- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

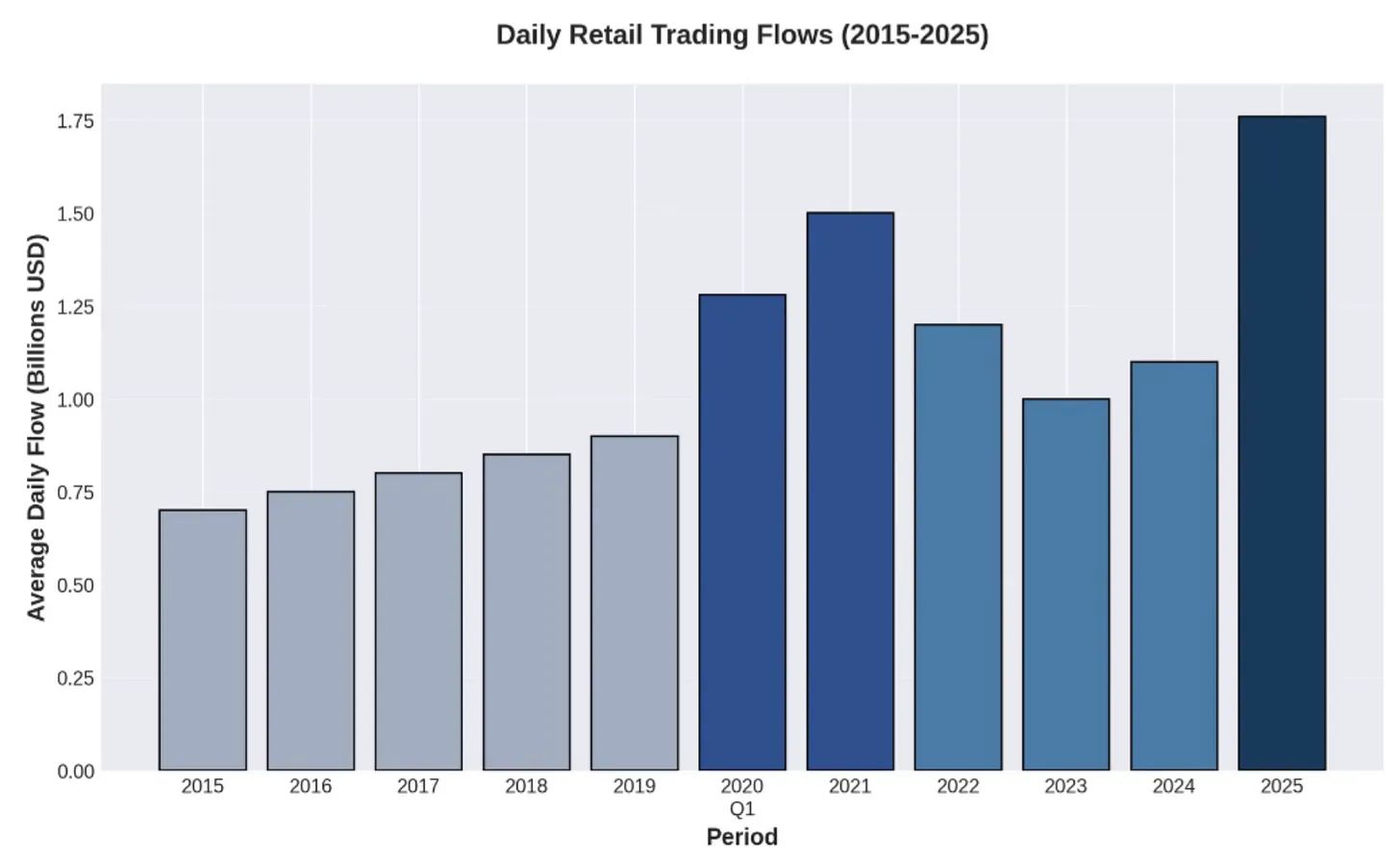

Retail Investor Flow Jumped 60% from 2024 to 2025

)..

1. Retail Investor Flow Jumped 60% from 2024 to 2025

Retail Flows Hit Record Highs

Here’s the part that should make Wall Street nervous: retail isn’t just maintaining presence, it’s accelerating. JPMorgan data shows that retail flows in 2025 jumped 60% from 2024 levels and are running 17% higher than the 2021 meme stock peak.

