- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

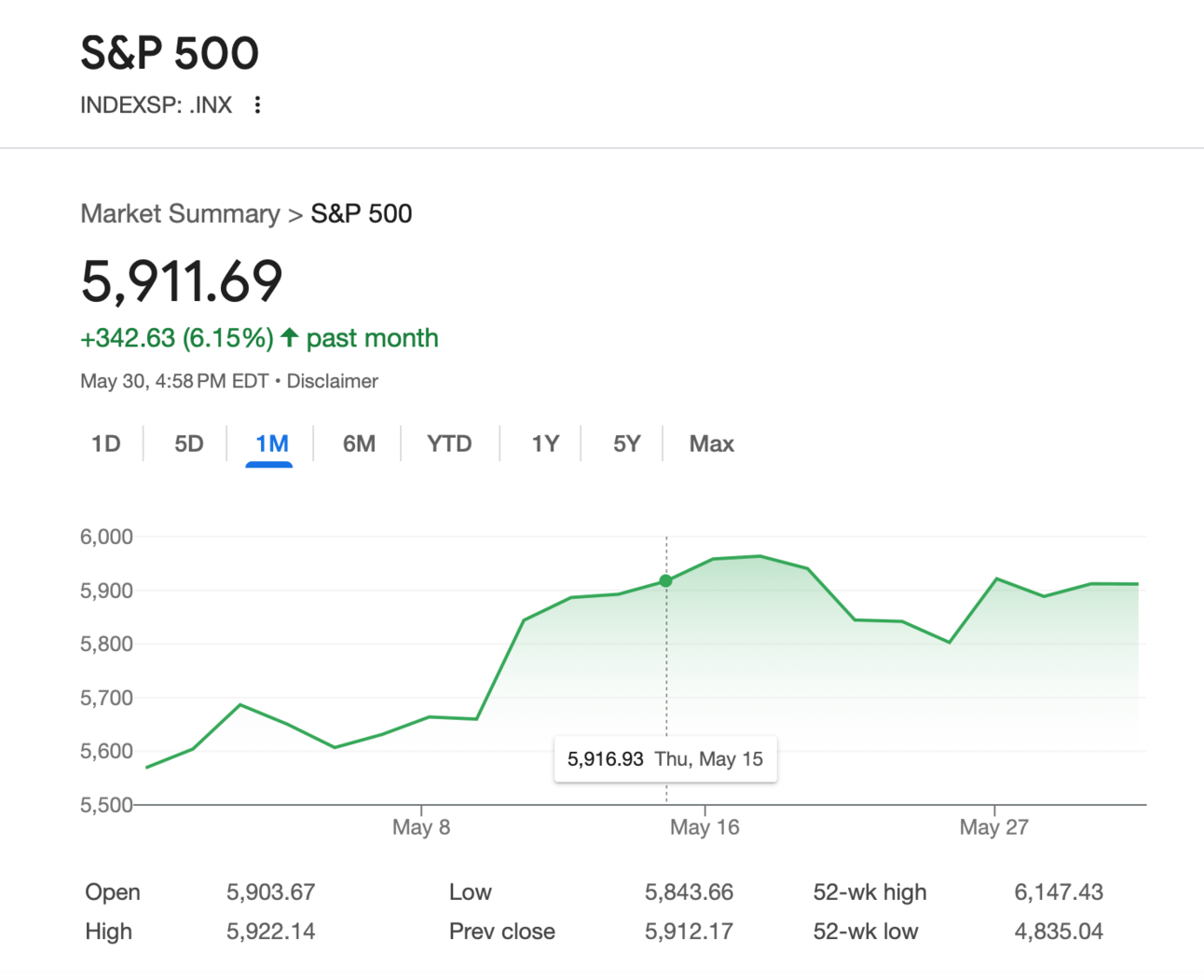

S&P Best May in 35 Years

….

