- TOPLEY'S TOP 10

- Posts

- TOPLEY'S TOP 10

TOPLEY'S TOP 10

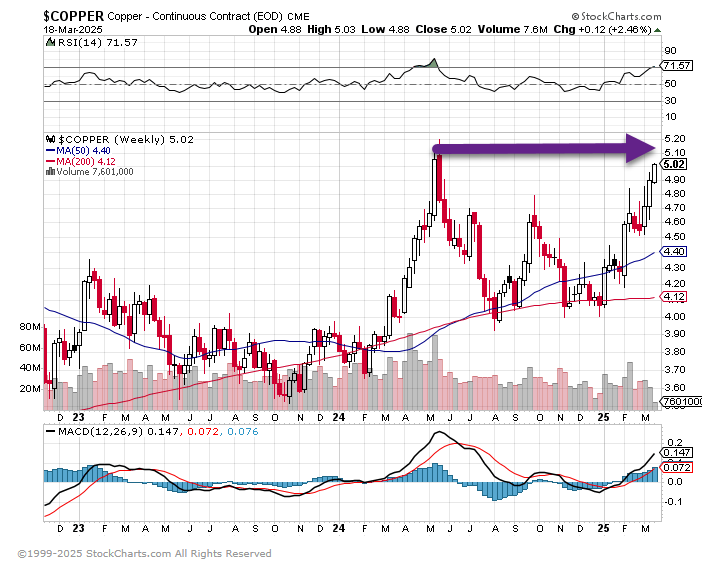

What Gold? Copper is About to Break-Out to New Highs.

….

…

…

…

…

…

…

…

8. Tesla -40% for 2025

Tesla board members, executive sell off over $100 million of stock in recent weeks Shares of Tesla have plunged nearly 50% since a peak in mid-December.

Via ABC News: Tesla vehicles vandalized since Musk began role at White House, authorities say the company's stock has tumbled nearly 48% this year.

As Tesla stock has fallen in recent weeks, members of the board and an executive at Elon Musk's company have been selling off millions of dollars in stock, according to filings with the U.S. Securities and Exchange Commission. Together, four top officers at the company have offloaded over $100 million in shares since early February.

Last week, longtime Musk ally James Murdoch -- the estranged son of Fox boss Rupert Murdoch and a board member since 2017 -- became the latest to do so, exercising a stock option and selling shares worth approximately $13 million, according to an SEC filing. The sale took place on March 10, coinciding with the stock's largest single-day decline in five years. According to one filing, the shares were sold "to cover the exercise price relating to the exercise of stock options to purchase 531,787 shares, which are scheduled to expire in 2025."

…

9. New BYD Car to Charge in 5 Minutes

Via Morning Brew: China’s top EV-maker says its newest cars will charge faster than the average time it takes to decide on a Takis flavor at the rest stop.

BYD announced it developed chargers that will allow its newest models to fully charge in as little as five minutes (for 250 miles of range). By comparison, the fastest-charging Teslas take at least 15 minutes to get 200 miles’ worth of juice.

The company plans to start shipping two five-minute-charge models next month and install 4,000 of the new Super e-Platform chargers across China.

Tesla trouble

BYDs with refueling time comparable to a gas-guzzler will rub salt in the wound for Tesla, which is getting schooled in China by domestic EVs that are cheaper and increasingly high-tech.

Of the EVs sold there in January:

27% were BYD-produced, while only 4.5% were Teslas, putting Elon Musk’s company at No. 6 by EV market share in the country.Tesla’s 2024 China sales were down 19% year over year.

Shares of Tesla have plunged 44% since the year began, and analysts expect its global sales to stagnate in 2025. Meanwhile, news of five-minute chargers powered BYD’s stock listed in Hong Kong to a record high yesterday.

It’s not just China…as BYD is also capturing Latin America’s fledgling EV market, more than tripling its Brazil sales last year

…

10. SUVs still dominate roads

Via Semafor: SUVs accounted for 54% of cars sold globally in 2024, despite predictions that the future belonged to smaller, more environmentally friendly vehicles. That figure is three percentage points higher than in 2023 and five higher than 2022, and 95% of SUVs currently on the road burn fossil fuels. Sales of smaller vehicles have declined across major markets. An industry spokesperson told the BBC that the change is driven by SUVs’ “practicality, comfort and good view,” although environmental activists said the industry gets higher profit margins on larger cars and has pushed them with “huge marketing and advertising campaigns.” The tech writer Martin \Robbins recently proposed an alternative hypothesis: That safety requirements in many markets make smaller cars economically impractical to sell.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.