- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

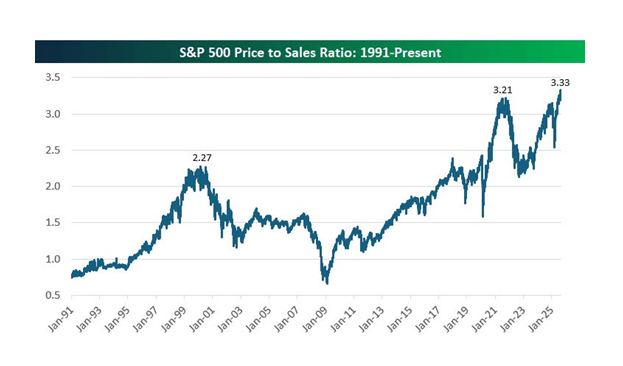

Cap Weighted Price/Sales Record Highs

?

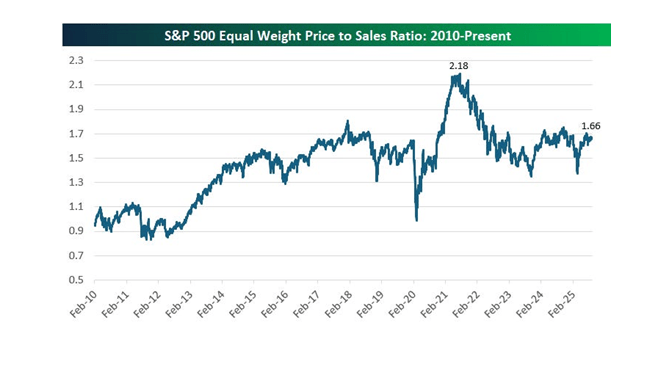

1. Cap Weighted Price/Sales Record Highs….Equal Weighted Well Off Highs and Near 25-Year Median

?

?

