- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

U.S. ETFs Attracted $1.4 Trillion in 2025.....1000 New Products Entered the Market

..

1. U.S. ETFs Attracted $1.4 Trillion in 2025…..1000 New Products Entered the Market

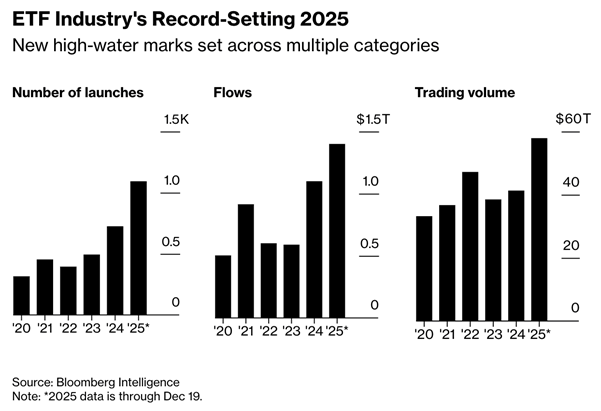

ETF stats. "US-listed ETFs have attracted a staggering $1.4 trillion in 2025, shattering the annual flow record set just last year. At the same time, more than 1,000 new products have entered the market — another unprecedented sum. Trading volume in the ETF market also hit a new yearly high. The last time all three measures hit a record in a single year was in 2021."

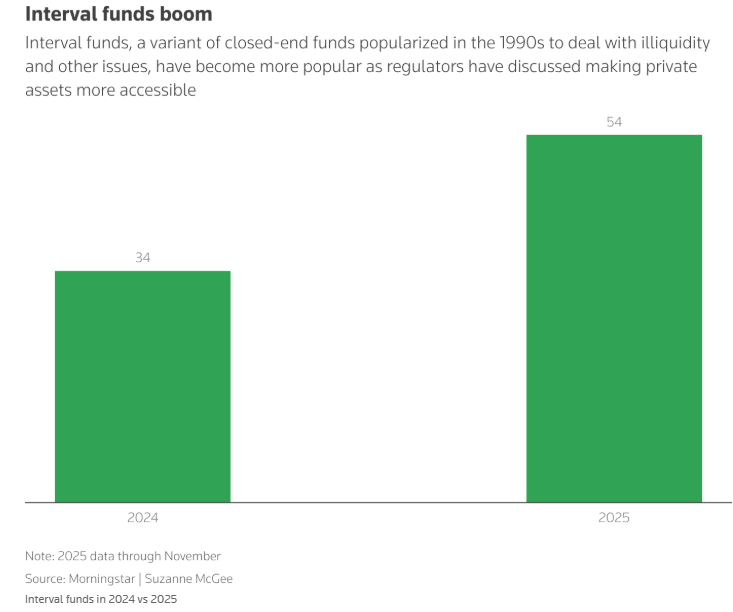

2. Interval Funds Doubled the Number of Launches

Reuters

..

…

4. Tech Companies Moved $120B of Data Center Spending Off their Balance Sheets

FT-Tech companies have moved more than $120bn of data centre spending off their balance sheets using special purpose vehicles funded by Wall Street investors, adding to concerns about the financial risks of their huge bet on artificial intelligence. Meta, Elon Musk’s xAI, Oracle and data centre operator CoreWeave have led the way on complex financing deals to shield their companies from the large borrowing needed to build AI data centres.

..

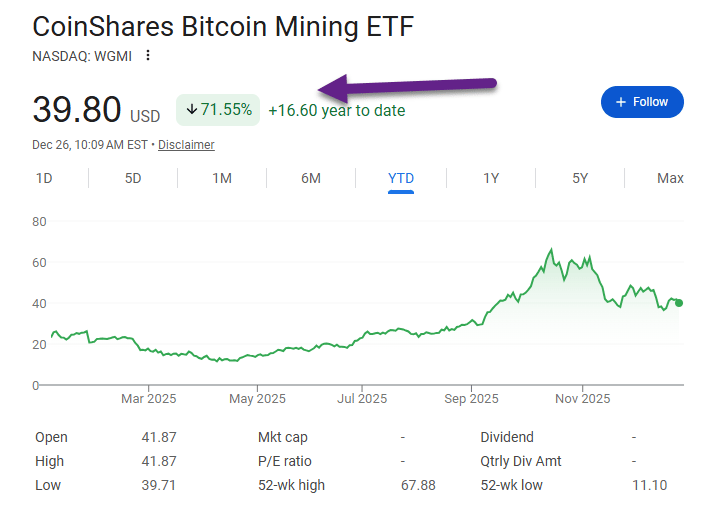

5. Bitcoin Mining ETF WGMI +71% 2025

The pivot to AI has lifted a bitcoin-mining ETF by around 90% this year, even as bitcoin itself has slumped.

.

.

7. China Investigated 63 High-Ranking Party Leaders in 2025

Semafor

.

.

.

.

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.