- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

Top 10 Largest Companies S&P at 30x P/E

2….

1. Top 10 Largest Companies S&P at 30x P/E

Barrons-Tech’s strength has people talking about bubbles once again—and not without evidence. The top 10 companies in the S&P 500 trade for close to 30 times 12-month forward earnings, notes Torsten Sløk, chief economist at Apollo Global Management, above the 25 times the top 10 fetched during the dot-com bubble. “The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s,” he writes

The bill also allows companies to expense all of their domestic R&D costs in the year they do the spending rather than amortizing it over a five-year period. That means companies get all of the tax benefit at one time, lowering their taxable income and improving cash flow, Pinder says—and they also get to apply the new rule to spending from 2022 to 2024.

And who does most of that spending? The Magnificent Seven stocks, which account for 47% of R&D by S&P 500 companies. “For them, the windfall should be somewhat immediate and provide more cash to reinvest in growth, or return to shareholders,” Pinder writes. https://www.barrons.com/articles/donald-trump-ai-bubble-best-friend-soaring-bda738a8?mod=past_editions

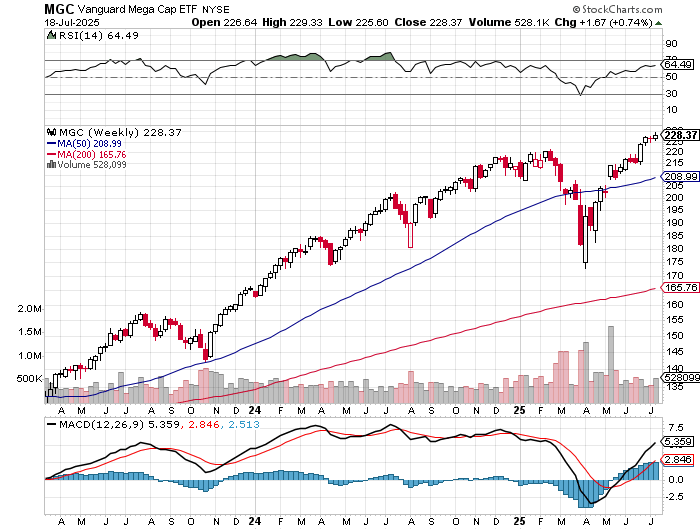

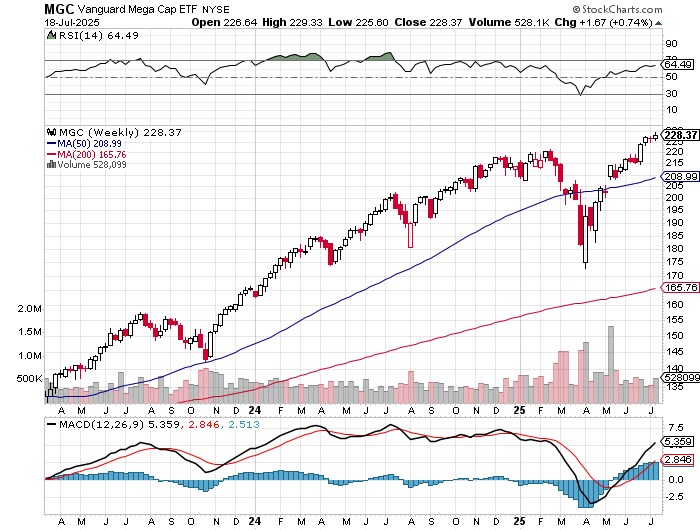

Mega Cap Stock ETF New Highs

…

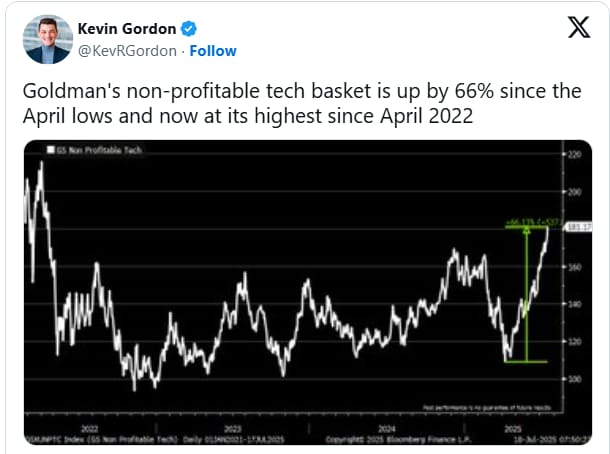

2. Goldman Non-Profit Tech Basket of Stocks Not Yet Back to 2021 Levels

…

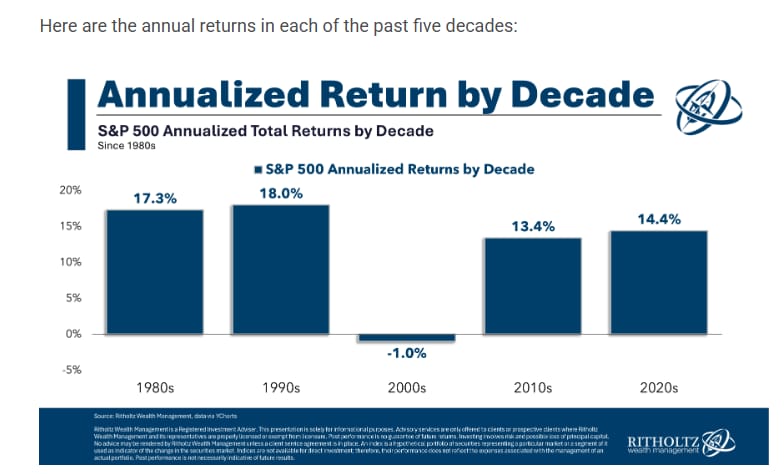

3. 2010-2015 Big Returns But Below 1980’s and 90’s

…

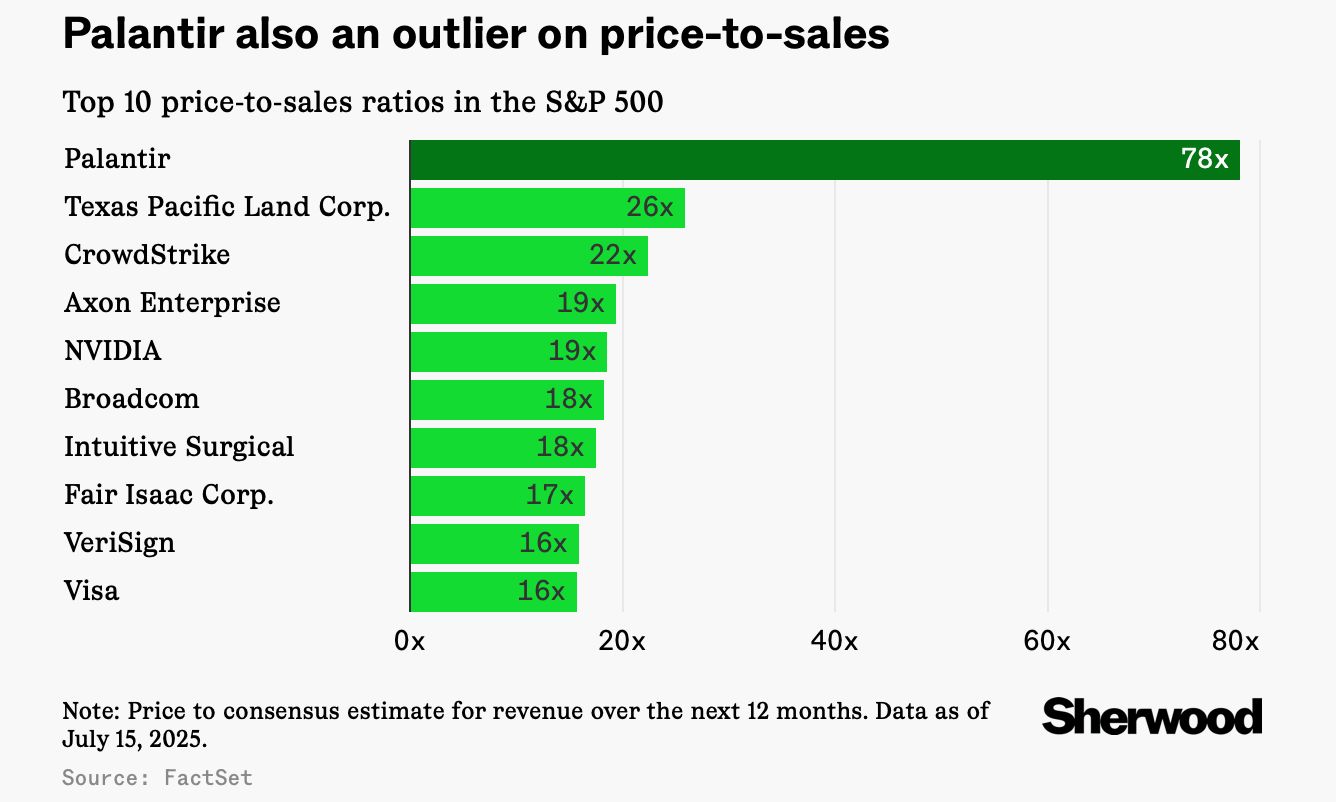

4. Palantir Expensive Beyond Rest of S&P Highfliers …This is Price to Sales Not P/E