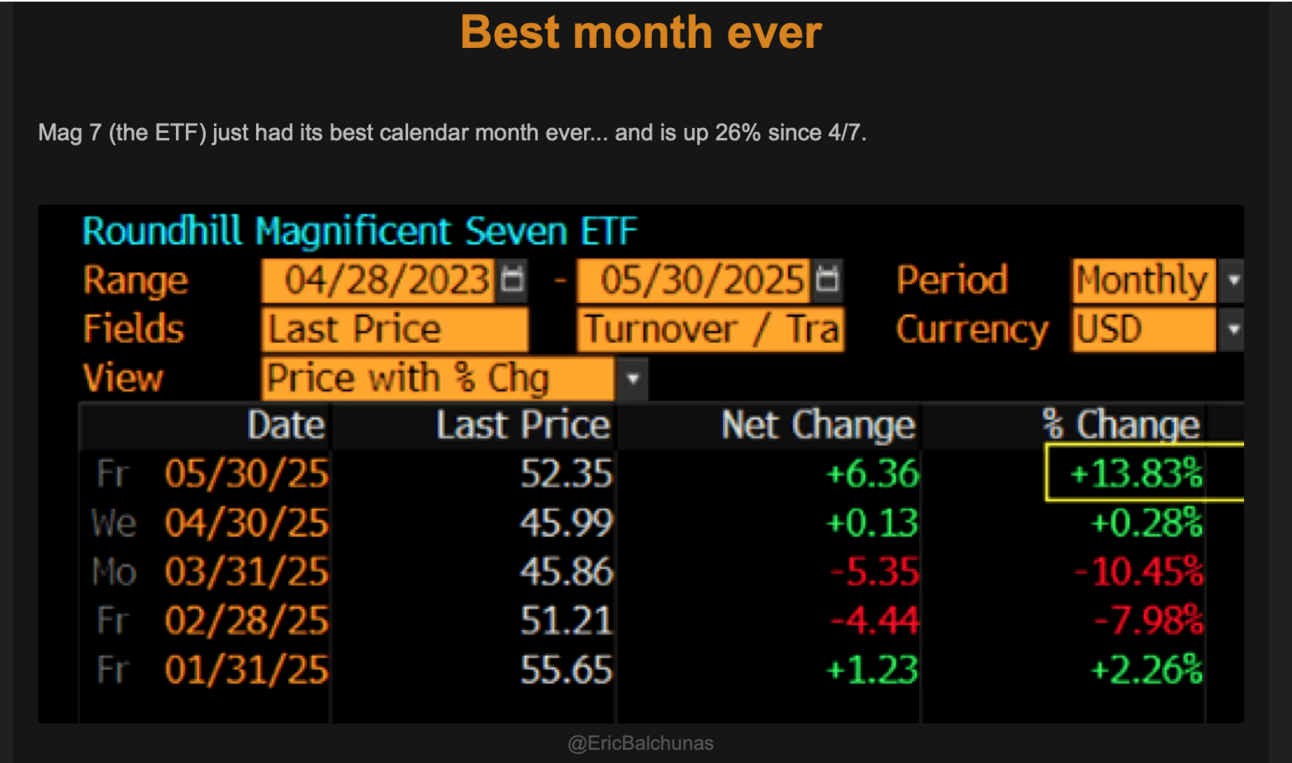

1. S&P Best May in 35 Years

Earnings for companies that have already reported are up 13% year over year, according to Jeff Buchbinder, chief equity strategist at LPL Financial. An impressive 78% of companies have beaten earnings expectations, he notes, and most companies have been expanding their margins despite anxiety that tariffs and consumer weakness would weigh on them. The biggest tech stocks have contributed about half of that earnings growth, which is a big reason why the Nasdaq is outpacing the other indexes.

