- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

IBIT Flows 5x Faster than S&P 500 ETF VOO

2….

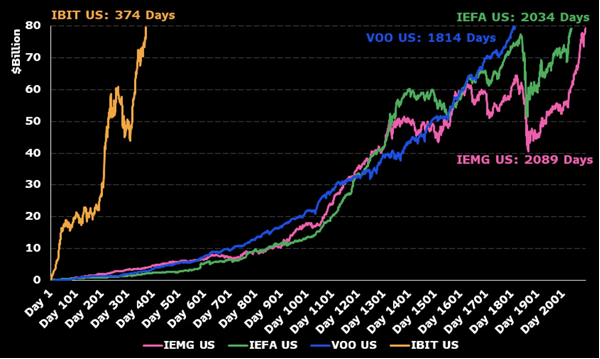

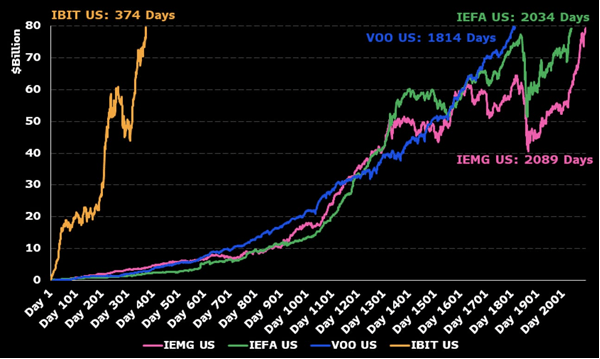

1. IBIT Flows 5x Faster than S&P 500 ETF VOO

Bitcoin ETF flows. "$IBIT blew through the $80b mark last night, fastest ETF to get there in 374 days, about 5x faster than the previous record, held by $VOO, which did it in 1,814 days. Also at $83b it's now 21st biggest ETF overall."

…

…

…

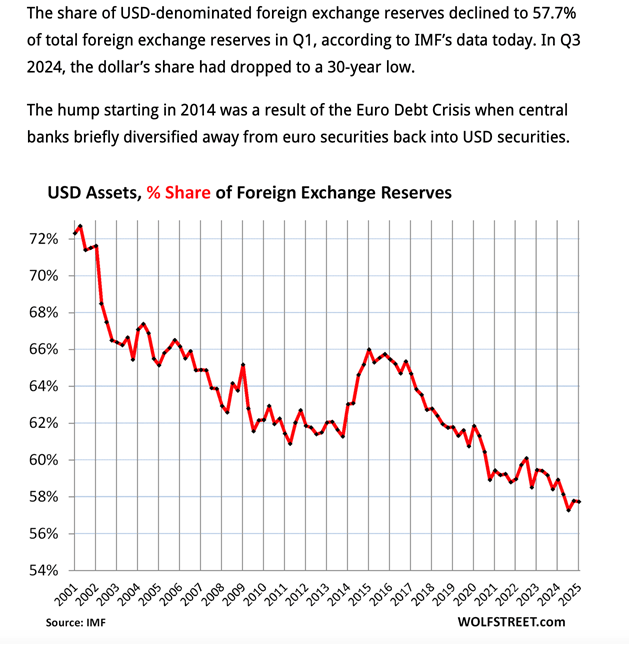

4. The Share of U.S. Dollar Foreign Reserves Going Down for 25 Years

…

5. SPACS, Reverse Mergers and Digital Assets Joining Up

Bloomberg-For dealmakers who cultivated crypto relationships through the industry’s troubled years — not to mention who hung in during the post-pandemic collapse of the SPAC boom — now is the time to cash in. The appeal of blank-checks is in their relative speed. Unlike IPOs that can take more than six months, a reverse takeover or SPAC deal can be agreed in weeks, according to Paul McCaffery, KBW’s co-head of digital assets.

A rebound in token prices and a more permissive US regulatory environment have emboldened crypto firms, leading to more deals, particularly among SPACs and reverse mergers.

…

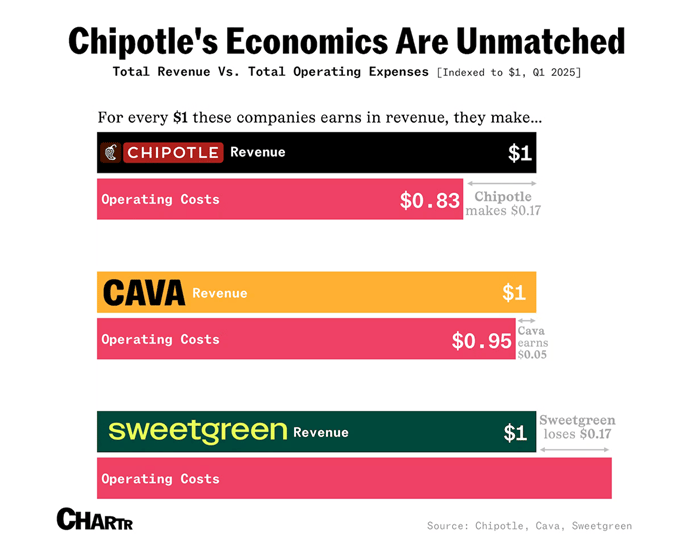

6. Chipotle’s Economics vs. CAVA

…

…

8. US government to invest in rare earths production

Jonathan Josephs--Business reporter, BBC News•jonathanjosephs

Bloomberg/Getty

The US government is to become the biggest shareholder in the country's only operational rare earths mine.

It is also going to take a series of other steps to underpin the future of the operation in Mountain Pass, California.

Rare earths are essential to huge amounts of modern technology, such as electric cars and wind turbines.

Access to these metals has been at the heart of a US-China trade war, with Beijing controlling about 90% of global processing capacity.

MP Materials, which owns the mine, has entered into an agreement with the US Department of Defense that is designed to reduce America's dependency on imports of rare earths.

The deal means that for the next 10 years the US government will commit to MP Materials receiving a minimum price of $110 per kg for its neodymium and praseodymium output.

These are two of the most in-demand of the 17 different rare earths for the global economy. They are crucial for making permanent magnets, which are found in everything from smartphones to MRI scanners and electric motors.

The move follows concerns that China has used its near total control of the industry to push prices down and force companies in other countries out of business.

…

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.