- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

History of +1% Starts to the Year

..

1. History of +1% Starts to the Year

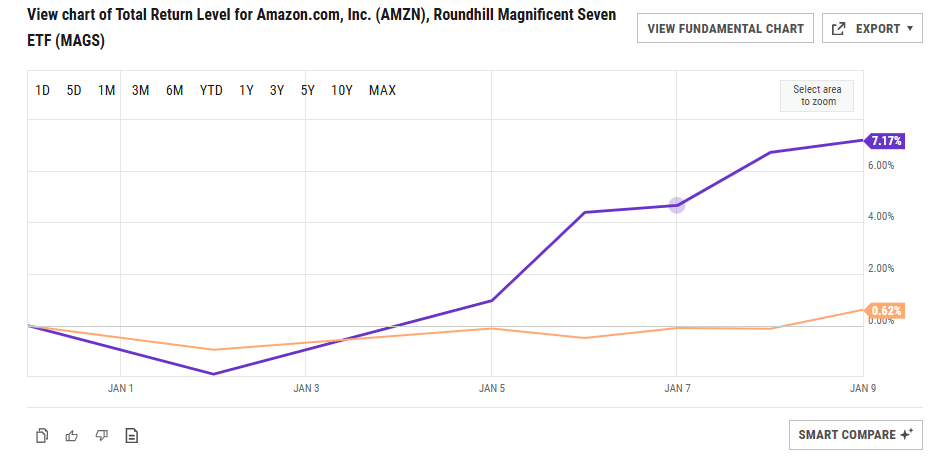

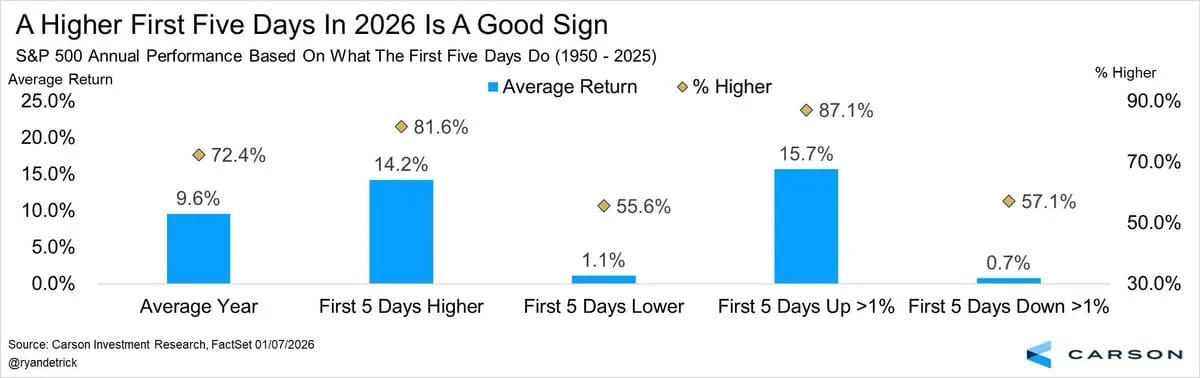

Good Start, Good Year: the strong start to 2026 bodes well for the rest of the year, as Ryan Detrick Notes: “The S&P 500 is up more than 1% after the first 5 days of 2026. Historically, when this happens, the full year is positive more than 87% of the time and up nearly 16% on average.”Thinking it through, the main logic to this statistical boon is probably a combination of momentum effects and the absence of bad macro/fundamental news.

Source: @RyanDetrick

..

..

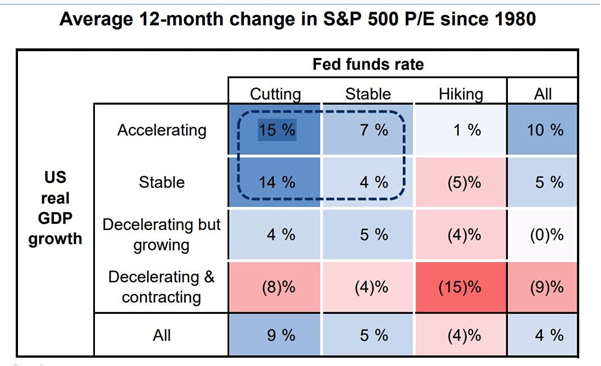

3. GDP x FFR vs. SPX P/E. "Accelerating/stable GDP growth with Fed cutting supports multiple expansion...best combination"

..

4. Tech Debt 2026 vs. 1999…Not An Issue Yet

At least no debt, yet TMT debt growth - this is the key difference between the Dot Com and AI CAPEX booms.

..

.

.

.

.

.

10. Room temperature-Seth’s Blog

Left alone, a cup of coffee will gradually cool until it reaches room temperature.

Stable systems regress to the mean. Things level out on their way to average, which maintains the stability of the system.

The same pressures are put on any individual in our culture.

Sooner or later, unless you push back, you’ll end up at room temperature.

(As I write this, the built-in grammar tool has made suggestions to every single sentence, pushing to make it sound less like me and more like normal.) https://seths.blog/

.

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.