- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

Silver Intra-Day Reversal

..

..

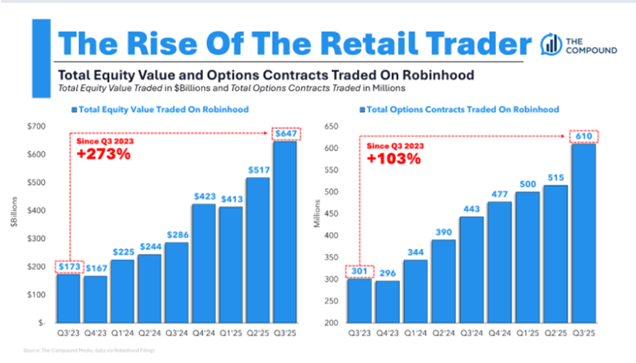

2. Silver Volume Running at 15x Average…More than S&P Yesterday

..

..

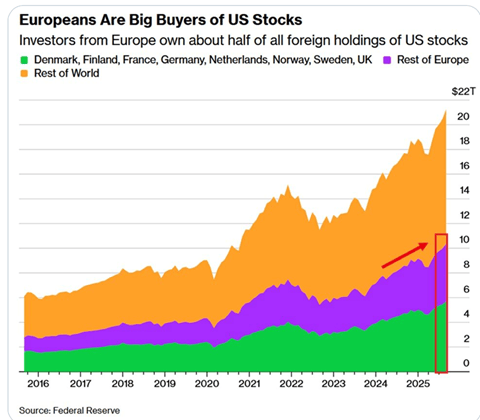

4. Sell America Not Showing Up In Flows

Barrons-Healthy capital inflows into U.S. capital markets, which totaled some $1.569 trillion in the 12 months through November, according to the latest Treasury International Capital Data. That included $481 billion going into Treasury notes and bonds and government agency securities.

But while market watchers tend to concentrate on foreign purchases of Treasuries as an indication of global support for Uncle Sam’s borrowing needs, the biggest international inflows of the past 12 month were into U.S. equities. Not surprisingly, the world was coming to America to participate in the artificial-intelligence boom, buying $689 billion of U.S. equities, or 44% of long-term securities purchases, in the span. Foreign purchases of corporate bonds (an increasing amount of which funds AI buildouts) accounted for a quarter of long-term securities purchases. So, AI is not only an essential factor in the stock market’s advance but also a key component in funding the U.S. current-account deficit.

..

.

6. Productivity Improvements from AI Showing Up

.

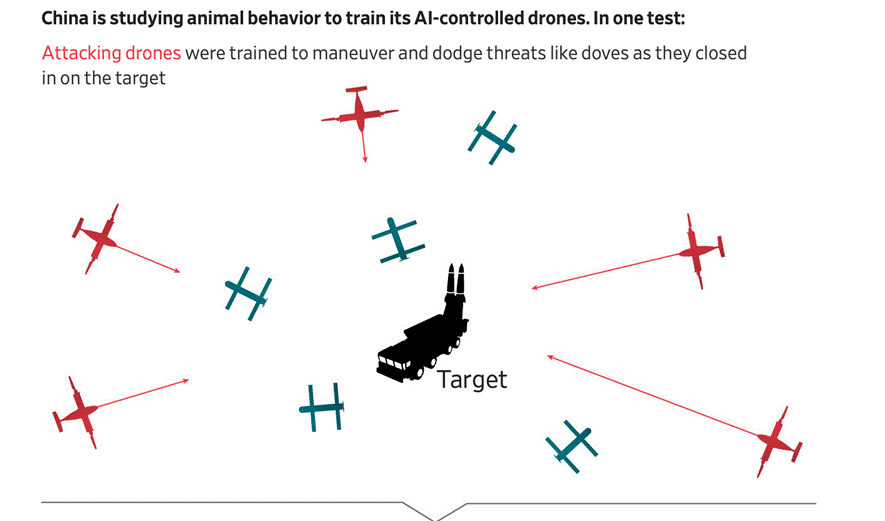

7. China Trains AI-Controlled Weapons With Learning From Hawks, Coyotes

Beijing’s military focuses on swarming drones that can pick off prey or robots that can chase down enemies

.

