- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

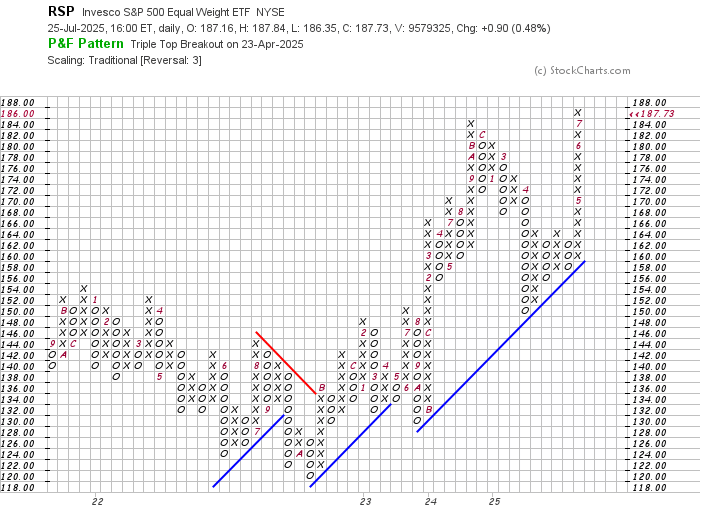

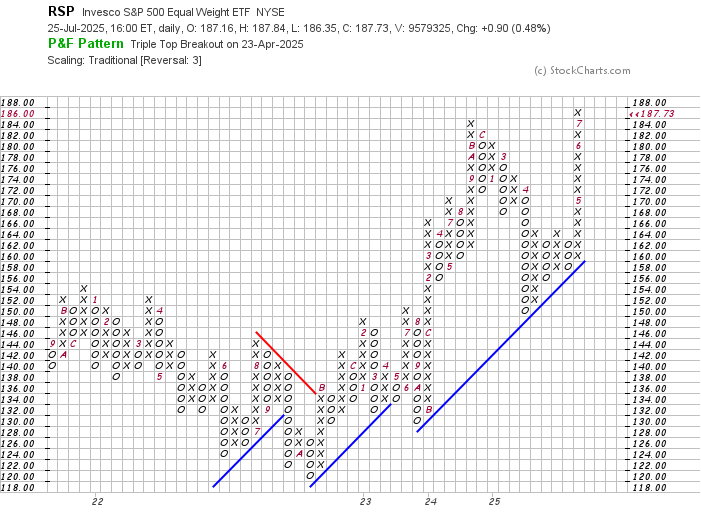

Not Just a Tech Rally

2….

