

…

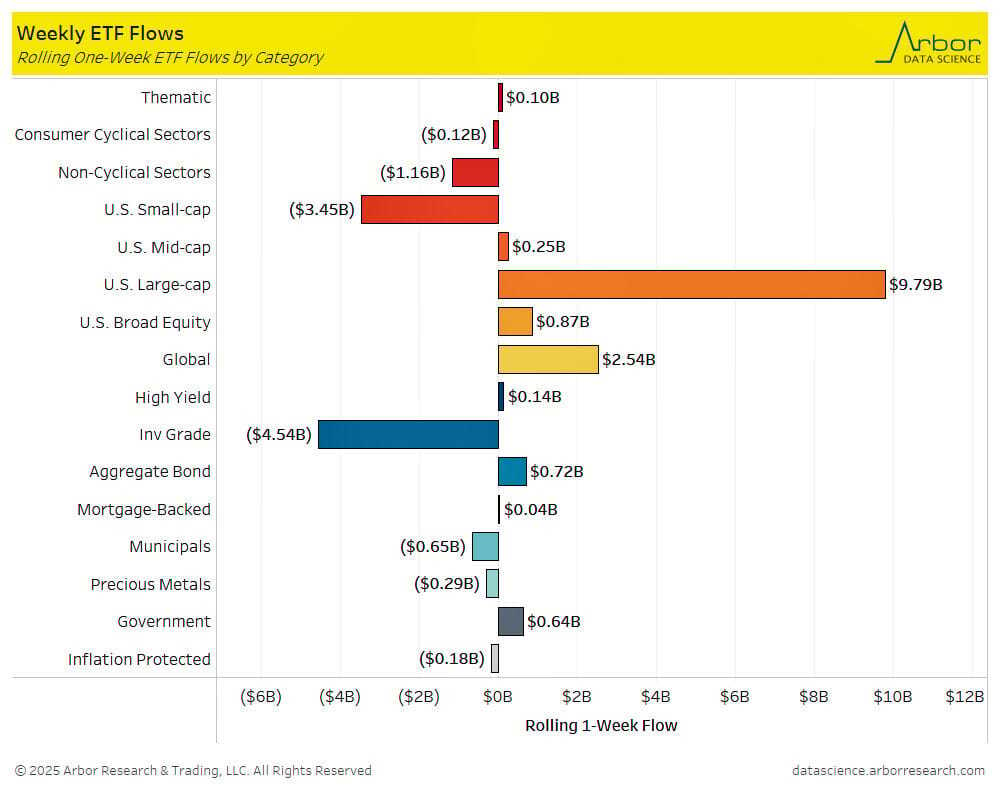

3. Large Cap Growth Dominating Flows Again

Weekly ETF flows. "Over past week, flows into U.S. large-cap ETFs soared by nearly $10B ... investment-grade bonds saw largest outflows, followed by U.S. small caps."

…

…

…

6. Goldman Sachs and BNY join Forces to Transform $7.1 Trillion Money Market Industry with Digital Tokens

Key Points

Goldman Sachs and Bank of New York Mellon have created the ability for institutional investors to purchase tokenized money market funds, CNBC has learned.

Clients of BNY, the world’s largest custody bank, will be able to invest in money market funds whose ownership will be recorded on Goldman’s blockchain platform.

Via CNBC: Goldman Sachs and Bank of New York Mellon are set to announce that they’ve created the ability for institutional investors to purchase tokenized money market funds, CNBC has learned.

Clients of BNY, the world’s largest custody bank, will be able to invest in money market funds whose ownership will be recorded on Goldman’s blockchain platform, according to executives of the two firms.

The project has already signed up fund titans including BlackRock, Fidelity Investments and Federated Hermes, as well as the asset management arms of Goldman and BNY.

The Wall Street giants believe that tokenizing the $7.1 trillion money market industry is the next leap forward for digital assets after President Donald Trump last week signed a law marking the arrival of U.S.-regulated stablecoins. The GENIUS Act is expected to boost the popularity and use of stablecoins, which are typically pegged to the U.S. dollar, and JPMorgan Chase, Citigroup and Bank of America have said they are exploring their use in payments.

But unlike stablecoins, tokenized money market funds pay owners a yield, making it an attractive place for hedge funds, pensions and corporations to park their cash.

“We have created the ability for our clients to invest in tokenized money market share classes across a number of fund companies,” said Laide Majiyagbe, BNY’s global head of liquidity, financing and collateral. “The step of tokenizing is important, because today that will enable seamless and efficient transactions, without the frictions that happen in traditional markets.”

Money market funds are mutual funds that are typically invested in safer, short term securities including Treasuries, repo agreements or commercial paper. They are generally considered the most cash-like of investments that still offer a yield. Traditional money market funds can be liquidated within a day or two, though redeeming shares only happens during market hours.

