- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

Vanguard #1 Holder of MSTR?

2….

1. Vanguard #1 Holder of MSTR?

Vanguard owns more than 20 million shares, nearly 8%, of all of Strategy’s (MSTR) outstanding Class A common stock, and likely surpassed Capital Group Cos. for the no. 1 spot sometime in the fourth quarter, according to data compiled by Bloomberg based on regulatory filings. The dozens of Vanguard mutual funds and ETFs that hold the stakes track everything from small- and mid-cap benchmarks to momentum, value and growth gauges, among o “God has a sense of humor,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence and author of The Bogle Effect. “Vanguard chose this life. When you have an index fund, you have to own all the stocks, for better or worse, and that includes stocks that you may not like or approve of personally.”

…

…

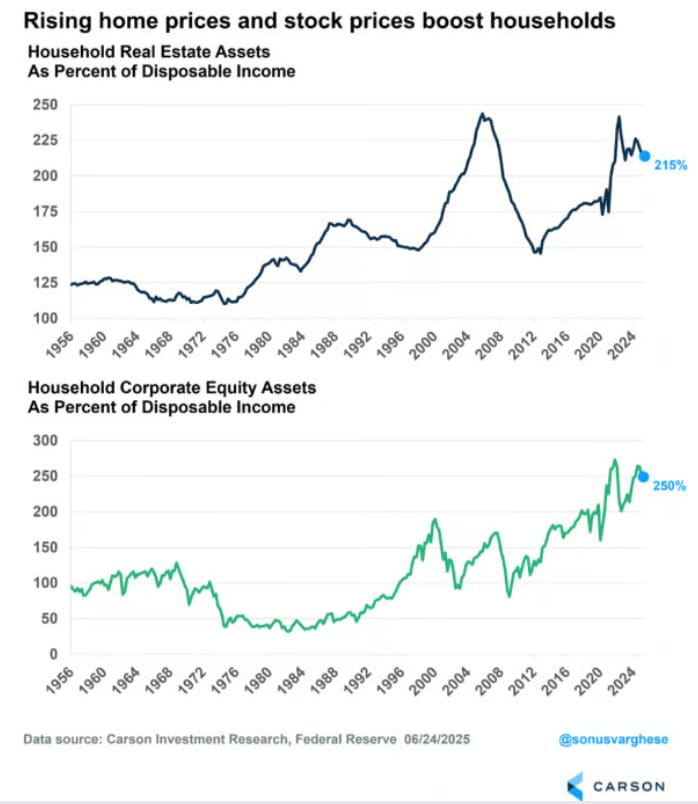

3. Rising Home Prices and Stock Prices Put Household Balance Sheets in Good Shape

…

…

…

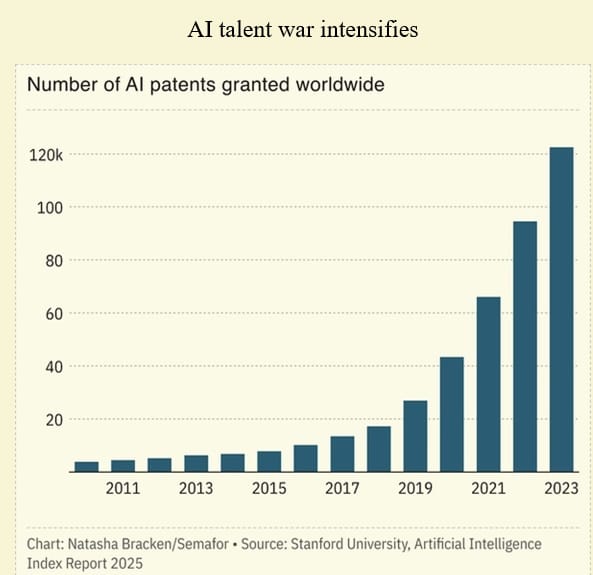

6. Number of AI Patents Granted

Google spent $2.4 billion to hire the leaders of an artificial intelligence programming company, the latest big-ticket move in an intensifying AI talent war. Windsurf’s CEO and co-founder will join Google DeepMind along with several top employees. Tech giants buying stakes in rivals attracts the attention of antitrust regulators, but hiring decisions do not, The New York Times reported; Google’s huge outlay is comparable to a soccer team paying a transfer fee to acquire a top player’s contract. Meta, too, has been on a hiring spree recently, sometimes offering compensation packages of up to $100 million for top talent, as it tries to make up ground in the AI race.