…

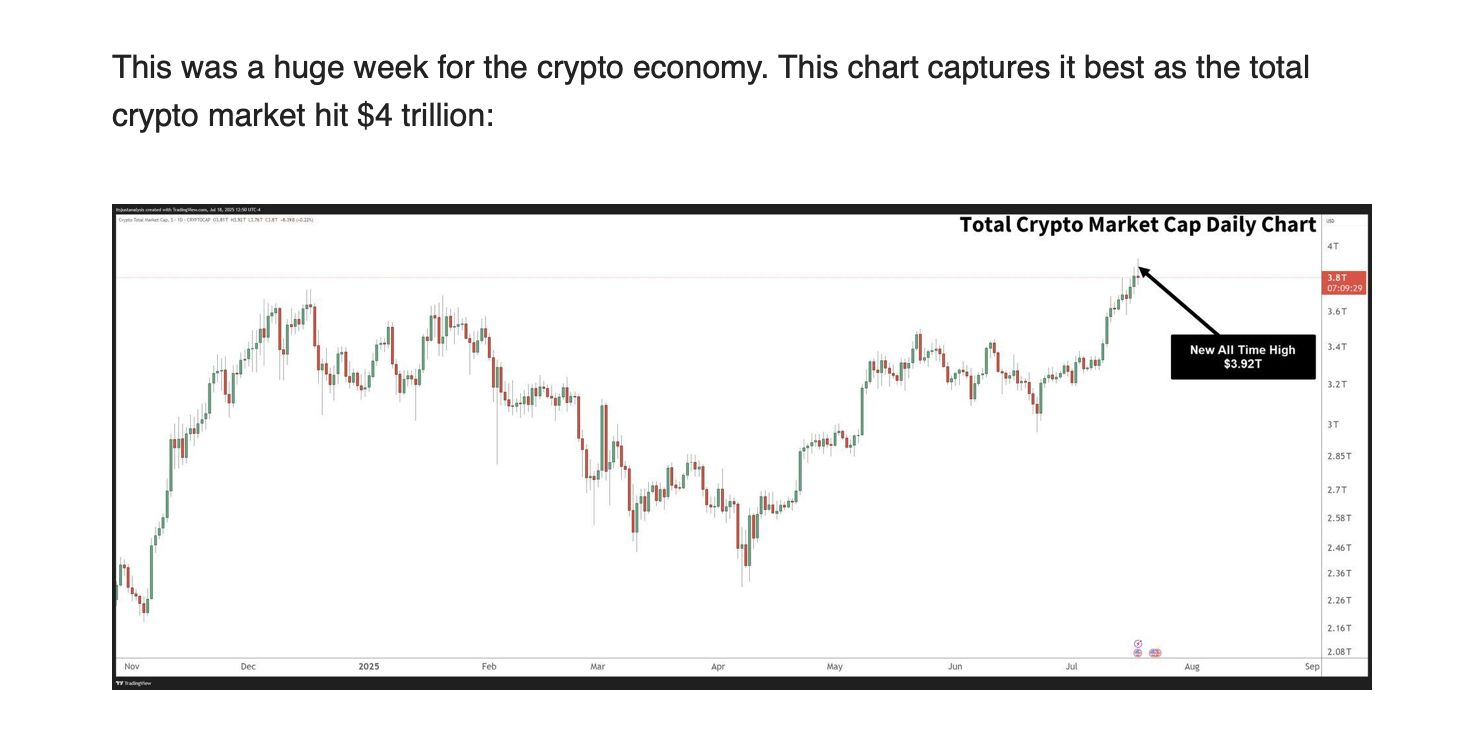

5. Crypto Economy Crossed $4 Trillion in Market Cap

…

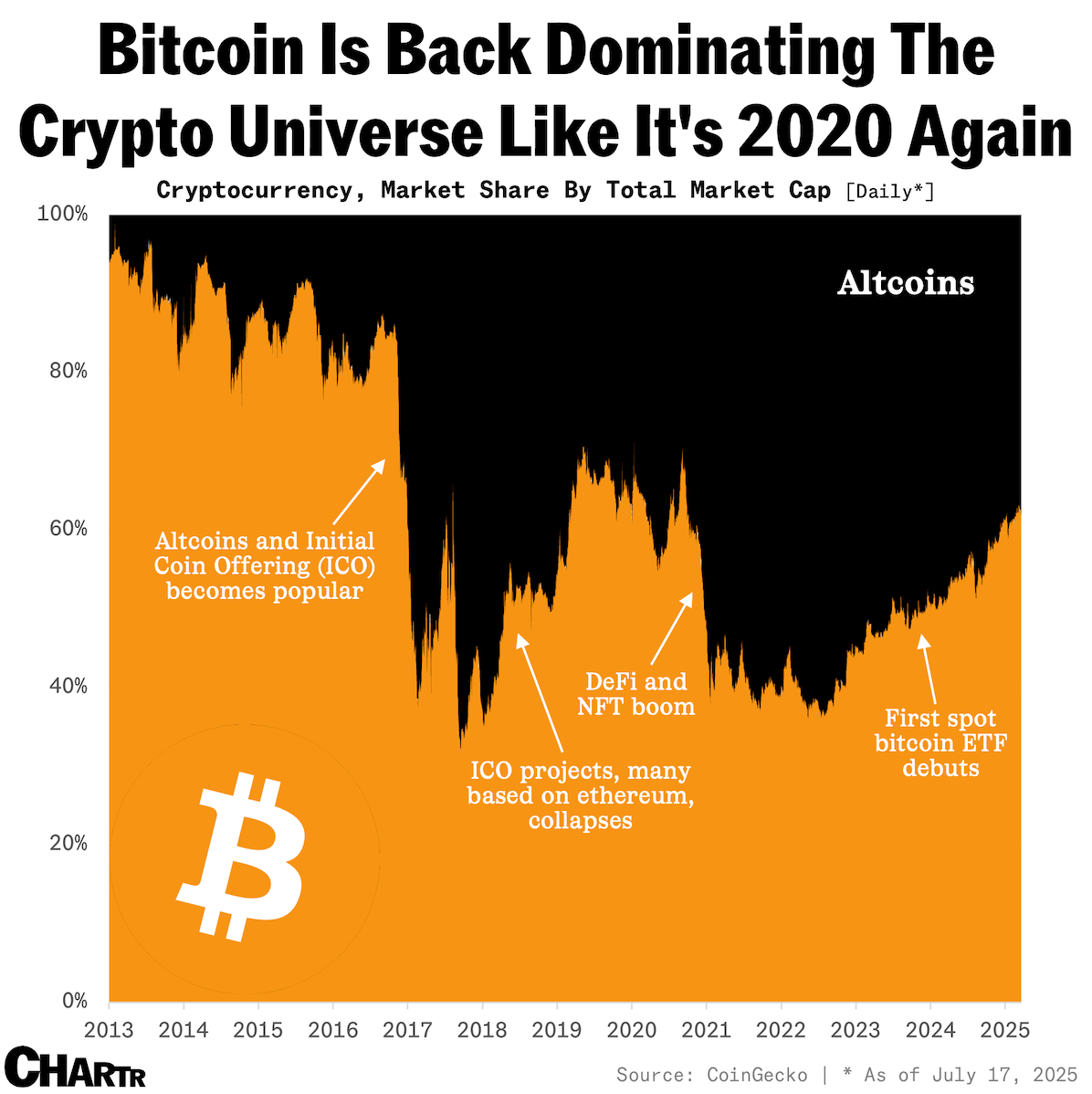

6. Bitcoin is 63% of Total Crypto Market Value

On Monday morning, bitcoin briefly flew past a record $123,000 price point, before climbing down a little later in the week, as a handful of meme coins and altcoins started to steal the show. However, when it comes to the bigger (often messier) crypto picture, Bitcoin is still very much the main focus — accounting for a whopping 63% of the total crypto market’s value.

