- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

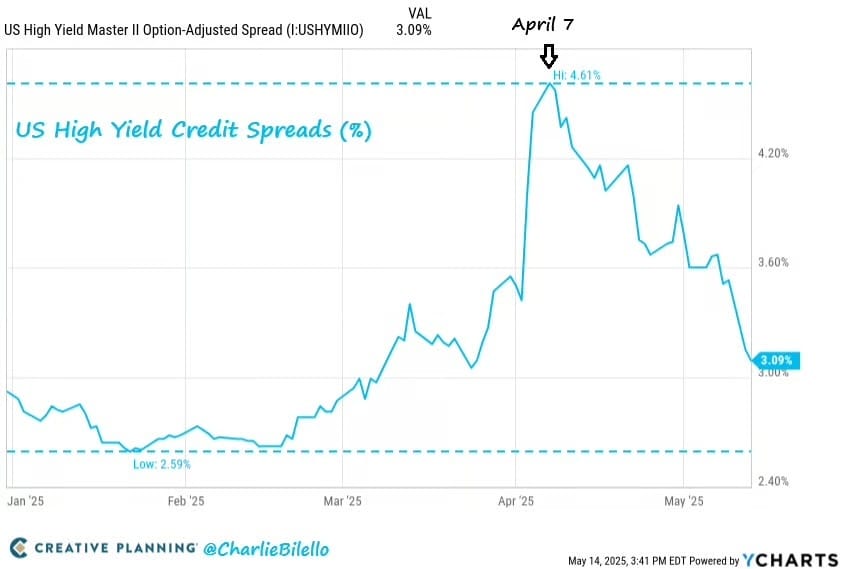

Credit Spreads Not Signaling Danger

….

1. Credit Spreads Not Signaling Danger

During a huge risk-on advance, US High yield spreads have tightened 152 bps since April 7. With spreads now at 309 bps above Treasuries, credit market investors are back to pricing in a very optimistic outlook with no recession and few defaults.

…

2. AI Premium to Overall Market at 2017 Levels

The P/E premium vs the overall market for a basket of 48 AI-related stocks is back down at levels last seen in 2017.

…

…

…

5. Housing Market Needs Lower Rates

Inflation rose to levels not seen since the 1980s and high mortgage rates have largely frozen the US housing market, as housing affordability plunged to its lowest level in decades.

…

…

…

…

9. With US trade war, China now top buyer for Canadian crude on Trans Mountain Pipeline

Via Reuters: China has emerged as the top customer for Canadian oil shipped on the expanded Trans Mountain pipeline, ship tracking data showed, as a U.S. trade war has shifted crude flows in the year since the pipeline started operating.

China's new interest in Canadian oil comes as U.S. President Donald Trump's trade war has strained relations between longtime allies Washington and Ottawa. It also reflects the impact of U.S. sanctions on crude from countries like Russia and Venezuela.

…

10. 49ers to Sell Nearly 6% Stake at Record Sports Team Valuation

Via Sportico: The owners of the San Francisco 49ers have reached an agreement to sell about 6% of the NFL franchise to a trio of Bay Area families at a valuation higher than $8.5 billion, according to a person familiar with the details, the highest valuation ever for a global sports team in a transaction.

The buyers are the Khosla family, the Griffith family and Deeter family, said the person, who was granted anonymity because the details are private. The Khosla family is buying the biggest stake, the source said, but it is unclear exactly how the 6% is being broken up between the three.

The NFL’s finance committee has reviewed the deals, though they still require more formal approval. A representative for the 49ers declined to comment. Attempts to reach the three families weren’t immediately successful.

The 49ers are owned by the York family. Sportico values the team at $6.86 billion.

The transaction continues a trend of recent minority stake sales in the world’s most valuable sports league. While the NFL opened its ownership ranks to private equity last year, some continue to prioritize individual investors. The Eagles recently sold two minority stakes to individuals at an $8.1 billion valuation. The New York Giants are in the market looking to sell about 10%, and the current owners’ preference is for high-net-worth individuals, not institutional funds, Sportico previously reported.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.