- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

Worst Decade for Government Bonds Ever

2….

…

2. Worst Decade for Government Bonds Ever

One section of the pack shows how this has been the worst decade for government bonds across the globe on record, at least in nominal terms, although in real terms it's still one of the worst. In today’s CoTD we show this for 10yr US govt bonds (or equivalents) back over 200 years, and for 10yr Bunds over the last 70 years. In the pack we also show the real adjusted graphs and also include the same for 30yr USTs, 10yr JGBs, 10yr Gilts and 10yr OATs.

…

…

…

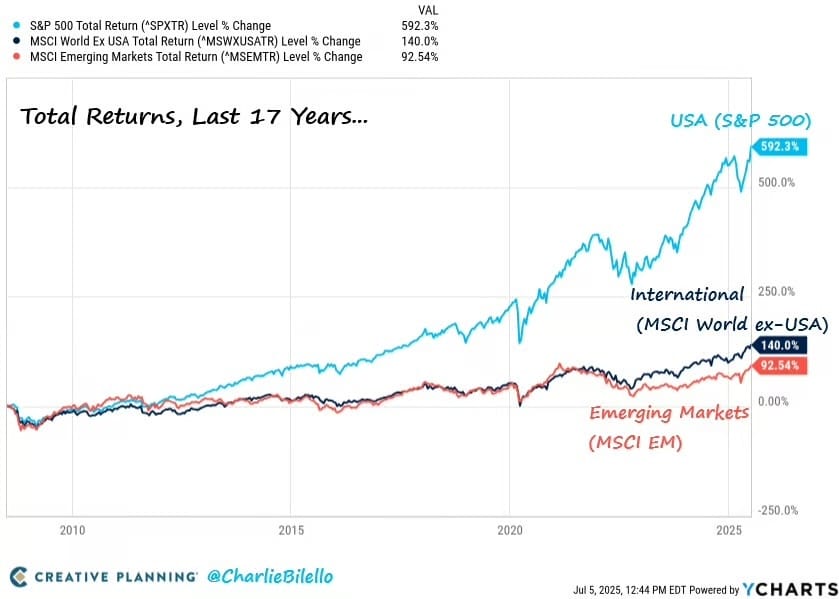

5. International Stocks Over 17 Years

Over the last 17 years, US stocks have gained 592% versus 140% for International stocks and 93% for Emerging Markets.

Charlie Bilello

…

…

…

8. Internal Divisions at BRICS Summit…Half the Group’s Leaders Did Not Attend

This weekend’s BRICS summit in Brazil put a spotlight on the growing internal divisions within the bloc of developing nations. About half of the group’s leaders, including China’s Xi Jinping and Russia’s Vladimir Putin, didn’t attend the gathering. While BRICS has expanded from five members — Brazil, Russia, India, China, and South Africa — to 11 in the last two years, the additions have brought fresh points of contention, and perhaps diluted its clout. Delegates avoided any controversial subjects that might trigger Washington’s ire, analysts said: A joint declaration condemning tariffs refrained from naming US President Donald Trump, and mentioned Ukraine only once. It marked a contrast from last year’s gathering in Russia, where the Kremlin pushed for alternatives to US-dominated financial systems.

…

9. Foreign Direct Investment into U.S. by Country/Region

This graphic, via Visual Capitalist's Kayla Zhu, visualizes foreign direct investment (FDI) into the U.S. by country or region of origin in 2023.

…

10. Not smart vs. stupid

Via Seth’s Blog: Not smart is a passive act, remedied with learning, experience and thought.

Stupid is active, the work of someone who should have or could have known better and decided to do something selfish, impulsive or dangerous anyway.

The more experience, assets and privilege we have, the less excusable it is to do stupid things. And at the same time, the more useful it is to announce that we’re not smart (yet).

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.