…

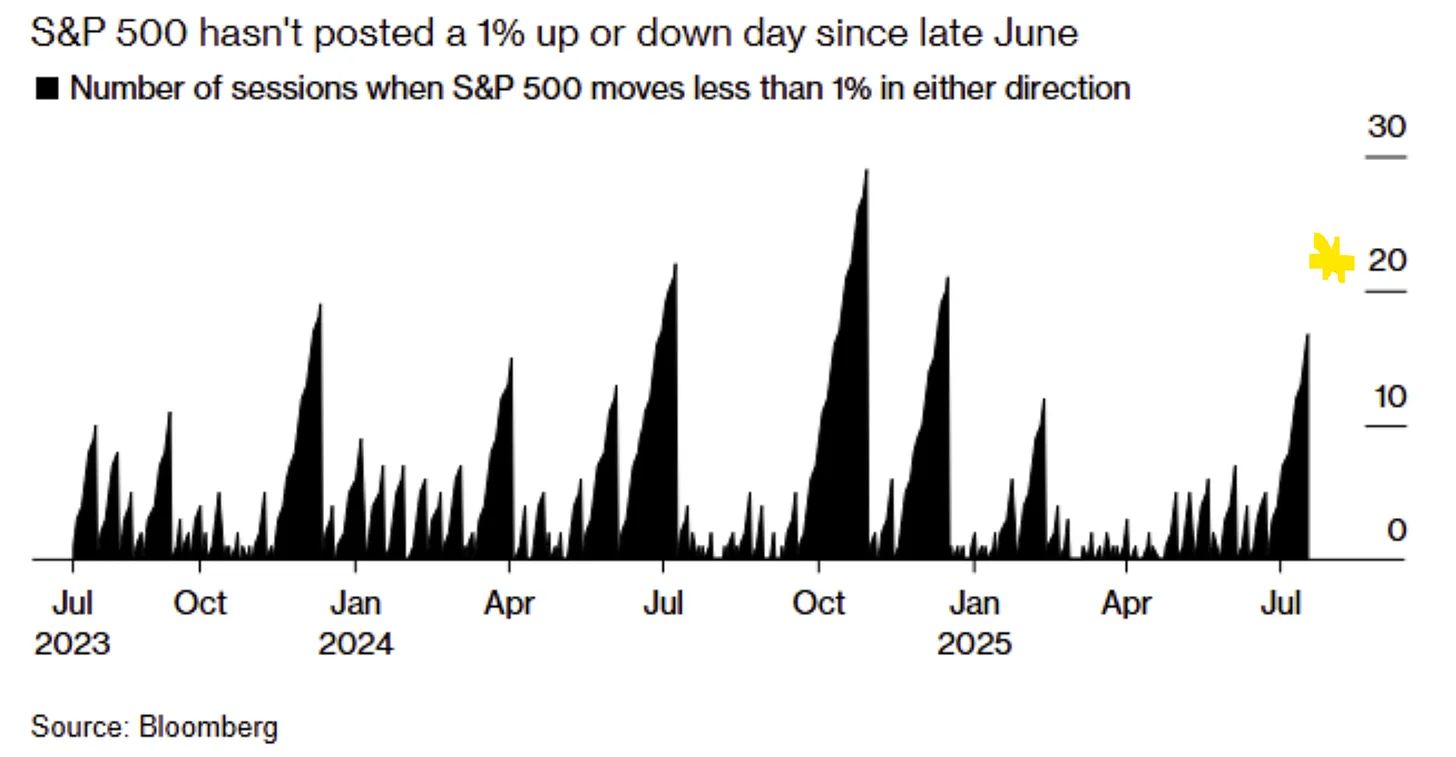

2. Slow Rise Up….22 Trading Days without 1% Move in S&P

One day One percent: And in terms of being “due” for some volatility, it’s now been 22 trading days since we last saw a 1% move up or down. If you feel like it’s been a little quiet lately —that’s why.

…

3. Finra Margin Debt to GDP Not at 2021 Levels Yet

Eric Soda Blog Margin debt vs. GDP. FINRA margin debt crossed above the $1 trillion mark in June. Relative to GDP, it remains below the 2021 peak but above Dotcom and GFC levels.

