- TOPLEY'S TOP 10

- Posts

- Topley's Top 10

Topley's Top 10

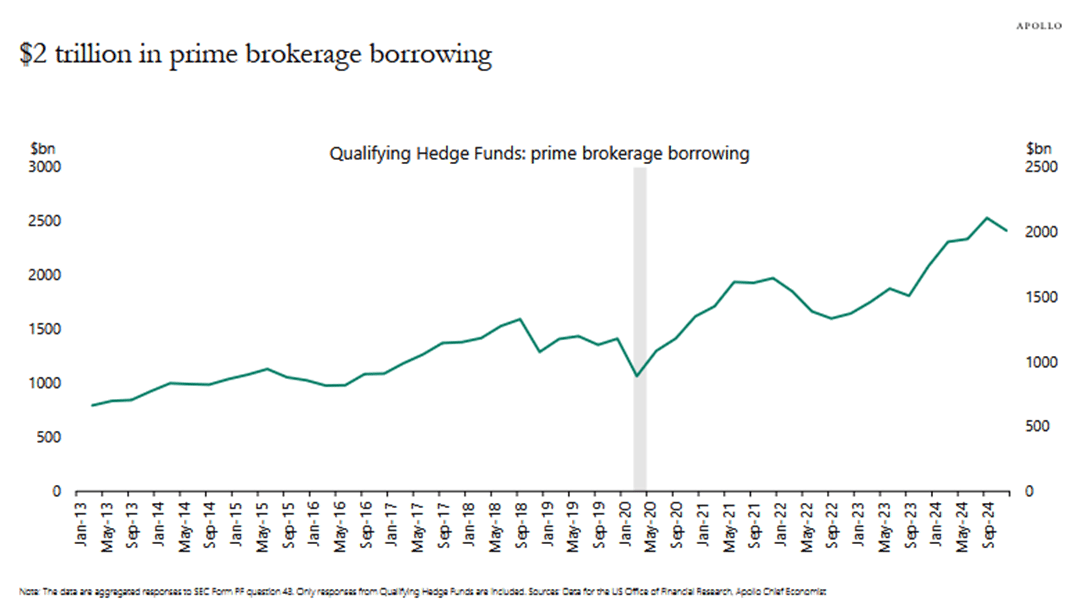

$2 Trillion in Prime Brokerage Borrowing

….

…

…

…

…

…

…

7. RIP to the IPO comeback…It Will Be 4 Years in a Row with Lower Number of IPOs

Via Business Insider: A few months ago, after years of abysmal performance, it looked like IPOs were finally set for a comeback. ServiceTitan, a software platform for general contractors, saw its stock soar by 35% after its debut in December. A bunch of hot companies were lined up to go public: the buy-now, pay-later lender Klarna, the ticket reseller StubHub, and the AI infrastructure provider CoreWeave. Silicon Valley, it seemed, was about to return to the good old days, when snazzy new startups could expect a huge payoff on Wall Street. "All signs were pointing to 2025 as the year when we would finally get some IPOs," says Matt Kennedy, a senior strategist at Renaissance Capital.

But now, the long-anticipated boom in IPOs has suddenly gone bust. CoreWeave's public offering in March was the biggest tech IPO since 2021, but it was forced to price itself well below the expected range. And on Friday, StubHub and Klarna both delayed their planned IPOs, as Donald Trump's tariffs sparked a huge slide in the stock market. IPO analysts at Renaissance now estimate that there could be as few as 150 deals this year, which would make 2025 the fourth straight down year for IPOs.

"This is going to shut down the IPO market," Kennedy says. "The question is, for how long?"

…

8. Housing in South Update

New single-family houses for sale in the South, where Florida is by far the largest housing market, have ballooned past the Housing-Bust high since mid-2024 to a range between 290,000 to 304,000 houses for sale, with 296,000 new houses for sale in February, up by 72% from February 2019, according to Census Bureau data, which doesn’t provide state-level data, only regional data.

Those new houses are adding large amounts of additional supply to the surging inventories of existing homes. Homebuilders are the pros in this business, they know how to move the inventory: price cuts, building at lower price points, large-scale mortgage-rate buydowns, and incentives. And homeowners wishing to sell have to compete with this supply of new houses and increasingly aggressive builders.

Buyers are still on strike: In the South, pending sales of existing homes rose month-to-month in February, seasonally adjusted, but were down by 3.4% from the collapsed levels February last year, and booked the worst February in the data from the National Association of Realtors. Compared to 2019, pending sales plunged by 29%.

…

…

10. How to Become an Expert

Via Barking Up The Wrong Tree: Here’s how to become an expert at anything:

Concepts First: Learning the fundamental principles instead of just the immediate behaviors is the difference between being a cook and being a chef.

It Needs To Be Difficult: If you’re doing it right, you don’t feel like an expert; you feel like a person who has been mildly electrocuted by their own ambition. It’ll make you wonder if ignorance really is bliss. But an arduous process is what creates mastery.

Don’t Cram: Distributed practice is the sensible Volvo of studying techniques. You’re supposed to take things step-by-step, day after day, until the knowledge seeps into your brain and settles down like a retired couple moving to Florida. Your brain hates the quickie approach and prefers to be seduced gradually, like a Jane Austen character.

Feedback: It’s not “feedback”; it’s a forensic investigation into your incompetence. Find a mentor.

Retention: The “decay curve” is like a ski slope, except there’s no lodge at the bottom -- just a pit of “Whoops, I forgot how to speak Spanish.” Overlearning is repetitive, it’s boring, it’s the linguistic equivalent of hitting your head against a wall until the wall starts to feel bad for you. But that’s how you make stuff stick. Wax on, wax off, Daniel-san.

…

Did someone forward this email to you? Get your own:

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.