Retail investors are now over 20% of the total U.S. trading volume. Retail has now become a bigger force in the market than institutional long only and hedge funds.

..

..

..

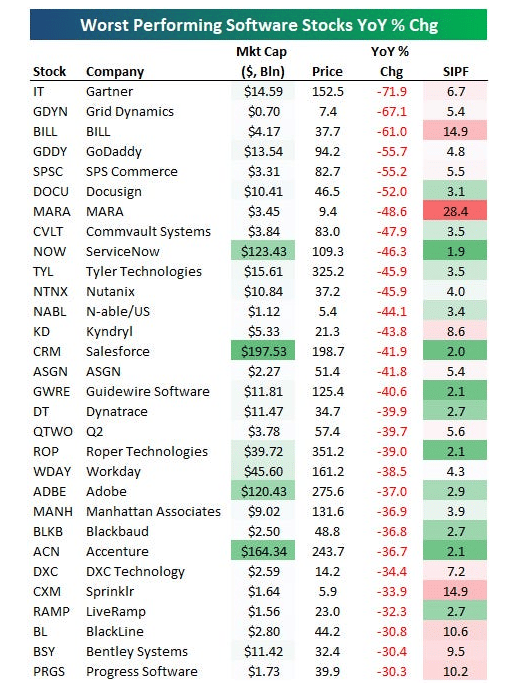

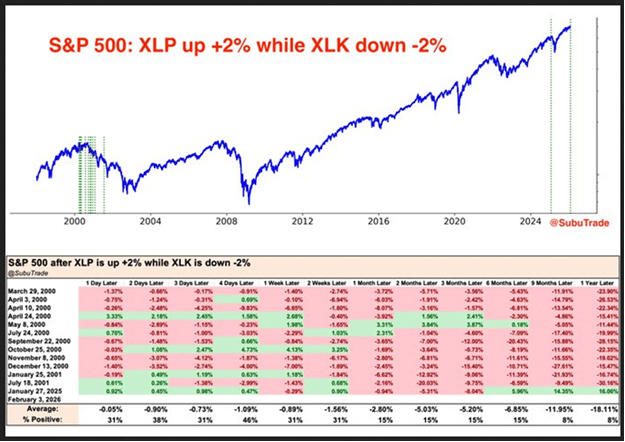

4. History of Consumer Staple Rally vs. Tech

"Due to the AI disruption fear in Service Businesses, Legal tools, Consulting and Advertising -we are seeing rotation into Consumer Staples and Cyclicals that are less threatened by AI" Noted JonesTrading’s Mike O'Rourke. Yesterday the Defensive sector XLP was up +2%, while tech sector XLK was down -2% - “This only happened in 2000-2001 dot-com bust & January 2025 (before Trump tariffs crash)” noted Twits.

..