…

…

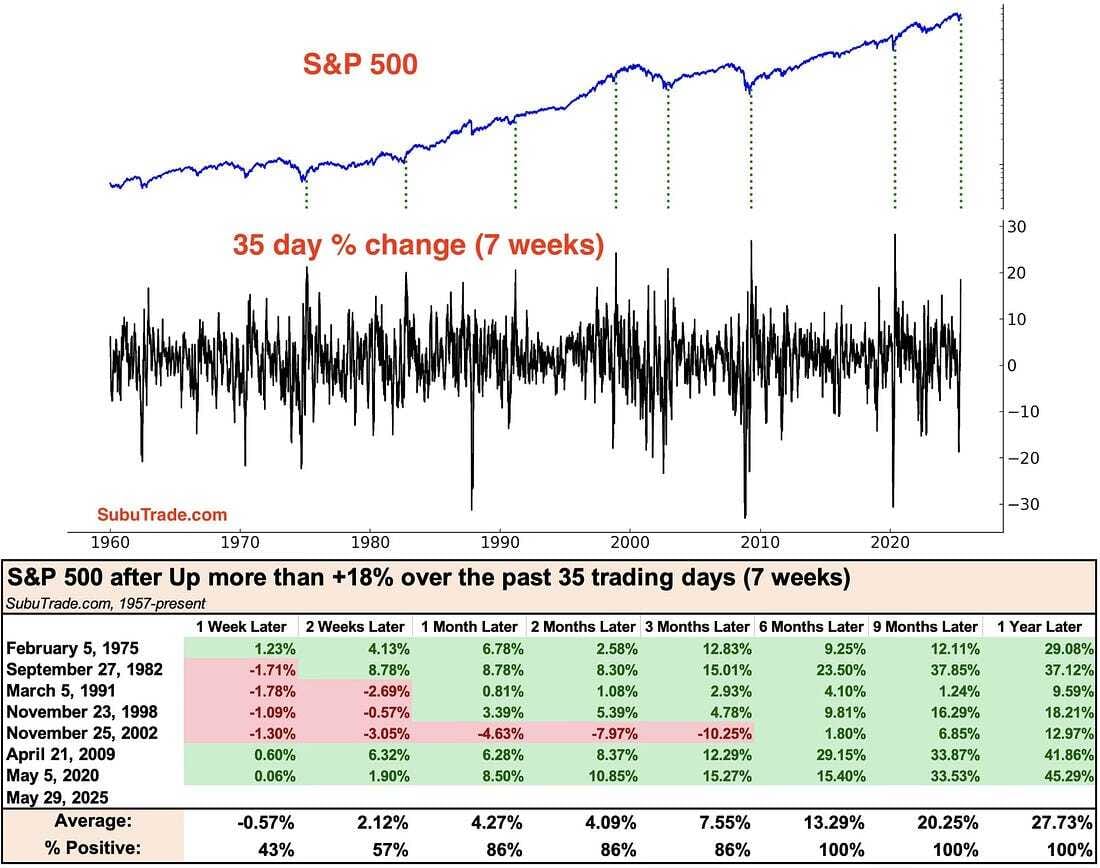

3. Big Rally Off Bottom is Historically Bullish

I didn’t quite realize that the S&P 500 has been up over 18% in the past 7 weeks. That’s occurred in only 35 trading days! That tells me that the market has been white hot! Does that mean we should expect some red now in the short to medium term? Not quite the case. A lot more green has followed.

…

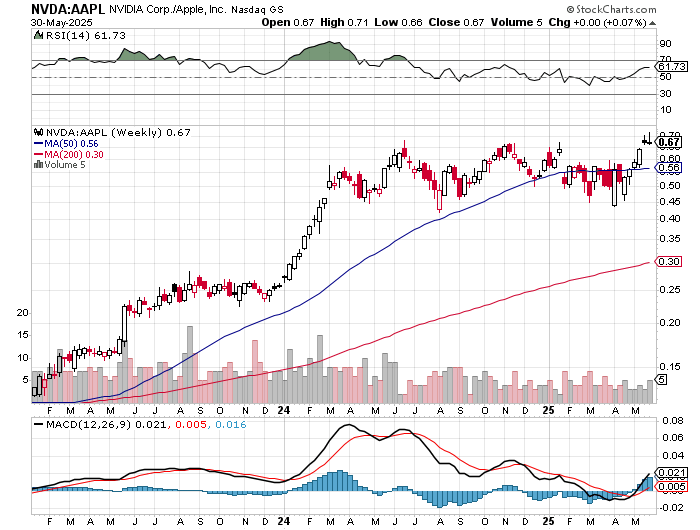

4. NVDA Vs. AAPL Chart...Breakout for NVDA

Nvidia stock is now up nearly 40% from the trade war lows in April. It’s up 4% on the year. Even after the latest rally, the stock isn’t expensive, trading at 29 times forward earnings estimates, while analysts expect 45% sales growth over the next 12 months. Compare those numbers to Apple , which trades at 28 times with 4% sales growth. Nvidia is far more attractive on a valuation-to-growth basis.

