- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

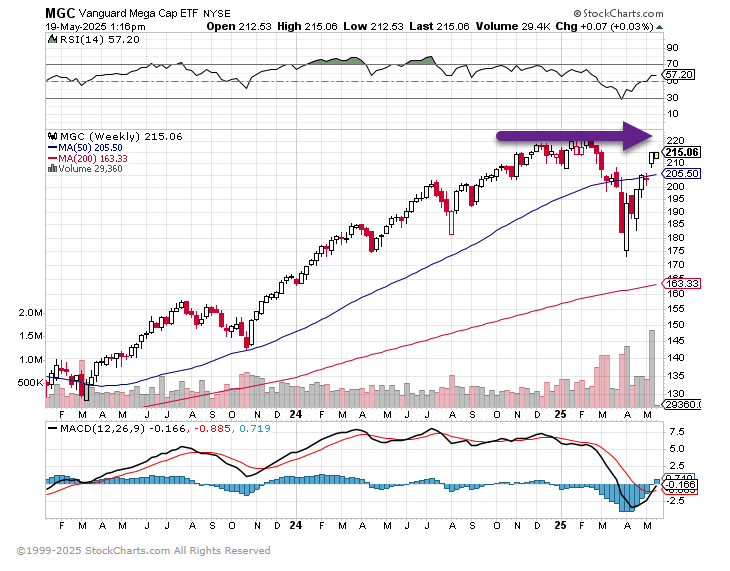

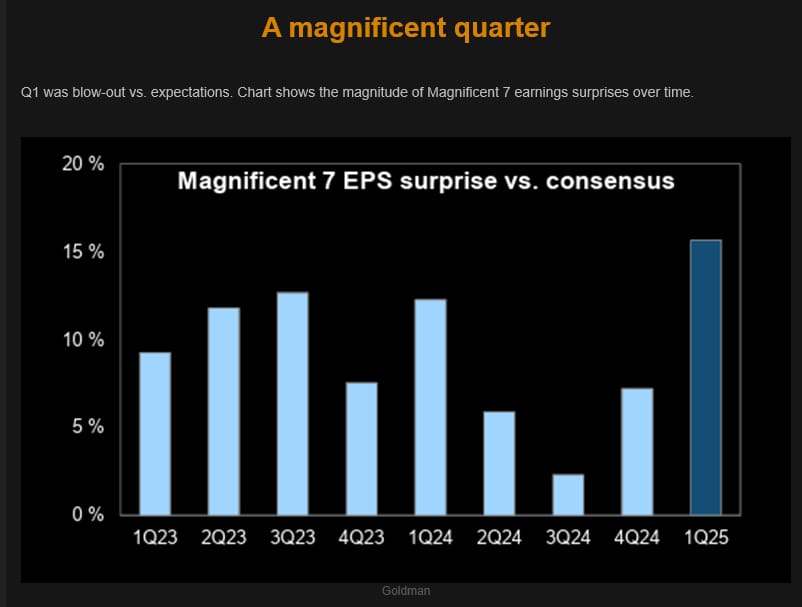

MegaCap Led By MAG 7 Solid Earnings

….

…

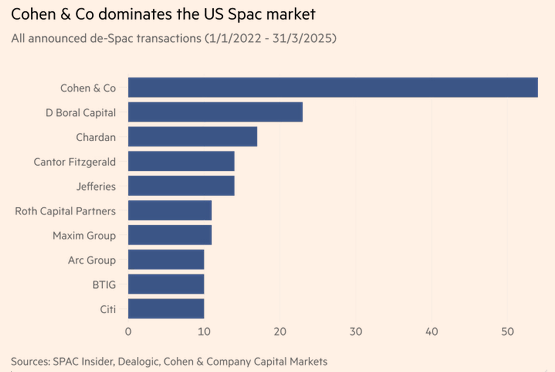

2. Can’t Believe It But SPACS are Back Already

SPACS R BACK – A new cast of boutique banks is fuelling a fresh fervour for blank-cheque companies — one of Wall Street’s hottest and most controversial products during the pandemic-era bull market. Special purpose acquisition vehicles, or Spacs, exploded in popularity during the Covid-19 crisis, with around 600 deals in the US raising a record $163bn in 2021 before the frenzy died down as global stocks tumbled the following year due to rising interest rates.

