- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

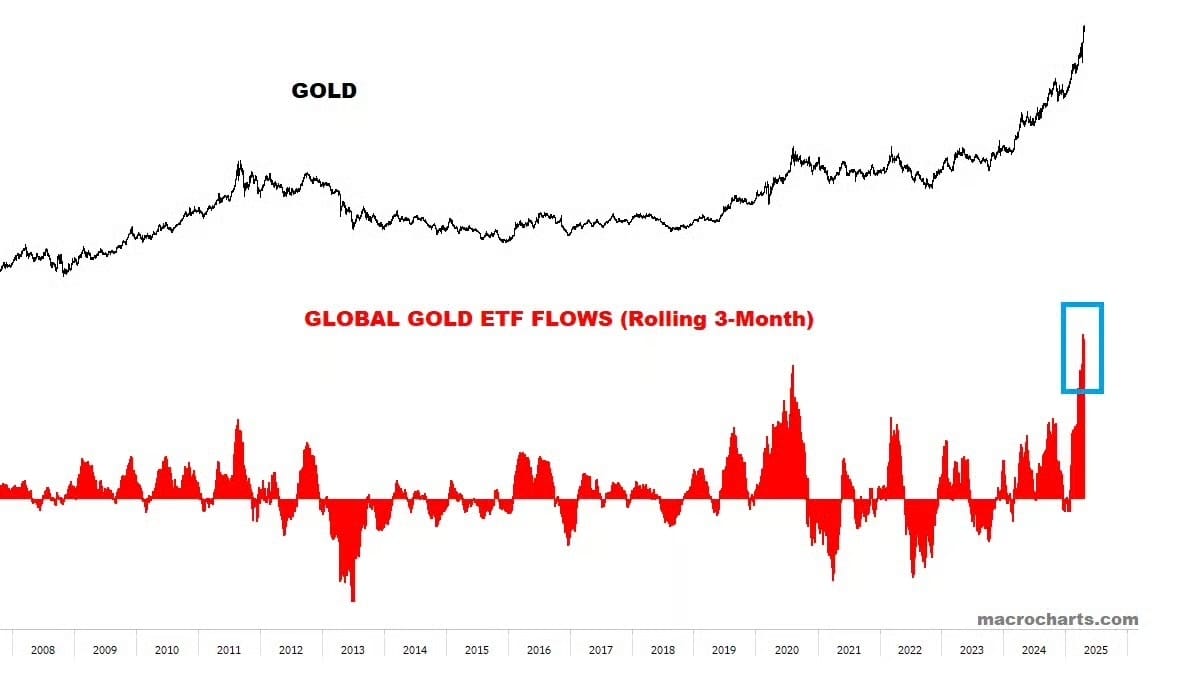

Gold ETF Flows Hit Record Level.

….

1. U.S. Dollar Positive Yesterday…Due for Bounce

‘Sell America’ gathers steam. The dollar plunged to a three-year low, as a US trade war and threats against the Federal Reserve drove “Sell America” trades. President Donald Trump’s renewed push to fire the Fed chair, in particular, has undermined the haven status of US assets, resulting in a combined stock, currency, and bond weakness not seen since 1981, according to Sherwood News. Pension funds worldwide are reassessing whether to keep betting on the US, while Chinese state investors are pulling back from US private equity. Traders have flocked to gold, which hit a fresh record Monday, as well as German bonds. The “exorbitant privilege of the US,” Commerzbank’s chair said, “may not be carved in stone.”

…

…

…

…

…

…

…

8. Ex-US Stocks See Record Volatility…ACWX Did Not Make New Highs on International Rally

From Nasdaq Dorsey Wright: International equities have held up better than US stocks during the most recent bout of global uncertainty. The iShares MSCI ACWI ex US Index ETF (ACWX) fell into correction territory on April 4 with a 10% decline from its most recent high on March 19. The fund ultimately bottomed out 13.8% below that high on April 8. Over the next couple of weeks, ACWX advanced sharply to notch a 10% rally last Thursday, April 17, officially moving the fund out of correction territory.

The 20-day peak-to-trough move for ACWX was the shortest correction the broad international fund has seen since 2009, spanning less time than the previous 18 corrections. The nine-day rally was also the quickest ascent we have seen since 2011, outside of the two-day rally during COVID that saw ACWX climb out of correction territory in record time. Meanwhile, US stocks still sit in correction territory, despite the 9.5% upside movement seen from the S&P 500 Index (SPX) on April 9, the day after the recent low.

…

9. More Take Private Deals than IPOs

Private equity capitalized on take-private opportunities in the first quarter of 2025 as the market grappled with the new reality of tariffs and prolonged uncertainty around deals.

Take-private deal value increased 24.6% quarter-over-quarter, according to PitchBook’s Q1 2025 US PE Breakdown, with one big deal driving much of the action.

That prominent deal occurred in March, when consumer retail sector-focused investor Sycamore Partners acquired Walgreens in a transaction valued at $23.7 billion, the largest PE-backed take-private transaction over the last two years.

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.