Institutional and retail investors have rushed into the asset class in recent years, pouring roughly $2.5 trillion into them since the Federal Reserve began a rate-hiking cycle in 2022.

The banks view tokenized money market funds as setting the foundation for a future in which the assets are traded in a real-time, always-on digital ecosystem. Investors and corporations could lean on stablecoins for global payments and tokenized money market funds for cash management.

But tokenizing the asset class gives the funds new capabilities beyond speed and ease of use; the digitized funds could eventually be transferable between financial intermediaries without having to first liquidate funds into cash, according to BNY and Goldman.

That could bolster its use by the world’s largest financial players as collateral for a multitude of trades and margin requirements, said Mathew McDermott, Goldman’s global head of digital assets.

“The sheer scale of this market just offers a huge opportunity to create a lot more efficiency across the whole financial plumbing,” McDermott said. “That is what’s really powerful, because you’re creating utility in an instrument where it doesn’t exist today.”

…

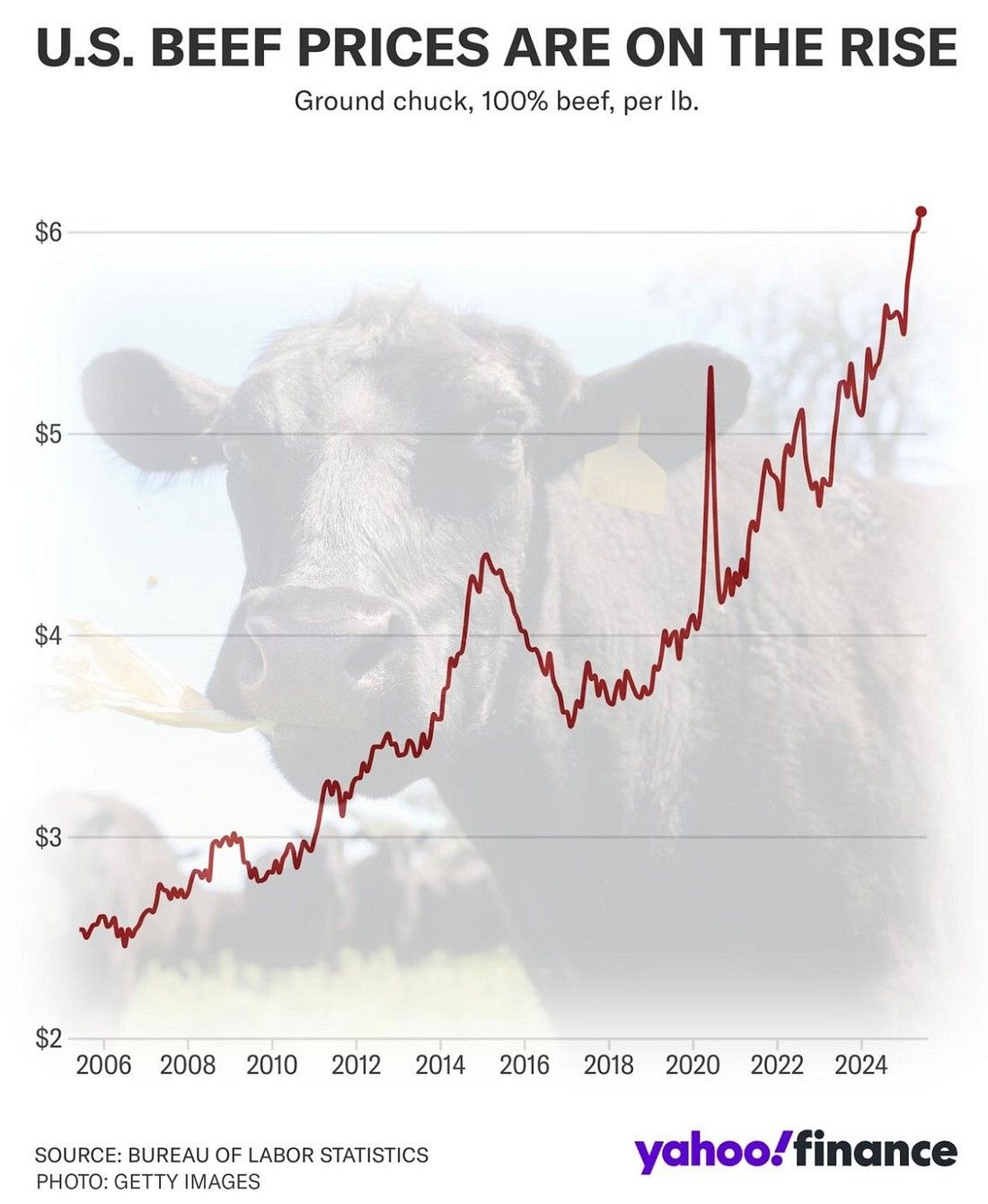

7. U.S. Beef Prices …Protein Bull Market Adding to Supply/Demand Factors

…

…

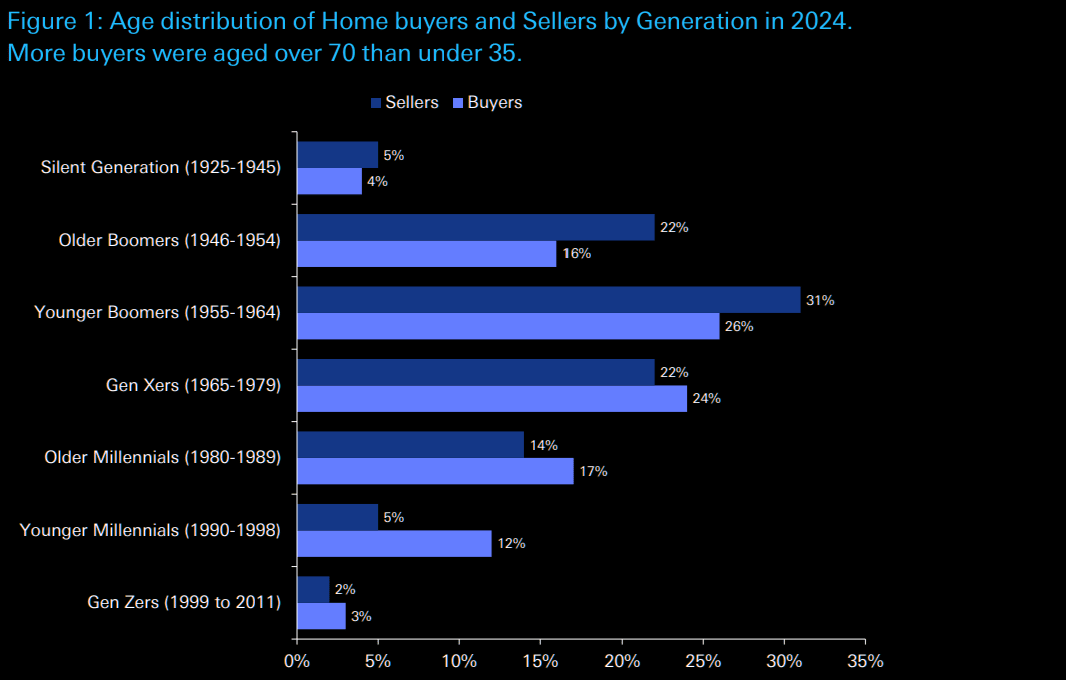

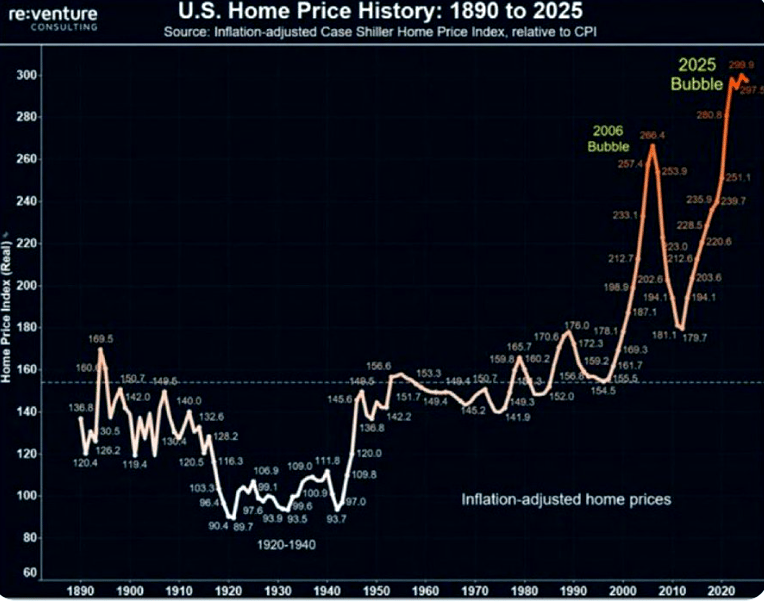

9. 46% of American Homes Being Purchased by 60+ Year Olds

In 2024, more US homebuyers were aged 70 and above (20% of buyers) than under 35 (around 15%). In fact, 46% of homes were purchased by those aged 60 and over. DB noted: "Over the long run, property is an asset that ultimately gets redistributed from one generation to the next. Right now, that handoff is being stalled by high interest rates and elevated home prices. At some point, either—or both—will have to adjust, or real wages for younger people will need to rise sharply. Eventually, the younger generation will own the homes currently held by the older generation. We just don’t yet know what the price will be."

Zach Goldberg Jefferies

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.