- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

Foreign Ownership of U.S. Assets

….

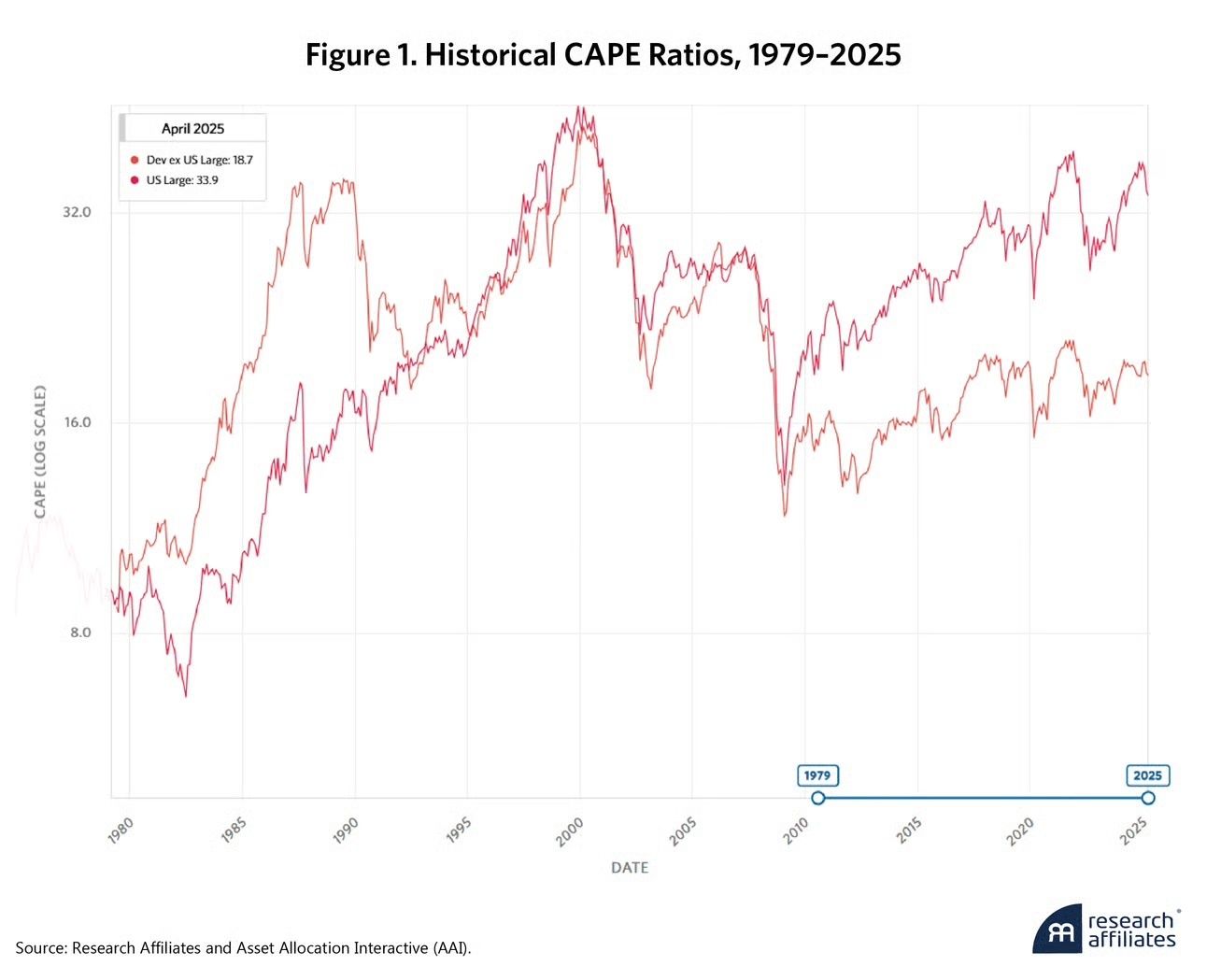

1. U.S. 33.9 vs. Developed 18.7 Markets Cape Ration Comparison

US vs. DM. "Developed ex-U.S. large caps have a CAPE ratio of 18.7 compared to 33.9 for U.S. large caps ... U.S. large caps hover in the 96th percentile while developed ex-U.S. equities quietly sit in the 40th percentile, modestly cheaper than their long-term median."