Unlike the early days, when 10,000 bitcoin would pick you up a couple of large pizzas if you were lucky, the asset has become seriously big — and somewhat seriously stable — as business, and institutional investors started taking notes in a major way.

Indeed, even bitcoin’s latest record surge is less to do with individuals looking to park their cash away from the governing and corporate powers that prop up the centralized financial system, and more closely related to some of those entities themselves getting into BTC.

…

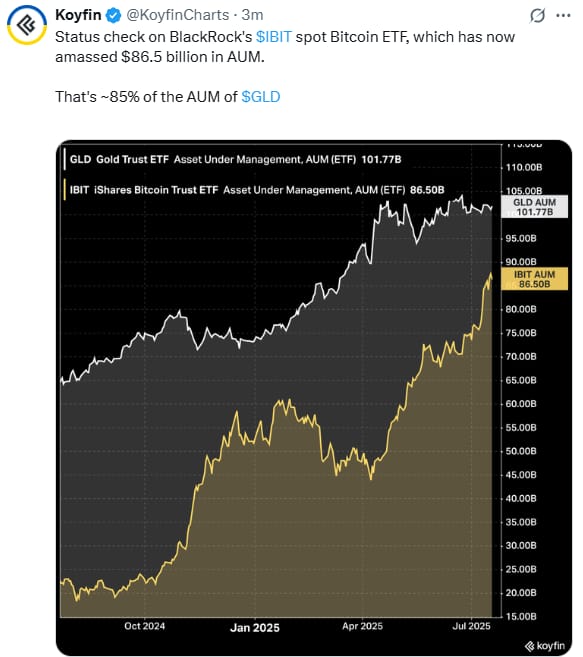

7. IBIT Bitcoin ETF 85% of Assets vs. GLD Gold ETF

…

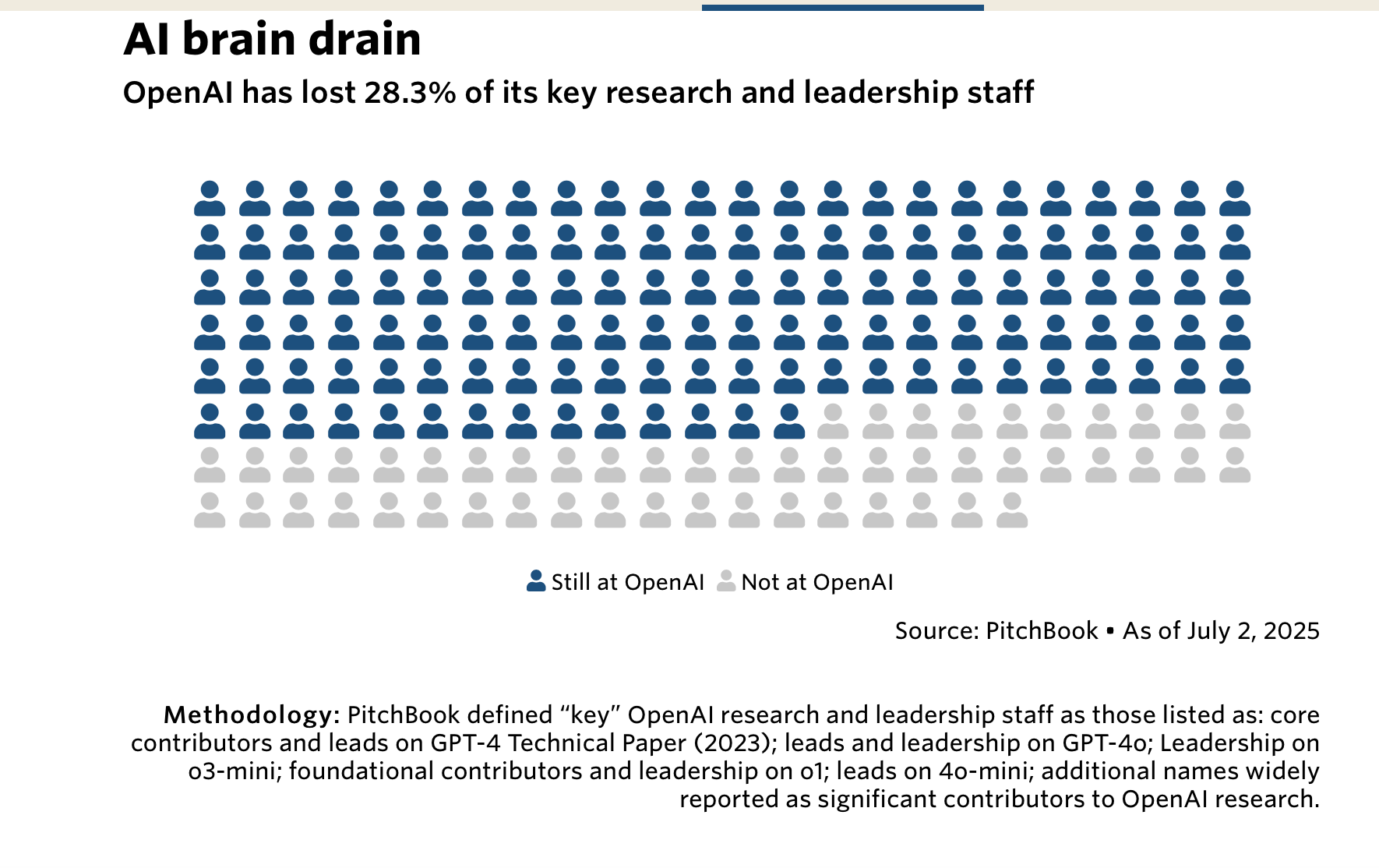

8. Open AI Lost 28% of Leadership Staff…Pro Sports Recruiting in AI

…

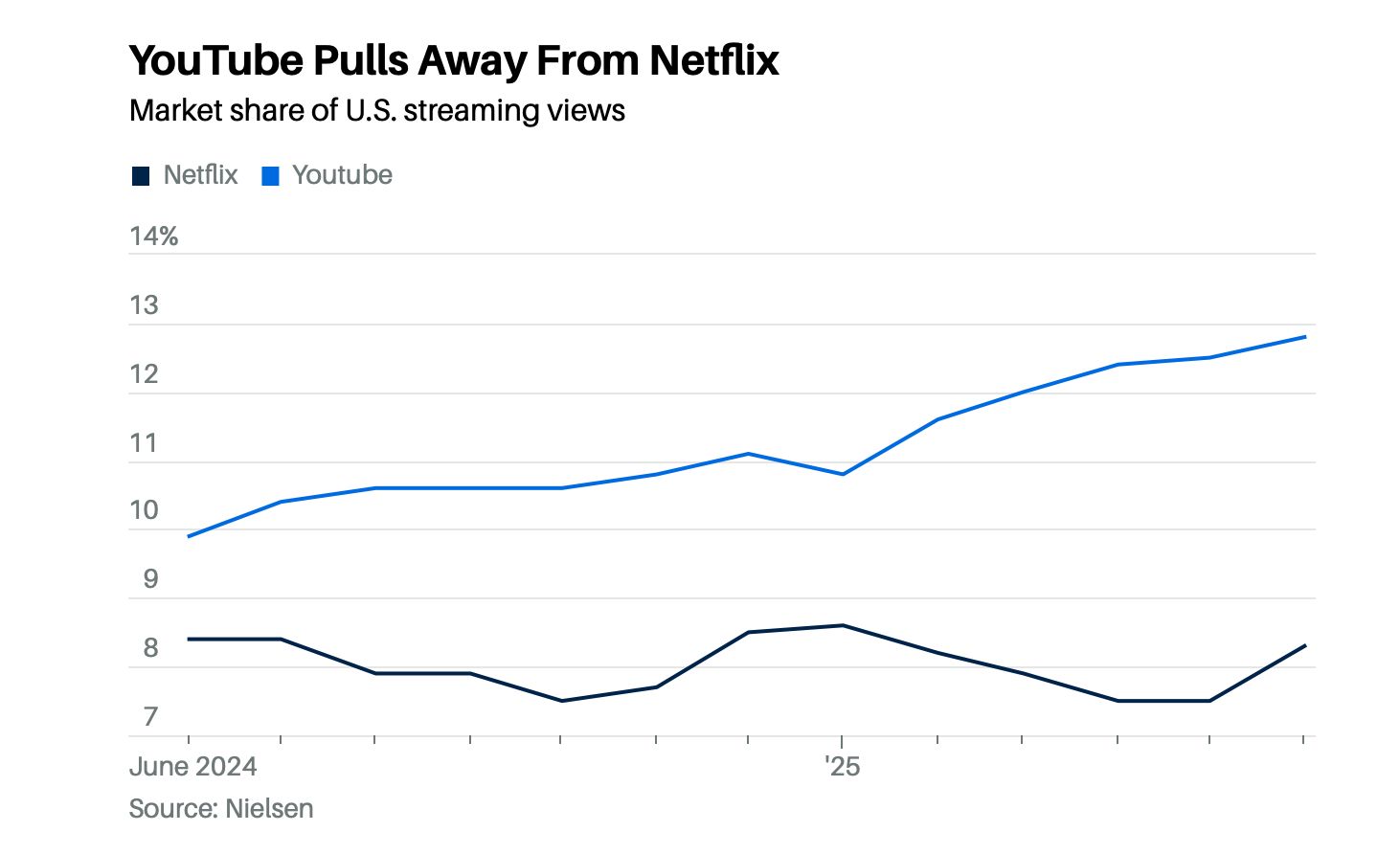

9. YouTube Stand Alone Valuation $720 Billion

Analyst Laura Martin of Needham estimates that YouTube revenue was $58 billion in 2024, and will be $70 billion in 2025, with $30 billion of that coming from subscriptions. She projects that a stand-alone YouTube would have a market capitalization of $720 billion. Netflix has a market cap of $556 billion. Barrons By Adam Levine

10. Farnam Street Blog Knowledge Project

The Knowledge Project [Outliers]