…

…

…

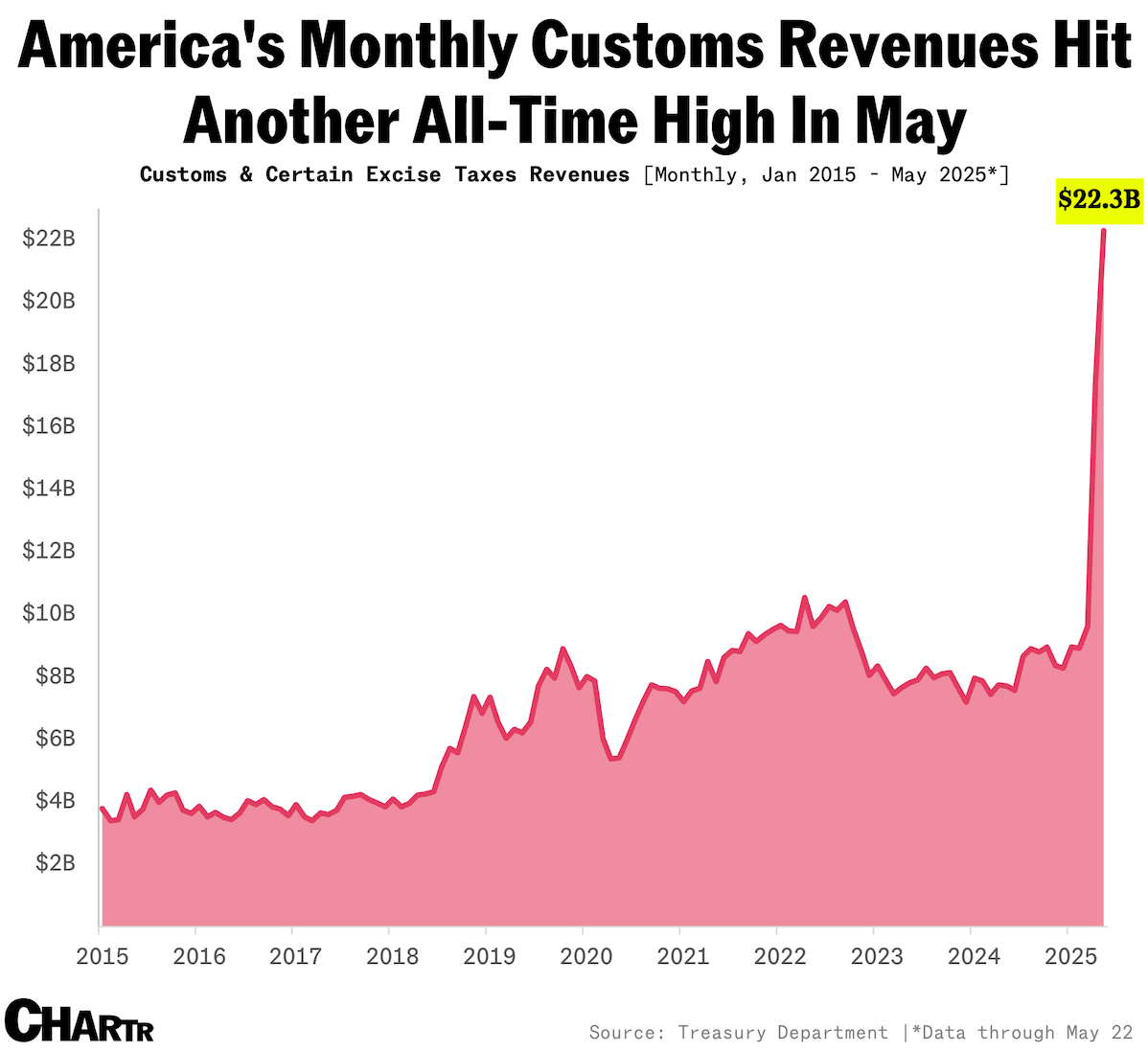

7. Massive Jump in U.S. Customs Revenues from Tariffs

As President Trump and his team continue to search for plan B, and maybe plan C, to enact their trade agenda, data from the Treasury Department reveals that the US has brought in ~$40 billion worth of customs duties since the start of April, with a record-breaking $22.3 billion already collected in May (as of May 22). That’s a massive jump from $9 billion back in January, and is likely even lower than the actual total, given the customs-only figure excludes excise taxes on specific imported goods like fuel, alcohol, and tobacco.

Of course, the ruling this week means that the US government might have to give that revenue back.

But for now, tariffs remain a go, with a federal appeals court granting a temporary reinstatement of the levies, including the 10% baseline tariff applicable to nearly all imports.

Should Trump’s legal challenges — which might include going to the Supreme Court — fail, the White House has other levers and trade lawsat its disposal. Per Goldman Sachs analysts writing on Wednesday evening, the ruling “might not change the final outcome” for a lot of America’s major trading partners anyway.

…

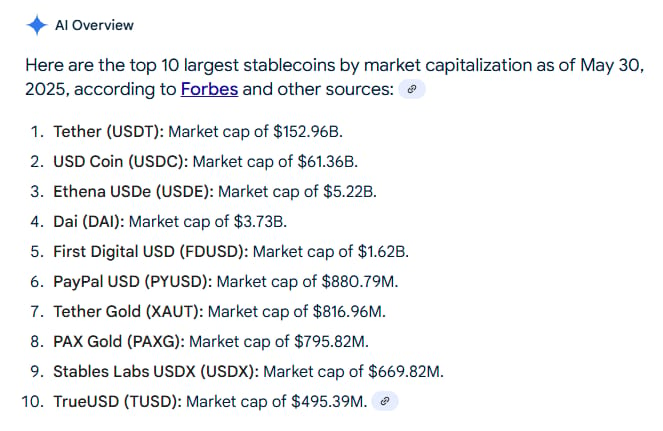

8. Top 10 Largest Stablecoins

Perplexity

…

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.