- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

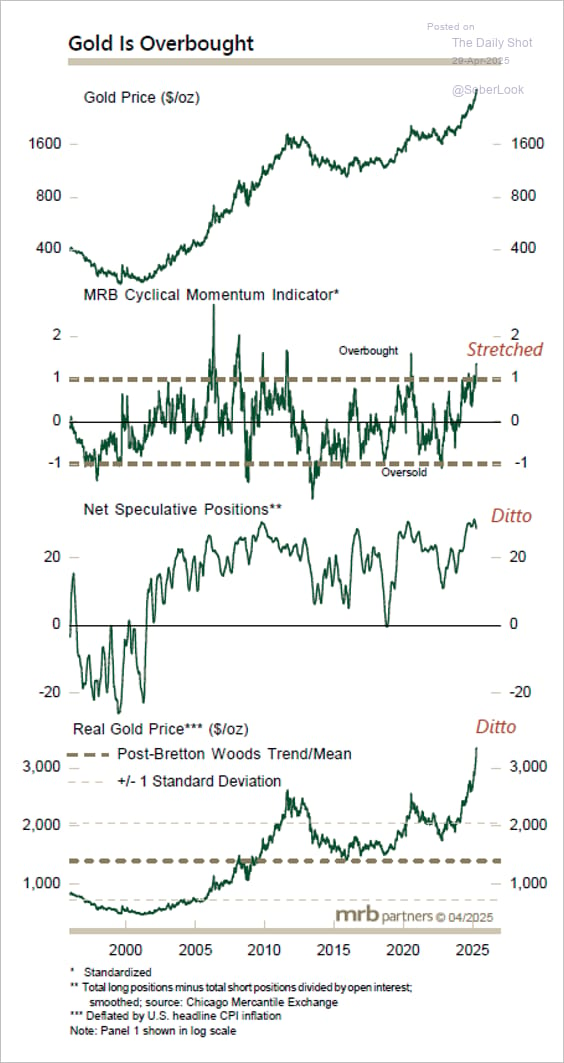

Gold Short-Term Overbought.

….

1. Zweig Market Breadth Thrust

The Zweig Market Breadth Thrust has triggered for the 17th time in history. The previous 16 times have resulted in an S&P 500 average gain of 16.35% after 6 months and 23.78% after 12 months. The S&P 500 has NEVER been red after 6 months and 12 months following the trigger.

…

…

…

4. Bitcoin ETFs $2.9B Inflows

Bitcoin flows. "Last week, US spot Bitcoin ETFs recorded a net inflow of 31,323 $BTC, equivalent to approximately $2.9 billion. In BTC terms, it was the fifth-largest weekly inflow on record. In dollar terms, it ranks even higher - the third-largest inflow."

…

…

…

…

…

9. Top Colleges Are Too Costly Even for Parents Making $300,000

Many families earn too much to get meaningful aid but too little to cover tuition out of pocket.

…

10. Win the Morning

Via The Daily Stoic: One of the most relatable moments in Meditations is Marcus Aurelius's argument with himself at the beginning of Book 5. It's a struggle he's clearly faced many mornings—as have so many of us: He knows he must get out of bed, yet desperately wants to stay under the warm covers.

It’s relatable…but it’s also impressive. Marcus didn’t actually have to get out of bed. He didn’t really have to do anything. As emperor, he could do as he pleased. One of his predecessors, Tiberius, basically abandoned the throne for an exotic island. Marcus’s adopted great-grandfather Hadrian hardly spent any time in Rome at all. The emperor had all sorts of prerogatives, and here Marcus was insisting that he rise early and get to work.

Why? Because Marcus understood that winning the morning was essential to winning the day—and ultimately, life itself. Though he wouldn't have known the phrase "the early bird gets the worm," he grasped that a day well-begun is half done. By pushing himself to do something difficult, by committing to what he knew he was born to do and loved to do, Marcus set himself up for daily success (more on this in our How To Read Meditations guide, by the way).

This is a practice we must follow today and every day. We should rise early, without delay. We should nourish ourselves properly. We should maintain good habits. We should tackle our most important task first thing. By winning the morning, we reduce the power that the rest of the day—much of which lies beyond our control—holds over us.

Well-begun is half won. So get started.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.