Charlie Munger once asked me: ‘How can someone give away fifty percent of profits and make billions more than if he’d kept it all?’ Before I could answer, he told me about Les Schwab, a tire shop owner who understood incentives better than almost anyone.

What Schwab discovered will change how you think about business and life.

Here are a few of his lessons:

1. Win Win, The Math of Generosity: Les discovered that splitting profits 50/50 with store managers didn’t cut his wealth in half, it multiplied it. His reasoning was pure math: “If I share half the profits, I still have half. And if Frank makes more money, he’ll work harder to make the store successful. If the store is more successful, my half is worth more than my whole used to be.” You get rich by making others rich.

2. All-In or All-Out: At 34, Les sold his house, borrowed against his life insurance, and scraped together $11,000 to buy a failing tire shop with no running water. He’d never changed a tire. His competitors had decades of experience. But Les had something they didn’t: no backup plan. That total commitment forced him to figure it out. One year later, he’d quintupled revenue. Half-measures guarantee half-results.

3. High Agency: Everything is your job. Les bought his first tire shop having never fixed a flat in his life. On day one, a customer needs tires mounted. Les fumbles with hand tools on the cold concrete, making a complete mess until his employee arrives. He insisted on being taught, so the situation never repeated. Sometimes, the only qualification you need is the willingness to figure it out.

4. Go Positive, Go First: Les instituted free flat repairs for anyone, customer or not. Competitors called him crazy. Why fix flats for people who bought tires elsewhere? But Les understood reciprocity: humans are biologically wired to return favors, even those that are unearned. Those free repairs created a loop, doing more marketing than marketing could ever do. Most businesses wait for the transaction before the service. Consistently going positive and going first is the most powerful force in the universe.

5. Dark Hours: Every morning before dawn, teenage Les ran his paper route. Not biked, ran. For two months, he sprinted through dark streets on foot, saving enough to buy a bicycle. While his classmates slept, he earned. By senior year, Les owned all nine routes in town. When your competition sleeps, you can build your lead.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.