But the market has revved up again since Donald Trump won his second term as president, despite volatility sparked by his tariffs delaying several traditional initial public offerings. There have been 44 Spac offerings this year raising $9bn, compared with 57 raising $9.6bn during the whole of 2024, Dealogic data shows. Four years ago, Credit Suisse, Citibank, Deutsche Bank and Jefferies were among the busiest Spac advisers. But a cluster of lesser-known firms including Cohen & Company Capital Markets, D Boral Capital (The old EF Hutton), Clear Street and come to dominate the sector.

…

…

…

…

…

…

…

…

10. It is What it Is: The Power of Withholding Judgement (Meaningful Money)

❝There is nothing either good or bad, but thinking makes it so.❞ -William Shakespeare, Hamlet

You may have heard the old story about the Chinese farmer.

One day, his horse runs away. His neighbors come by and say, “What bad luck!”

The farmer simply replies, “Maybe.”

The next day, the horse returns with some friends—three wild horses.

“This is amazing!” the neighbors say.

“Maybe,” the farmer replies.

The following day, the farmer’s son tries to ride one of the wild horses, gets thrown off, and breaks his leg.

“Oh no, how terrible,” the neighbors say.

“Maybe,” says the farmer.

Then the army comes to town, drafting all the able-bodied young men. But because of the broken leg, the farmer’s son is spared.

“Wow, what good fortune!” the neighbors say.

“Maybe,” the farmer replies.

And on it goes.

We tend to label our experiences—this is good, that’s bad, this is unfair, that’s amazing. But the story of the farmer reminds us: it’s not always so clear.

Something that feels awful today might turn out to be a blessing in disguise. Something that seems great could lead to pain later on. Sometimes we just don’t know yet.

Even deeper than that, maybe the idea of “good” or “bad” is just something we’ve made up. We naturally reach for what feels pleasant and push away what feels unpleasant. But what if things just… are?

There’s a phrase I used to hear growing up: “It is what it is.”

I hated it. It felt like giving up. If I said, “This sucks,” and a friend replied, “It is what it is,” I felt dismissed.

But as I’ve grown, I’ve realized it might hold more wisdom than I gave it credit for.

Maybe “it is what it is” is simply an invitation to not rush to judgment.

OUR JUDGMENT GLASSES

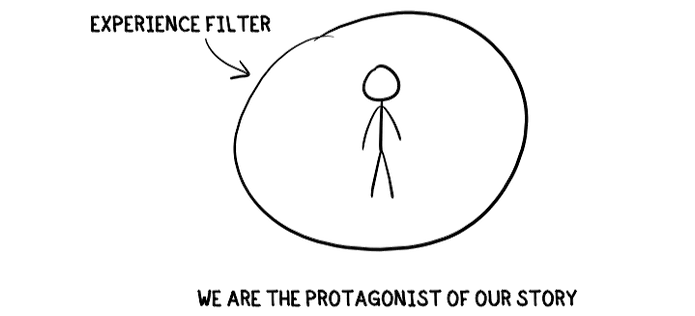

Here’s a simple truth: we’re always the main character in our own story.

If you’re watching a nature documentary and it follows a hungry lion, you might cheer when it finally catches an antelope. But if the next episode follows a lost antelope trying to survive, you’ll mourn when it gets eaten by a lion.

Same event. Different perspective.

The story changes depending on who you’re rooting for. That’s how we work too. When I land a new job, I celebrate. But for the person who was hoping to be promoted into that role? It’s a disappointment.

We see life through the lens of our own experience. It’s like we’re all wearing a pair of invisible judgment glasses—glasses that filter everything into good or bad. And most of the time, we don’t even realize we’re wearing them.

We all see the world through our own lens—what I like to think of as judgment-filter glasses. Our experiences, beliefs, and values shape how we interpret the world. They color everything we see.

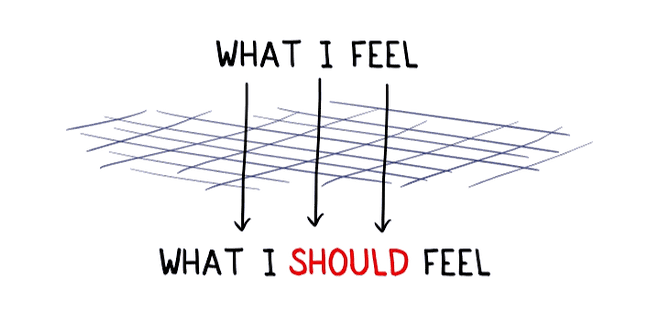

That filter can quietly shift how we feel. It turns “what I feel” into “what I should feel.” And when that happens, we lose connection with what’s really here.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.