…

…

…

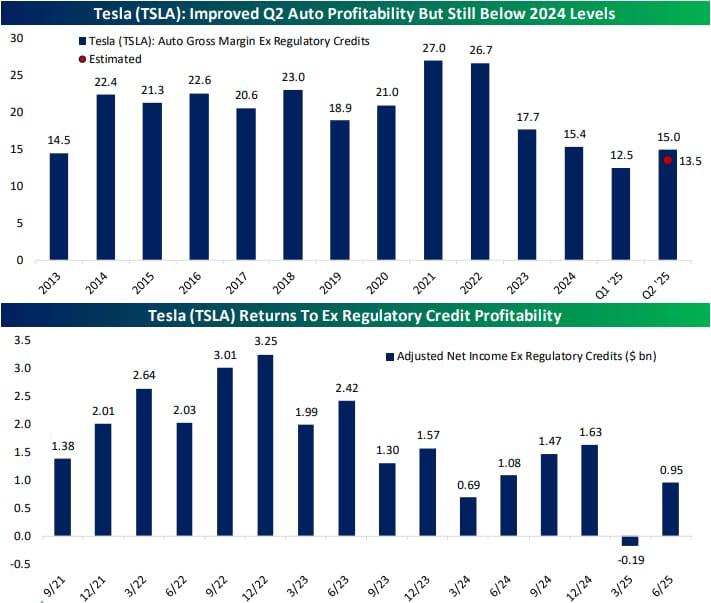

6. Tesla Auto Profitability History

Bespoke

…

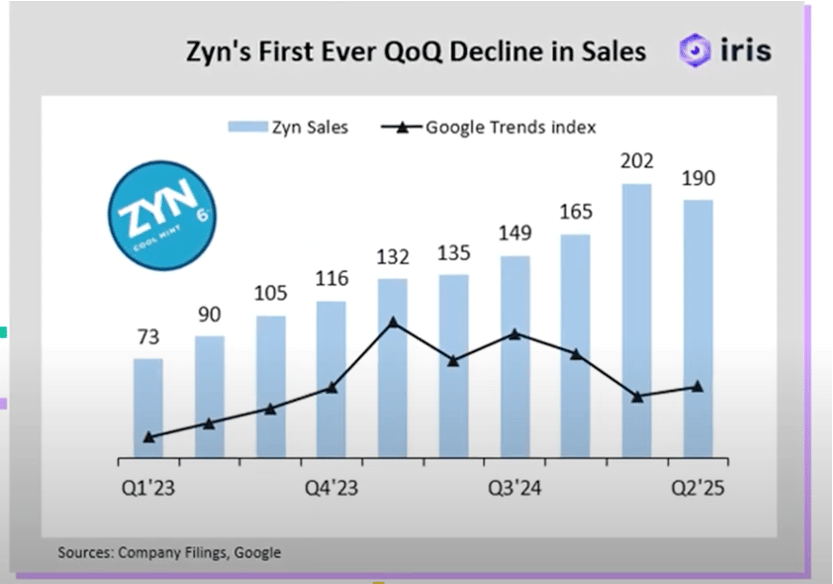

7. Zyn First Tick Down….202m Cans to 190m Cans

Stock Twits

…

…

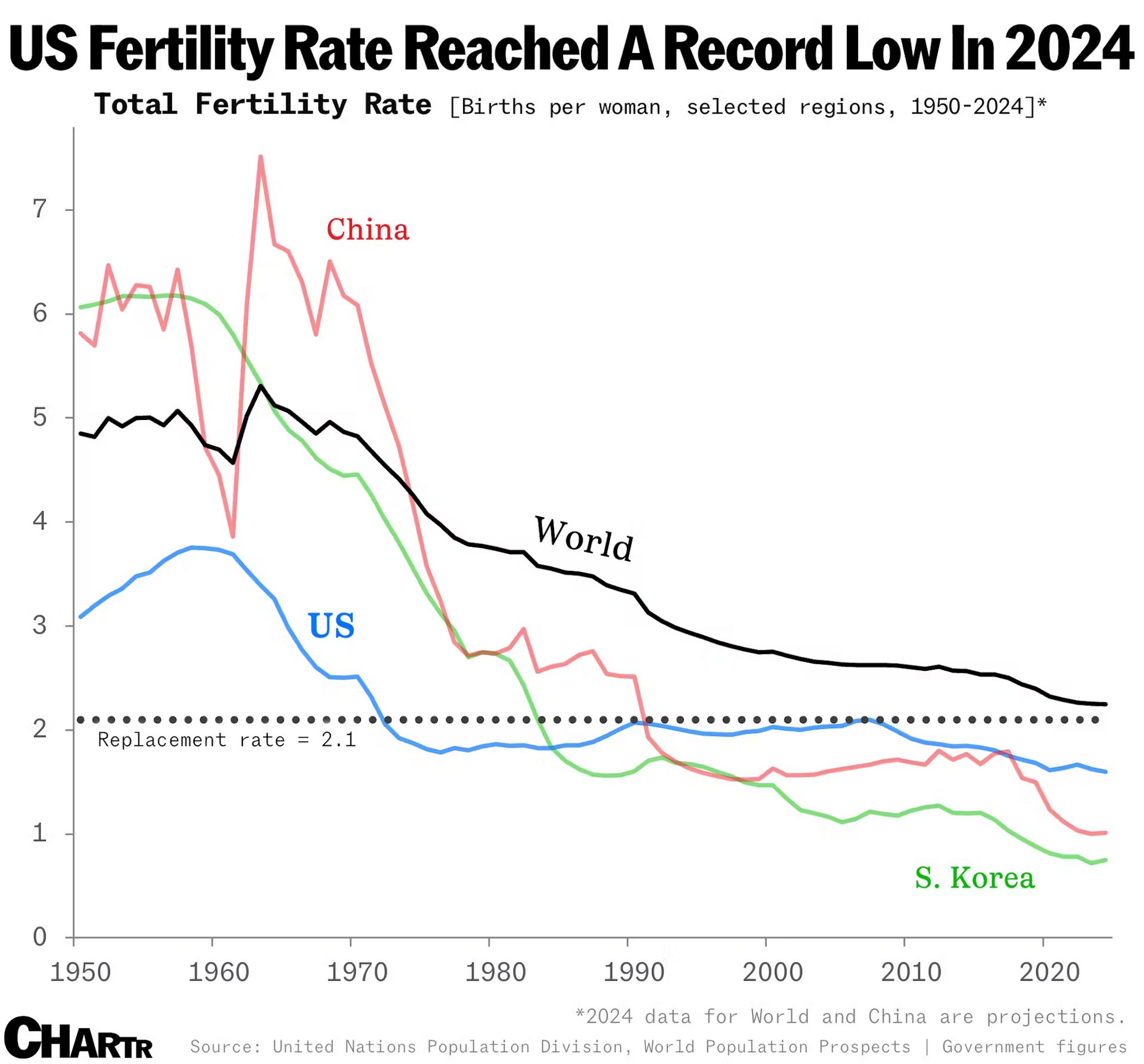

9. Demographics is Destiny

The fertility rate in the US has fallen to a new record low

New CDC data released Thursday shows that America’s fertility rate dropped to an all-time low of just under 1.6 children per woman on average in 2024.

For context, this is lower than the UN’s projection for the world’s overall rate (2.25), as well as the figure forecast for the US (1.62) in its World Population Prospects report for 2024. Imperatively, it also falls well below the replacement level of 2.1 — or, the birth rate required for a population to replace itself from one generation to the next.

Like much of the developed world, the US has seen its fertility rate slump in recent years as an increasing number of adults have decided to delay — or opt out of altogether — having kids, citing economic and social limitations (though it seems that many still can’t decide whether there are currently too many children or not enough).

Natal attraction

As plunging fertility rates worldwide have pointed to an impending global baby bust, governments are experimenting with incentives to encourage citizens to have more children.

Among these is the US, with raising the national fertility rate being one of the Trump administration’s priorities. Back in April, as part of their pro-natalist push, the White House reportedly considered a $5,000“baby bonus” for new mothers.

Interestingly, last year saw a rare child-rearing win for the country with world’s lowest birth rate. South Korea’s birthrate rose for the first time in nine years to 0.75 in 2024, as reported in February, and just this week the country announced notching record birth growth in the first five months of this year.

…

10. Farnam Street -Delay Your Intuition

Via Farnam Street

The Knowledge Project [Legends]