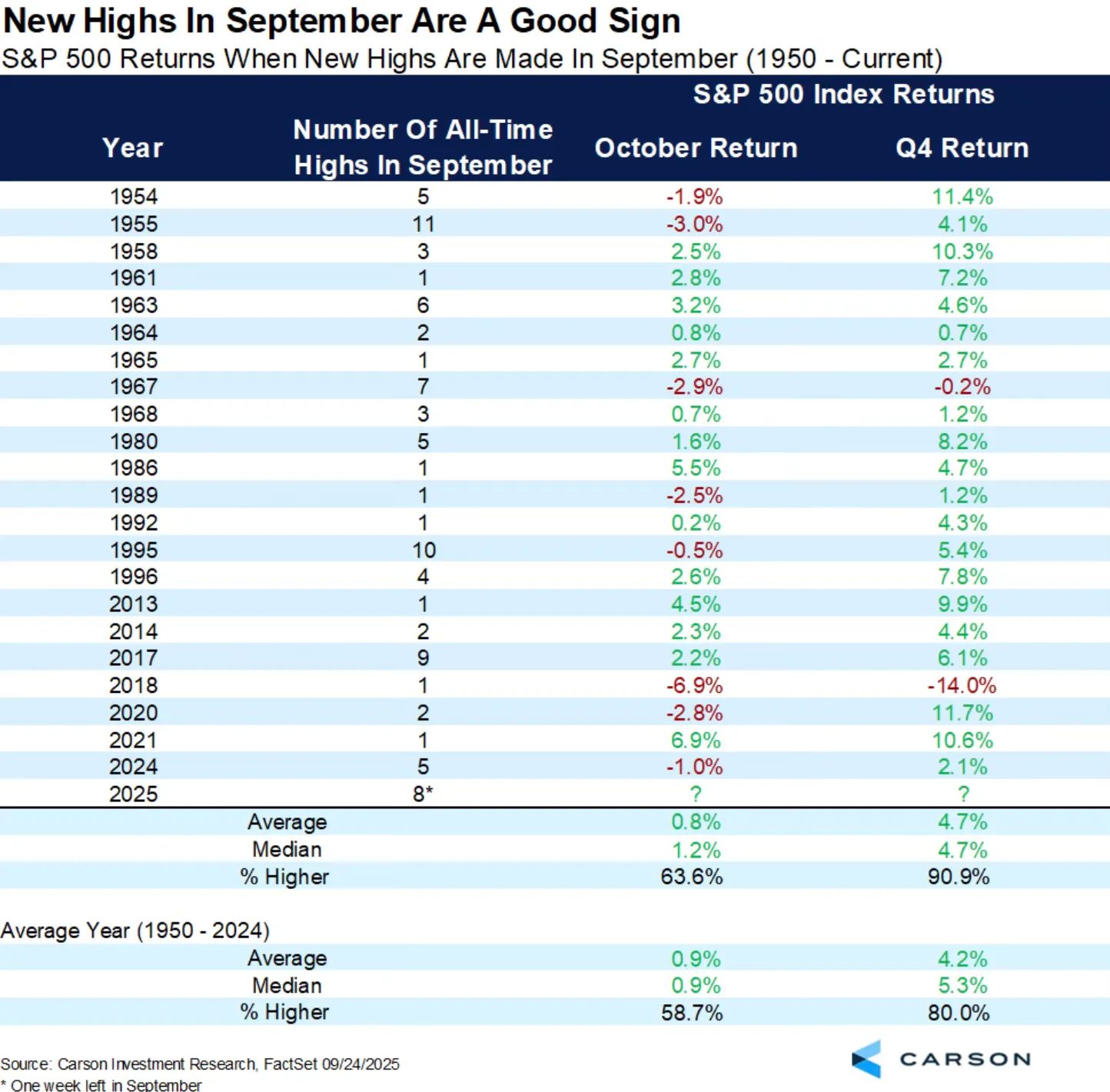

3. New September Highs Good For Q4

There were actually 8 new highs in September. When September makes new highs, Q4 is higher 90% of the time.

…

…

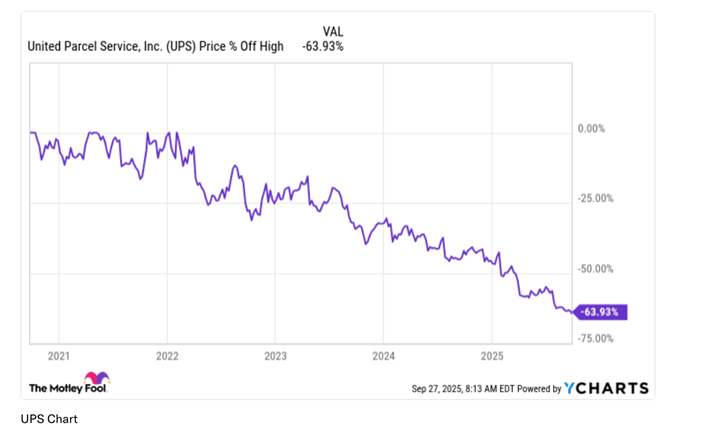

5. UPS Big Sell Off Sends Dividend Yield to 7.8%

Yahoo! Finance

…

…

??

?

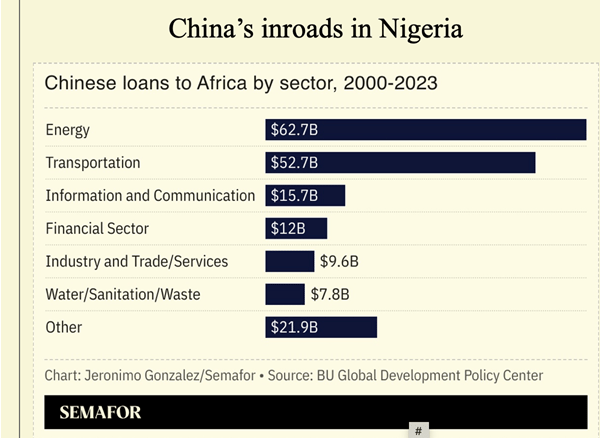

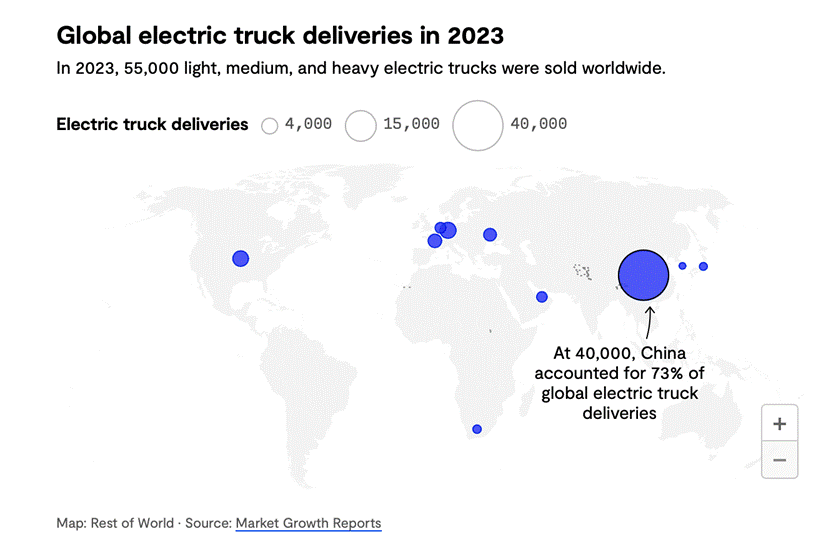

9. China won the electric car race. Up next: freight trucks

China’s BYD and Sany dominate the global electric freight truck market.

Fewer than 1% of heavy-duty trucks are electric in India, the U.S., and Europe, compared with 22% in China.

High upfront costs, a lack of charging infrastructure, and fragmented ownership make electrification of trucks difficult.

China flooded the world with electric cars. Its next target is freight trucks.

