- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

IWM Small Cap ETF Right Below 200-Day

2….

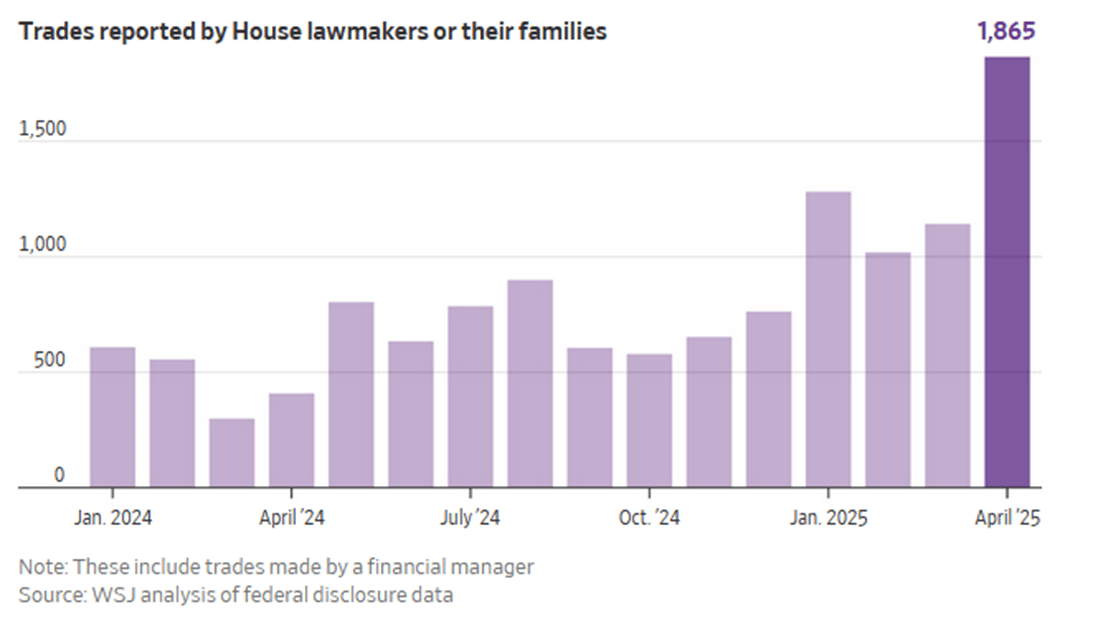

1. American House of Reps Families Trade Like Hedge Funds During Liberation Day Volatility

DAY TRADERS- As markets tanked in the wake of President Trump’s “Liberation Day” tariffs in early April, members of Congress and their families made hundreds of stock trades, shining a spotlight on a controversial practice that some lawmakers have pushed to ban. From April 2, when Trump launched sweeping tariffs to April 8, the day before he paused many of them, more than a dozen House lawmakers and their family members made more than 700 stock trades, according to a WSJ analysis. The trading took place during one of the wildest stretches for global financial markets of the past decade. The S&P 500 tanked more than 4.5% for two consecutive sessions shortly after Liberation Day and recorded the biggest fall since the March 2020 market crash. More than $6 trillion in market value vanished.

…

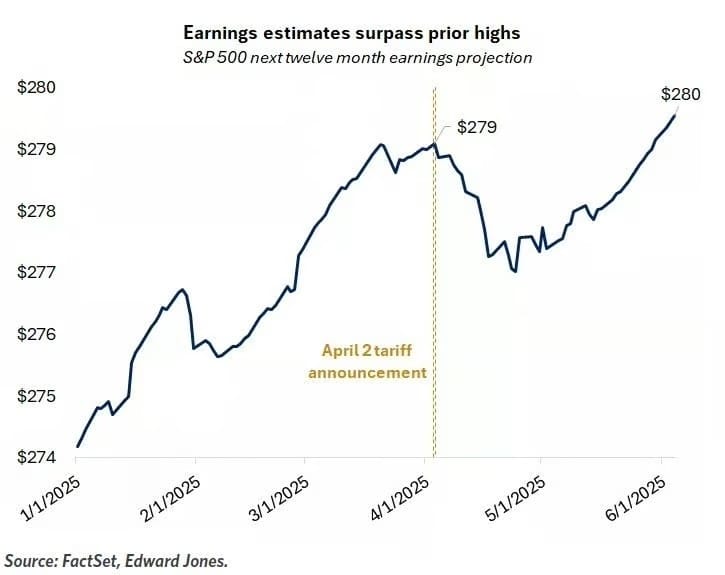

2. Earnings Estimates Moving Higher

SPX NTM EPS. "S&P 500 forward EPS estimate hits a fresh all-time high. $280."

…

…

…

…

…

…

…

9. 75% of Companies Have Already Raised Prices in Response to Tariffs, Fed Survey Finds

Via Barron’s: Early signs indicate that many businesses are quickly raising prices for shoppers to cover most of the higher costs from sweeping U.S. tariffs on imported goods.

Among businesses that are facing higher operational costs due to President Donald Trump’s aggressive tariff policies, roughly 75% are imparting at least some of the their cost increases on consumers, according to an analysis released Wednesday of the New York Fed’s Regional Business Survey of firms in the New York and Northern New Jersey region.

Almost a third of manufacturers and about 45% of service firms report they have fully passed along all their cost increases due to higher tariff rates, the survey said. Meanwhile, another 45% of manufacturers and a third of service firms said they shifted some—but not all—of the cost increases to consumers.

It’s worth noting, however, that the NY Fed conducted the survey between May 2 and May 9. That was before the Trump administration reduced the tariff rate on goods from China to 30% from 145%—and before the recent court rulings around tariffs at the end of May.

The latest survey results found that firms implemented these price increases fairly rapidly.

“Over half of both manufacturers and service firms said they raised prices within a month of experiencing tariff-related cost increases—many within a day or week,” NY researchers found.

Tariffs have a broad impact, with about 90% of manufacturers and 75% of service firms surveyed reporting that they utilize some form of imported goods.

Manufacturers reported that the average tariff rate they paid as of early May was about 35%. Service firms reported an estimated average tariff rate of 26%. That marks a significant increase for both types of businesses from the rates they reported six months ago.

“Firms’ costs of tariffed goods may not have increased by as much as the tariffs, in part, because importers may have switched towards suppliers in other countries or in the United States; foreign suppliers may also have lowered their prices to help offset the tariffs,” NY Fed researchers noted.

…

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.