Daniel Kahneman (1934 to 2024) won the Nobel Prize for proving we’re not as rational as we think.

You'd never know it by listening, but this conversation with Danny took place years ago, and most people reading this have never heard it.

In a world of disposable content, this conversation, which is both timeless and timely, is exactly the type of conversation I try to have on the Knowledge Project.

As I re-listened this summer, I created a list of 11 takeaways for myself:

1. Delay Your Intuition: Most people form an impression in seconds and spend the rest of their time confirming it. The best wait for all the information before letting their intuition speak.

2. Loss Aversion Creates Permanent Programs: Once you give people something (a perk, a feature, a benefit), it’s nearly impossible to take back. The founder who would offer free lunch on day one can’t cancel it on day 1000. Small groups lose something specific, while large groups gain something abstract. Every time.

3. Your Rules Become Your Default: Danny was human just like us; he often said yes to things he didn’t want to do. So he created a rule. Not a goal, not an intention, a rule. It reprogrammed his unconscious mind, turning his desired behavior into his default behavior.

4. Facts Don’t Form Beliefs: “I believe in climate change,” Kahneman said. “I believe in the people who tell me there is climate change. The people who don’t believe in climate change, they believe in other people.” This is how we form all beliefs. We don’t examine evidence and reach conclusions. We trust people we like, then adopt their views. “The reasons are not the causes of our beliefs,” he explained. They’re the stories we tell ourselves afterward. Want to change someone’s mind? Facts won’t do it. They need to trust you first. If they admire you, they’ll find reasons to agree. If they dislike you, the best evidence won’t matter. Smart people believe opposite things because they trust different people.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.