…

…

…

9. Crypto exchanges rushed to list Trump's coin - leaving many losers and some big winners

Summary

$TRUMP was listed in an average of 4 days by exchanges, vs 129 days for other big coins

Three crypto exchanges say they moved to list $TRUMP fast because of customer demand

Exchanges say no corners were cut in vetting the coin for listing

White House says Trump coin poses 'no conflicts of interest'

NEW YORK, July 14 (Reuters) - Crypto exchange Coinbase assures users on its website that it puts any new digital coin through "rigorous" vetting before allowing it to trade. It's an at-times lengthy process meant to protect customers by examining the people connected to the project and the risk of market manipulation or other scams.

With President Donald Trump's crypto token, $TRUMP, Coinbase made up its mind in just one day.

Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here.

The $TRUMP token, which launched three days before his inauguration in January, is a meme coin. Based on cultural fads or celebrities, these coins have no intrinsic value and – past experience has shown – are prone to large price swings that can leave investors with losses.

A Reuters analysis of crypto market data and industry announcements found that, compared to other recent large meme coins, the biggest crypto exchanges took Trump's to market with unusual speed, despite stating they vet risky coins thoroughly to protect small investors.

Some also approved the listing in spite of the high share of coins concentrated in the hands of Trump and his partners, which would normally represent a red flag because of the risk that dumping of tokens by insiders could collapse the price and hurt other investors, some executives said.

After reaching an all-time high of $75.35 on April 19, just two days after its launch, $TRUMP crashed to the $7 range by early April, leaving many holders nursing losses. It was trading around $9.55 Thursday.

…

10. Parlays and Memes

Via Sherwood News: A friend passed along a recent blog post from Drive by DraftKings, a venture capital firm whose founding partners include (wait for it) DraftKingsDKNG $43.85 (1.91%), titled, “The Gen Z Effect: The Behavioral Shift Shaping Gaming, Fandom, and Human Performance.”

Here’s a passage that piqued my interest (emphasis added)

“Gen Z’s approach to gaming is clear. They gravitate toward formats that are fast, emotionally charged, and offer the chance at a meaningful payoff. Traditional, slow-paced gameplay is losing ground to experiences that deliver instant feedback and the possibility of an outsized win.

This is why crash games, meme stocks, and parlay bets have gained so much traction with this generation. These formats share a common formula: low-cost entry, high potential upside, and just enough unpredictability to keep things exciting. A recent Morgan Stanley survey found that 60% of bettors aged 21 to 34 have placed parlays, a rate nearly 30% higher than the overall population. Similarly, around 30% of US stock investors aged 18 to 24 have invested in meme stocks compared to 12% of investors ages 45-54.

It’s not just the payout that attracts Gen Z. It’s the emotional volatility, the rush of possibility, and the shareable nature of “just-missed” or jackpot moments. The appeal is simple: put down a small amount, take a swing, and hope to hit it big. Most of these bets won’t pay off, but the ones that do tend to go viral. Social media elevates these wins, creating a sense of FOMO that draws others in. It becomes a feedback loop of visibility, aspiration, and repeat behavior, which keeps Gen Z highly engaged and emotionally invested in the experience.”

To riff on this conception of a “common formula” between parlays and meme stock punts, which often take place through the options market to access embedded leverage:

Both parlays and short-term options punts are examples of things where you need multiple things to go right to win. In parlays, it’s discrete (usually sports-related) outcomes; in options, you need to get the direction and magnitude right by a certain point in time.

This is why I love the use of options as a storytelling device: they are always and everywhere a greed, fear, or complacency play built around a specific date by which something needs to either happen or not happen. There’s a subject, verb, and time.

“I think one thing that’s very clear about Gen Z is that they’ve repeatedly been told nobody is coming to save you,” Emily Sundberg, author of the Feed Me Substack, said at a live taping of Bloomberg’s Odd Lots podcast. “You hear this sense of ‘get the bag while the world is still here for you to make some money out of it.’”

Kind of ironic that the generation that thinks nothing in the world is going right for them seeks out betting and trading structures that require multiple things to go right to profit.

Is this really a Gen Z thing, though?

One can quibble about some of this line of thought. And I will. The 2021 meme stock boom was occurring when the average member of Gen Z was just in their early high school years. I doubt many of them were part of the Apes Together Strong crew.

The “YOLO” catchphrase that serves as a shorthand for the kind of “eff it, we ball” approach to life was popularized by a somewhat seasoned millennial.

And to dodge any accusations of millennial-boosting, manias have existed well before we were a twinkle in our boomer parents’ eyes and will continue to persist long after we’re ashes. To this author, a person’s willingness to dive headfirst into booms is much more defined by their stage of life rather than the generation they belong to. Oh, to be young…

Gen Z likes structures with huge payoffs that often end in busts? How convenient for the VC firm, which concludes that the shifts in Gen Z behavior “reinforce why we focus where we do — on the edge of behavioral change, where category defining companies are born,” highlighting portfolio companies Triumph and Picklebet as great examples of firms whose products have been built for this generation.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.