…

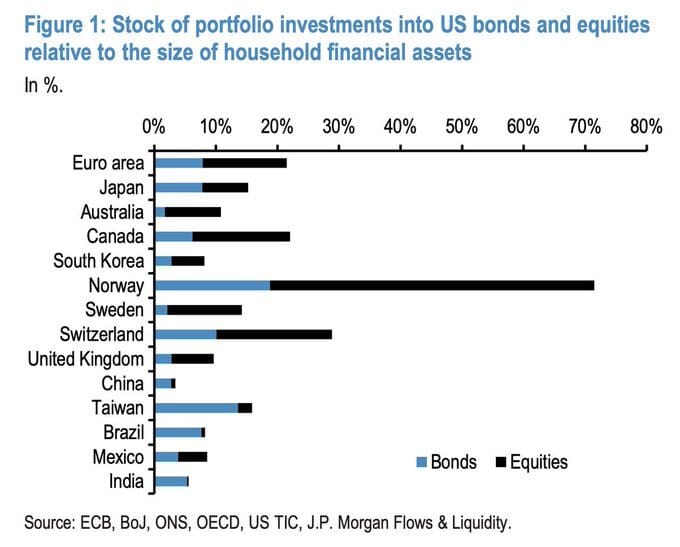

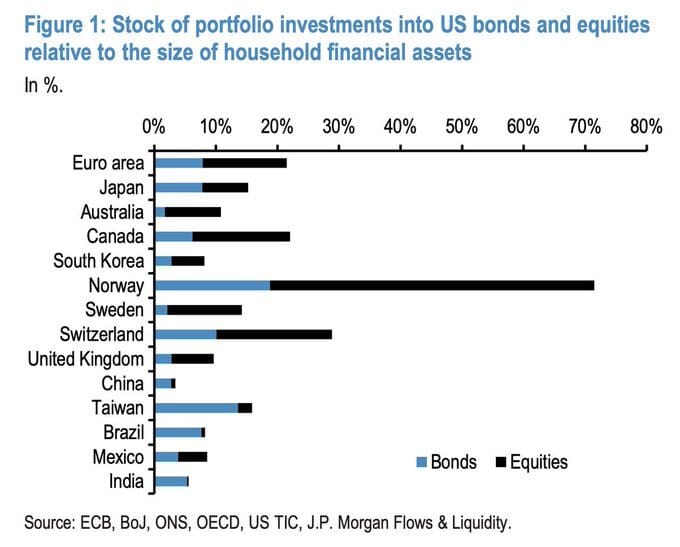

2. Foreign Ownership of U.S. Assets

JPMorgan’s Nikolaos Panigirtzoglou broke down US stock & bond ownership by country and then set it against the total household financial assets of that country to determine “which countries are the most vulnerable or exposed…While these portfolio investments are often made via institutions such as insurance companies and pension funds, the ultimate owners are typically households via their financial claims on these institutions,” Panigirtzoglou said to explain using that metric. The takeaway is that aside from Norway and Switzerland where the figures are boosted by sovereign wealth funds that have huge stakes in US assets, “[d]espite the rather large figures often mentioned in dollar terms for the stock of US assets held by the rest of the world, relative to the total financial assets of households, the allocations typically stand at around 10-20%” (excluding Norway and Switzerland), which Panigirtzoglou called “rather low compared to the share of the US in global equity and bond indices," suggesting that foreign investors don’t necessarily hold “too much” in the way of US assets.

Zachary Goldberg Jefferies

…

…

…

…

…

…

…

9. Housing Market Changing to Buyers Market??

Home sellers vs. buyers. "There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market."

…

10. Summer rentals in the Hamptons are down 30%

Via CNBC: Summer rentals in the Hamptons are down 30% from the same period in previous years, according to Judi Desiderio of William Raveis Real Estate.

Brokers who focus on ultra-high-end rentals are seeing an even bigger drop and say their rental business is down between 50% and 75%.

Some renters may be holding out for better deals or waiting to book, but brokers privately say there are other factors at play.

Summer rentals in the Hamptons are off to a chilly start to the season, as unrented homes start to pile up and sales slow, according to brokers.

Hamptons rentals are down 30% from the same period in previous years, according to Judi Desiderio of William Raveis Real Estate. Brokers who focus on ultra-high-end rentals say their rental business is down between 50% and 75%.

“People are holding on to their money,” said Enzo Morabito, head of the Hamptons-based Enzo Morabito Team at Douglas Elliman. “They don’t like uncertainty.”

Of course, Hamptons renters often wait until the last minute to book July and August rentals. Brokers say this year may be starting even later due to cold, rainy weather in May. Some renters may also be holding out for better deals in a Hamptons market that has become far more expensive after Covid.

Yet brokers and renters say privately that the volatility in the stock market and economic uncertainty sparked by the ever-changing tariff landscape has made some affluent renters and even some buyers hold off on a pricey Hamptons vacation this summer.

After the post-election euphoria in markets at the end of last year, brokers saw a surge in interest from potential renters in January and February. But as spring arrived, along with the April tariff announcements, the early interest didn’t translate into rentals.

Morabito said he represents several homeowners with large waterfront and luxury properties that typically would have been rented by March or April. Today, they’re still available. He said some homeowners who rent out three or four homes in the Hamptons during the summer may start to question their investments after this summer if renters don’t start emerging.

On the plus side, the rise in unrented inventory means potential bargains and choice for renters. Brokers say some listings have started lowering their prices by 10% to 20% in hopes of saving the summer. Some homeowners are adding more flexibility, allowing for shorter one- or two weeks stays in hopes of getting renters.

Gary DePersia of My Hampton Homes said the best houses in the Hamptons typically get rented early in the year. “But this year I have great rentals available in every town, from Southampton to Montauk.”

While tariffs and economic uncertainty may play a role in the slump, he said renters seem to have been waiting longer and longer every year, perhaps holding out for better deals. Eventually, he said, they end up renting.

“I think a number of people have deferred decisions, or they weren’t sure what [they were] going to do, go to Europe or the West Coast,” he said. “They will realize they want to be in the Hamptons; they have lot of friends and colleagues here and then they start scurrying around for rentals.”

Desiderio said the combination of weather and grim economic headlines made for a slow start that will quickly reverse.

“I believe this year there was so much ‘dark noise’ out there financially, and geopolitically, and the weather was not conducive to thinking of summertime,” she said. “There’s no doubt that by the time July 1 is upon us, all of the rentals will be taken this year.”

When it comes to home sales, the Hamptons real estate market remains fairly strong, despite relatively low inventory. Sales in the first quarter were down 12% from a year ago, although the median sales price jumped 13% to a record $2 million.

Brokers say when a quality home in the Hamptons is priced right, it sells immediately. They add that the surge in high-end sales in Manhattan over the past two months could also lift the Hamptons market.

“I just had two Canadians put a bid on an $18 million house, sight unseen” Morabito said. “When Manhattan comes alive, we always follow.”

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.