- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

S&P 500 +19% in 27 Trading Days

….

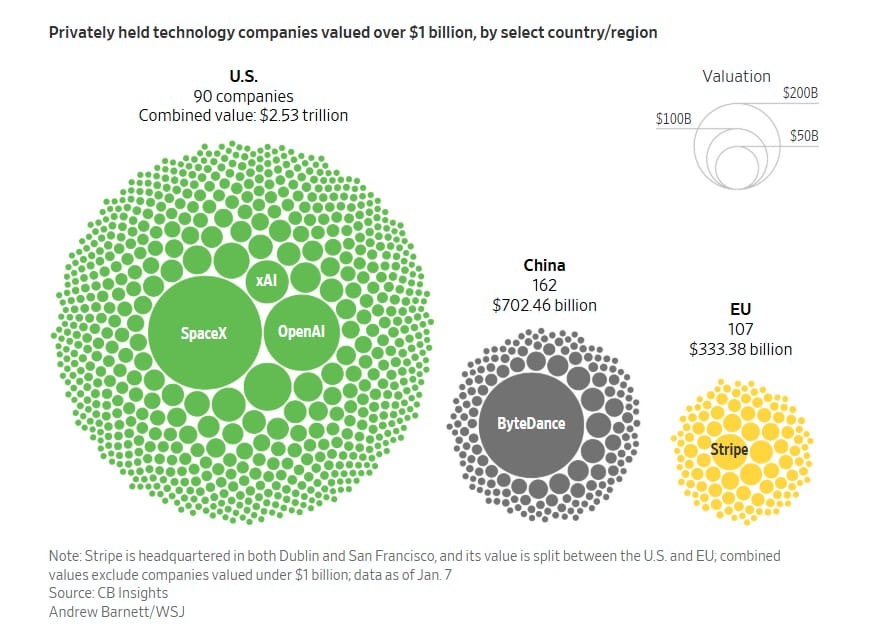

1. The Tech Industry is Huge and Europe’s Share is Very Small—"pubs in London’s financial district are usually full at 2 p.m. on Thursdays.”

Odenwald had spent nearly three decades working in California but hoped he could help build a European tech giant to compete with the Americans. He was shocked by what he saw. Colleagues lacked engineering skills. None of his team had stock options, reducing their incentive to succeed. Everything moved slowly. After two months, Odenwald quit and returned to California.

…

2. S&P 500 +19% in 27 Trading Days …One of the Greatest Comebacks in Market History

In Rare Company”: The S&P 500 is up over 19% in the last 27 trading days, one of the greatest comebacks in stock market history.

Charlie Bilelo

What immediately jumps out when looking at that table of big short-term rallies?

With the exception of November-December 2008, all have occurred at the start of new bull markets, following historic bear market lows in…

…

3. No Idea What Shakes Out Here…But Interesting Chart

Netscape vs. ChatGPT. "The Nasdaq after the releases of Netscape versus ChatGPT continues to track eerily closely. Bulls should hope the trend remains because we’re still in 1997 on this analogue…"

…

…

5. However Venture Different Story…New report shows the staggering AI cash surge — and the rise of the ‘zombiecorn’

Key Points

Silicon Valley Bank said in a report published on Tuesday that about 40% of the money raised by U.S. startups last year came from funds focused on AI.

Capital-intensive companies like OpenAI and Anthropic require billions of dollars to fuel their growth, but investors aren’t getting returns yet, and the IPO market has remained quiet.

Thus, there’s been an increase in the number of “zombiecorns,” or companies “with poor revenue growth and unit economics” that are struggling to raise money, the report said.

Via CNBC: Venture capital firms focused on artificial intelligence are driving much of the growth in the startup market, while companies in other areas are struggling to raise cash, according to a report from Silicon Valley Bank.

About 40% of the total amount raised by U.S. venture funds last year was from funds that “list AI as a focus,” SVB said in its “State of enterprise software” report published on Tuesday. That’s up from 10% in 2021. AI companies accounted for 45% of U.S. venture investment in enterprise software, jumping from 9% in 2022.

The dollars from AI megadeals — rounds of $100 million or greater — represented about half of all the money raised in the overall megadeal category. That’s a group that includes OpenAI and Anthropic.

“Exclude AI investment and the story changes,” the SVB report said. “There is no meaningful uptick for companies not leveraging AI, with investment from this group essentially flat for the last year.”

The challenge for the broader market is that exit activity remains tight, a theme that’s been in place since soaring inflation in late 2021 led to rising interest rates and a move out of risk.

Many investors were bullish that President Donald Trump’s return to the White House would reinvigorate the startup economy due to the prospect of lower taxes and less regulation, but the aggressive tariff policy announced in early April led several companies to delay planned IPOs.

The tech IPO market is showing signs of picking back up.

…

…

…

…

…

10. Grade Inflation and Declining Test Scores.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.