BYDi, the Chinese automaker that overtook Tesla in sales of electric cars last year, now ships electric freight trucks to Italy, Poland, Spain, and Mexico — alongside eight other Chinese companies that dominate the global market. Chinese automakers accounted for 80% of the world’s 90,000 electric cargo-truck sales last year, according to the International Energy Agency.

Globally, CO2 emissions from heavy-duty vehicles have risen by almost 3% every year between 2000 and 2018. Trucks accounted for 80% of the increase. Their outsize impact on the environment has made the electrification of trucks crucial for climate goals. Chinese companies are capitalizing on their massive home-market scale to export commercial-truck solutions, building factories from Mexico to Europe

“They bring cost competitiveness, manufacturing know-how, and proven technology stacks,” Bill Russo, founder and CEO of Automobility Limited, a Shanghai-based advisory firm, told Rest of World. “In many ways, they act as enablers for global fleet operators who want to decarbonize but lack local suppliers at scale.”

In China, electric trucks captured 22% of the heavy-duty market in the first half of 2025. In contrast, India sold just 280 long-haul electric trucks out of 834,578 total commercial truck sales last year. In Europe, EVs represent about 1% of truck sales. Tesla’s much-hyped Semi truck — announced in 2017 and delivered in token quantities to Pepsi in 2022 — has all but vanished due to component failures, range anxiety, and high costs.

10. Ed Stack: Lessons from Dick’s Sporting Goods-Shane Parish

Ed Stack built Dick’s Sporting Goods from a struggling family store into an empire of more than 800 stores and billions in sales. Along the way he nearly lost everything. Multiple times.

This episode is the story of what he did, how he did it, and the lessons you can learn.

Lessons From Ed Stack:

1. Believing in someone before they believe in themselves changes everything. Dick Stack’s grandmother pulled $300 from her cookie jar after his boss crossed out his carefully crafted list. She didn’t give him business advice or connections. She gave him belief. Dick’s Sporting Goods exists because a grandmother believed in an eighteen-year-old kid who barely graduated high school.

2. Your name is your biggest asset. When Dick’s second store failed in 1956, he could have declared bankruptcy like everyone expected. Instead, he sold his house, his car, everything he owned to pay back creditors in full. Six weeks later, when he asked those same suppliers for another chance, they remembered. Trust isn’t earned in the easy times; it’s earned in the fire.

3. Develop a taste for saltwater. Ed despised working at his father’s store every summer and on weekends from age thirteen. While friends played baseball, he unloaded trucks in suffocating heat. However miserable those years were, he learned. However, sometimes your worst experiences are the best education.

4. Ignorance can be a superpower. Ed and Tim signed papers to buy land in Syracuse with no plan, no budget, and no idea they were getting a “vanilla box”. They nearly opened a store with empty walls. They made every possible mistake. But here’s the thing: if they’d known everything that could go wrong, they might never have even tried to expand. Sometimes knowing too much kills action.

5. The quiet one is the decision maker. At the make-or-break GE Capital meeting, suits grilled Ed for ninety minutes. But in the back corner sat a man who never spoke, just watched. Ed reflected later, “If you’re in a meeting and there’s a guy sitting off in a corner, not saying anything, that’s the guy you probably have to convince. He’s the decision-maker.” Every important meeting works this way: The loud ones interrogate. The quiet one decides.

6. Own your mistakes. When GE Capital asked about Dick’s near-bankruptcy, Ed didn’t deflect or minimize. In fact, he was brutally honest: “We made a series of mistakes. Here’s what they were. Here’s why we made them. Here’s exactly how we’ll ensure they never happen again.” Most people explain away failure. The best own it. The precision of your diagnosis proves the depth of your learning.

7. Never rely on the kindness of strangers. After nearly losing everything in 1996, Ed learned what Buffett knew: “Never count on the kindness of strangers to meet tomorrow’s obligations.” The banks can’t take your business if you don’t owe them money. Never put yourself in a position to need the kindness of strangers.

8. Pick the company that wants it more. When Puma and Adidas wouldn’t return Ed’s calls, he gave shelf space to an upstart company that really wanted it. That company was Nike. When established brands ignored them, he backed a hungry football player making shirts in his grandmother’s basement. That company was Under Armour. Sometimes the best deals come from those desperate to prove themselves, not those who’ve already made it.

9. When the map and territory differ, believe the territory. The VCs pulled out spreadsheets showing Ed what looked good on the screen. But Ed remembered that kid in Buffalo who gasped at thirty feet of baseball gloves. Sure, that wall of gloves didn’t turn inventory fast, but it got people in the store. When spreadsheets and customers disagree, the customers are almost always right. The data isn’t wrong. You’re measuring the wrong thing. The map is not the territory. The spreadsheet is not the store.

10. Remember what you’re really selling. Dick’s Sporting Goods became an empire because Dick and Ed Stack knew they weren’t just selling equipment. They were selling dreams. When you understand what people really buy, you understand everything.

11. Become someone people want to root for. If people think you’re overrated, they’ll root against you. However, if people see you as underrated, they’ll go out of their way to help you. There is no status quo.

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.