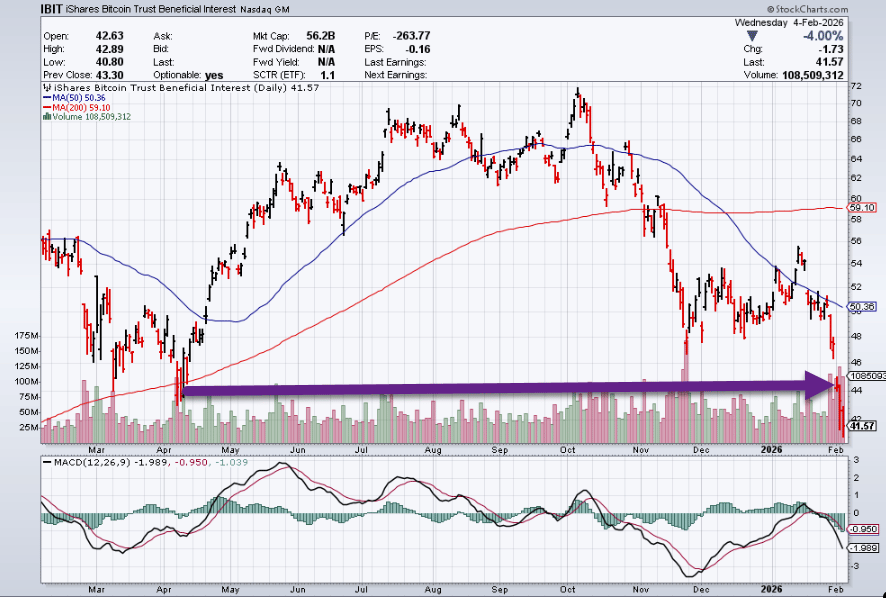

5. $227 Million Out of Bitcoin ETFS….IBIT Breaks Below April 2025 Levels

WSJ-$227 Million in Net Withdraws from Bitcoin ETFs Ending Jan 28Th

.

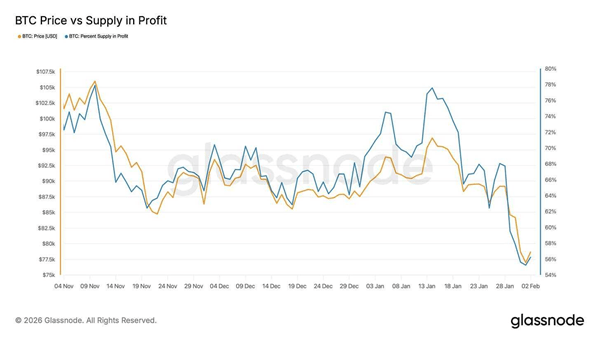

6. 44% of Bitcoin Supply is Now Negative Returns

BTC supply in profit. “44% of Bitcoin supply is now underwater.”

.

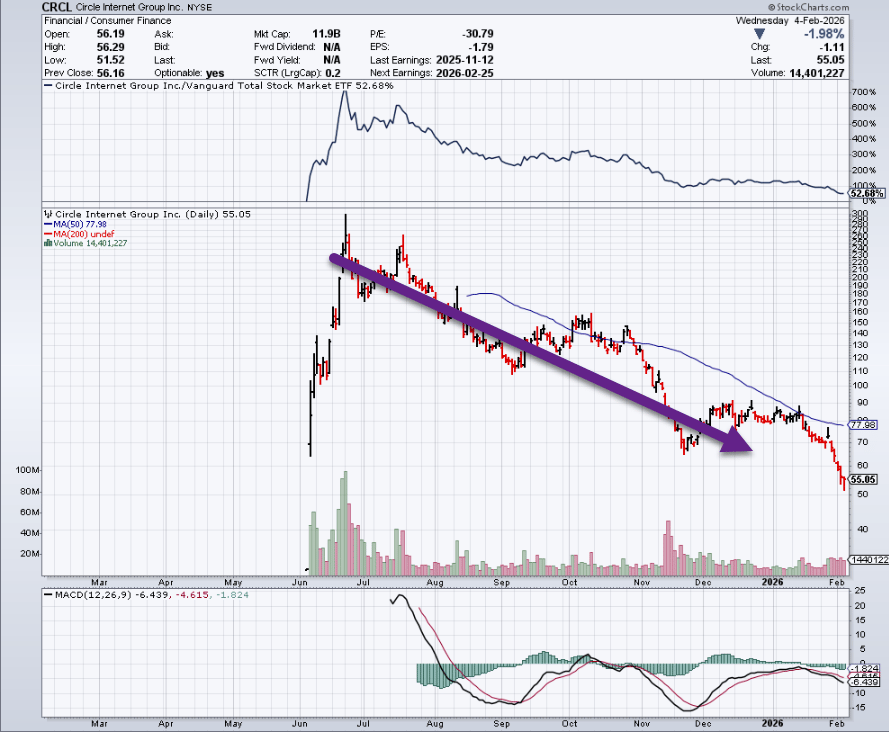

7. Fidelity Launched Dollar Backed Stablecoin in Direct Competition with CRCL…..CRCL -35% Year to Date

.

….

..

10. More trouble than it’s worth-Seth’s Blog

This is the hallmark of projects that turn out to be worth doing.

The trouble might be a symptom that we’re onto something that others don’t care enough to do.

And the things that are obviously worth doing are probably already being done.

.

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.