….

9. Books Coming Back?

Chartr-Then, after hedge fund Elliott Management acquired the chain for $683 million in 2019, B&N’s fortunes began to change. Headed by a new CEO, the company attempted a return to its indie roots — stripping back offerings like games and toys and giving store owners more autonomy, all while absorbing two other independent local booksellers.

..

10. Warren Buffett Says 5 Fundamental Habits Separate Successful People From the Pack

Five principles that quietly drive long-term success.

EXPERT OPINION BY MARCEL SCHWANTES, INC. CONTRIBUTING EDITOR, EXECUTIVE COACH, SPEAKER, AND AUTHOR @MARCELSCHWANTES

If you’re willing to move from agreement to action, these five classic Buffett principles still hold up remarkably well.

1. Get rid of bad habits

Most leaders and entrepreneurs already know what’s holding them back. The hard part is doing something about it.

Buffett has been blunt about the damage caused by self-destructive patterns. Speaking to graduating students at the University of Florida many years ago, Buffett said, “I see people with these self-destructive behavior patterns. They really are entrapped by them.” He noted that identifying your bad habits early on is key.

Here’s the thing: Bad habits don’t announce themselves as dangerous. And some of them are blind spots that fly below your radar. Over time, those bad habits grow quietly and affect the people around you. By the time you feel their weight, to Buffett’s point, they’re much harder to break.

For leaders, this shows up as avoidance, stonewalling, micromanagement, impatience, unaccountability, and letting standards slide. The sooner you confront these behaviors, the less damage they do—to you, your business, and to the people you lead.

2. Don’t risk what you have for something you don’t need

Buffett has watched businesses and individuals gamble away stability in pursuit of “more”—often driven by ego or greed.

His warning is simple: If something truly matters to you, don’t put it at risk for something that doesn’t. Here’s Buffett:

If you risk something that is important to you for something that is unimportant to you, it just doesn’t make sense. I don’t care if the odds you succeed are 99 to 1 or 1,000 to 1.

This is especially relevant for founders who are chasing scale too fast, leaders who are taking on unnecessary debt, or executives who are sacrificing culture for short-term wins to please shareholders. Just because the odds look good doesn’t mean the risk is worth it

3. Learn from your mistakes and become better

Buffett’s final shareholder letter, released in November, reads less like a financial document and more like a master class in the dos and don’ts of leadership.

Buffett opens with rare vulnerability: “Don’t beat yourself up over past mistakes—learn at least a little from them and move on. It is never too late to improve.”

Here’s a man who has made billion-dollar errors, yet he views failure not as a cause for shame but as an opportunity to learn. That’s the essence of resilience and a growth mindset; it’s humility wrapped up in fierce resolve, backed by action.

Buffett’s advice to “get the right heroes and copy them” underscores the importance of mentorship and modeling. He credits “wonderful friends” for helping him learn “how to behave better,” a reminder that none of us evolves in isolation.

4. Choose colleagues and mentors wisely

One of Buffett’s most enduring lessons about success is surrounding yourself with the right people.

He once told a young shareholder, “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

This message resonates in today’s leadership circles. As leaders seek to build resilient teams, meaningful cultures, and long-term influence, Buffett’s classic principle stands the test of time: You become like the people you spend the most time with. So, choose wisely.

If you aim to grow your business or advance in your career, relationships, or leadership, be deliberate about whom you choose to learn from.

5. Do what you love

This advice gets dismissed as idealistic, but Buffett has consistently argued that people do their best work when they enjoy what they’re doing. In his own words: “The people who are most successful are those who are doing what they love.”

Many professionals stay in well-paid, secure roles they quietly resent. Over time, that dissatisfaction bleeds into their leadership, decision-making, and health.

You don’t have to love every task. But if you fundamentally dislike your work, it shows—and it costs you more than you realize.

.

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.